Analyst Weekly, Might 19, 2025

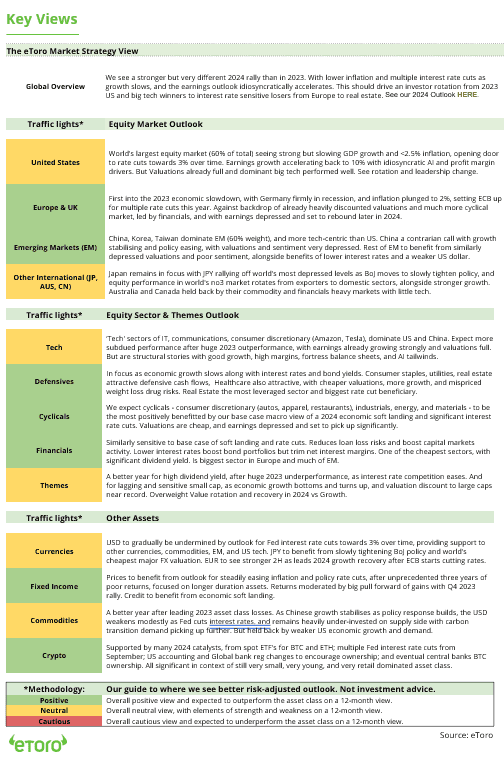

International markets are flashing indicators that matter for the highway forward, and savvy buyers are paying consideration. From AI enlargement into new areas to retail turning worthwhile and governments recalibrating commerce and taxes, the following section of the cycle is taking form. Right here’s what’s shifting markets and what it means on your portfolio.

Uncle Sam’s Not AAA Any Extra

Moody’s simply pulled the US’s closing AAA score, citing ballooning debt, a $2T+ annual deficit, and political gridlock over taxes and spending. However for a lot of available in the market, this was already priced in. The 27-year period of fiscal stimulus resulted in 2023 and internet curiosity funds have quietly climbed to 18% of tax revenues, far above historic norms. It’s clear that tariffs and paying for tax reduce extensions are indicators {that a} new interval of austerity has arrived.

The irony? Moody’s could be late to the social gathering. In 2011, S&P downgraded the U.S. after Congress handed $2T in cuts. Bond yields fell. Now, Moody’s is flagging deficits tied to tax reduce extensions that haven’t even handed whereas ignoring tariffs, which operate as a $2T consumption tax that really helps income. Tariffs damage progress, however they assist the Treasury: a trade-off the market appears to grasp higher than the score companies. Investor Takeaway: The downgrade displays what markets already know: we’re in a brand new fiscal regime outlined by austerity through tariffs and caps, not stimulus. Regulate Treasury yields and financial negotiations however don’t overreact to the downgrade itself. Historical past reveals these calls usually lag the basics.

Britain’s Massive Beat, Meet Massive Breach

The UK kicked off 2025 with a bang: GDP rose 0.7% q/q in Q1, topping forecasts and main the G7. Sturdy client spending and industrial output did the heavy lifting, giving the federal government a story win. Whereas questions stay round recent tax will increase and commerce tensions, the expansion beat reveals the UK financial system nonetheless has momentum. In different phrases, Britain’s financial system is successful the dash, however the marathon has obstacles forward (commerce coverage being a key one).

In the meantime, a really 2025 downside hit a British retail icon. Marks & Spencer (MKS.L) was sidelined by an enormous cyberattack that knocked out its web site and app for over three weeks. The ransomware-style assault left M&S unable to take on-line orders since late April, with some retailer cabinets even operating low as programs went offline. The retailer confirmed hackers stole sure buyer information (fortunately no fee information) and disruption has price it an estimated £30+ million in revenue up to now. M&S shares have tumbled about 14% for the reason that Easter weekend when the cyber woes started. The corporate is working to get operations again to regular, however the incident is a blunt reminder that even century-old manufacturers want cutting-edge cyber defenses. Investor Takeaway: A powerful financial system doesn’t immunize corporations from tech threats: buyers within the UK market should steadiness the encouraging large image (sturdy GDP, bettering sentiment) with due diligence on company-specific vulnerabilities (like cybersecurity resilience). Regulate commerce coverage strikes too, as any post-truce tariff flare-up may shortly flip Britain’s shock increase right into a bust.

Supply: Bloomberg, As of Might 18, 2025.

Desert Offers Gas AI Chip Rally

Walmart Lastly Cashes In On-line

Copper: Electrified, Scarce, and (Barely) Tariffed

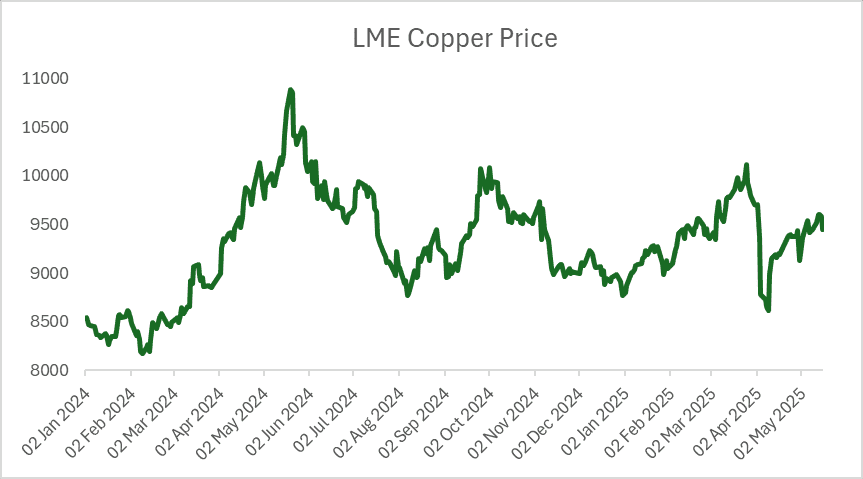

Copper simply received hotter. Structurally, demand is being supercharged by all the things from EVs and photo voltaic panels to AI information facilities (sure, servers want critical energy). China, which buys over half the world’s copper, has rolled out infrastructure-heavy stimulus for 2025, including extra gas to the fireplace. However provide? That’s the place it will get tight. Chile and Peru (which mine 40% of worldwide copper) are battling falling ore high quality, political disruptions, and water shortages – a mixture that’s slowing down manufacturing simply as demand ramps.

Then got here a curveball: the US is doubtlessly (not but imposed) implementing a 25% tariff on copper imports, spooking merchants and quickly flooding inventories, which despatched costs tumbling. A 90-day truce with China has helped stabilize sentiment, however the market’s nonetheless edgy. Investor Takeaway: For buyers, the setup stays advanced: structurally bullish, however tactically risky. UK-based publicity ranges from direct copper exposures like WisