South Africa Reserve Financial institution(SARB) governor’s query, “Why not strategic beef reserve?” on the 2025 World Financial Discussion board in Davos might have been rhetorical, however Lesetja Kganyago’s seemingly sarcastic comment about “strategic bitcoin reserves” inadvertently underscored the necessity for Africa to rethink its financial methods within the face of world monetary shifts. In a world more and more outlined by digital transformation, the idea of cash and worth storage is evolving quickly. Africa is not any stranger to commodity-based economies. From oil to gold, beef to cocoa, the continent has lengthy relied on pure sources for financial sustenance. Nevertheless, these commodities are fraught with challenges. International commodity costs are extremely inclined to market fluctuations, geopolitical tensions, and local weather change. For example, the worth of beef can swing dramatically as a consequence of illness outbreaks or commerce restrictions, simply the best way the worth of fiat currencies swings and stays unpredictable when traded in opposition to digital belongings like bitcoin as a consequence of regional monetary insurance policies and foreign money devaluation. In keeping with the Meals and Agriculture Group (FAO), beef costs have skilled volatility of as much as 30% year-over-year as a consequence of elements like foot-and-mouth illness and export bans.

Picture Supply : FAO

Despite the fact that Brian Armstrong, CEO of Coinbase, responded to Kganyago’s query with a compelling argument: Bitcoin is not only a greater type of cash than gold, it’s also extra moveable, divisible, and utility-driven. Over the previous decade, Bitcoin has outperformed each main asset class, cementing its place as a superior retailer of worth. For Africa, a continent typically marginalized within the world monetary system, a Strategic Bitcoin Reserve could possibly be the important thing to unlocking financial independence, fostering innovation, and securing long-term prosperity. How?

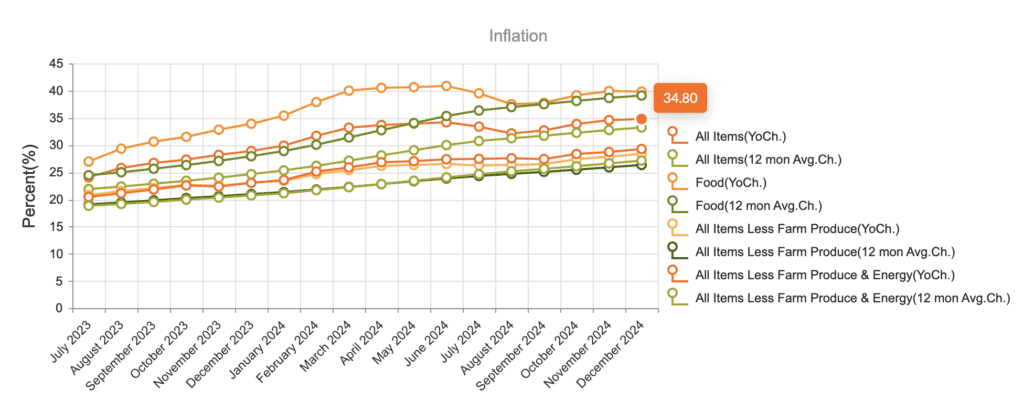

It’s time to be factual and lifelike in our comparability. Bitcoin exists digitally and requires no bodily storage, commodities like beef and mutton are perishable and dear to take care of. The World Financial institution estimates that post-harvest losses for agricultural merchandise in Africa quantity to $48 billion yearly, highlighting the inefficiencies of commodity-based reserves. Whereas commodities have intrinsic worth, their utility is restricted to particular industries. Bitcoin, then again, is a worldwide, borderless asset with functions in finance, know-how, and past whereas its distinctive properties make it a perfect candidate for a strategic reserve asset. With a capped provide of 21 million cash, Bitcoin is inherently deflationary, in contrast to fiat currencies that may be printed indefinitely or beef with limitless reproductive mechanisms. In keeping with CoinMarketCap, Bitcoin’s market capitalization has grown from lower than 1 billion in 2013 to over 1 trillion in 2025, demonstrating its speedy adoption and worth appreciation.

Picture Supply : CoinMarketCap

WHY BITCOIN OVER BEEF ?

Bitcoin could be transferred throughout borders in minutes and divided into smaller items (satoshis), making it extra sensible than gold or beef. Over the previous decade, Bitcoin has delivered a median annual return of over 200%, outperforming gold, shares, and actual property. A research by Constancy Investments discovered that Bitcoin’s risk-adjusted returns are superior to conventional belongings, making it a lovely choice for long-term wealth preservation. Globally, nations are starting to acknowledge Bitcoin’s potential as a reserve asset. El Salvador made historical past in 2021 by adopting Bitcoin as authorized tender, whereas nations like Switzerland and Singapore have built-in Bitcoin into their monetary techniques. That is 2025 and America “Strategic Bitcoin Reserve” Invoice is already within the pipeline. In keeping with a 2023 report by Chainalysis, Africa is without doubt one of the fastest-growing cryptocurrency markets, with Nigeria, Kenya and South Africa main in adoption.

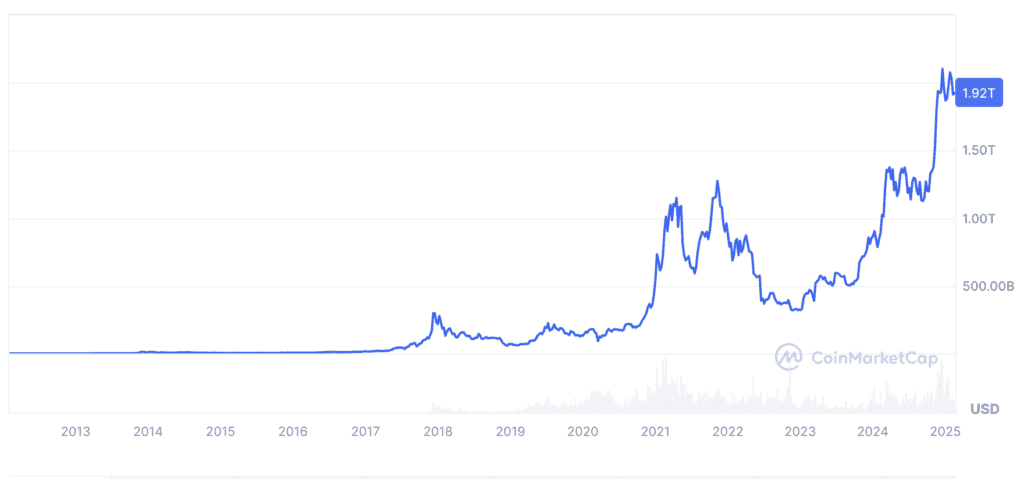

Bitcoin’s deflationary nature makes it an efficient hedge in opposition to inflation, which has plagued many African economies. For instance, Nigeria’s inflation fee hit 34.80% in 2024, eroding the worth of the Naira. A Bitcoin reserve might shield nationwide wealth from such devaluation. By allocating simply 1% of its reserves to Bitcoin, Africa might unlock billions in worth. For example, if the continent’s mixed overseas reserves of 500 billion included 5 billion in Bitcoin, a 10x appreciation in Bitcoin’s worth would yield $50 billion in returns. Not like beef manufacturing, which contributes to deforestation and greenhouse fuel emissions, Bitcoin mining could be powered by renewable power. In keeping with the Cambridge Bitcoin Electrical energy Consumption Index, 58.5% of world Bitcoin mining is powered by renewable power as of 2021. Africa’s huge photo voltaic and hydroelectric potential makes it a perfect location for sustainable Bitcoin mining operations. Storing and managing Bitcoin reserves is much more cost effective than sustaining commodity reserves. There aren’t any storage prices, no danger of spoilage, and no want for complicated logistics.

Picture Supply : Central Financial institution of Nigeria.

El Salvador’s adoption of Bitcoin as authorized tender offers helpful insights for Africa. Regardless of preliminary skepticism, Bitcoin has boosted tourism and overseas funding in El Salvador. In keeping with the Central Reserve Financial institution of El Salvador, tourism income elevated by 30% within the first 12 months following Bitcoin adoption. Over 70% of Salvadorans beforehand lacked entry to banking providers. Bitcoin has enabled thousands and thousands to take part within the world financial system. By decreasing reliance on the U.S. greenback, El Salvador has taken a daring step towards monetary independence. Many African nations rely closely on the U.S. greenback for commerce and reserves, leaving them weak to exterior financial insurance policies. Bitcoin gives a decentralized different, decreasing reliance on conventional monetary techniques.

By establishing a Strategic Bitcoin Reserve, Africa can safe its financial future, shield its wealth from inflation, and place itself as a worldwide chief within the digital financial system. The time has come for Africa to maneuver past outdated financial fashions and embrace the way forward for cash. As Brian Armstrong aptly said, Bitcoin is not only a greater type of cash; it’s the basis of a brand new monetary paradigm. For Africa, the selection is evident: Bitcoin, not beef, is the trail to prosperity. Bitcoin represents a transformative asset class that gives unparalleled benefits over conventional commodities like beef or mutton.

It is a visitor publish by Heritage Falodun. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.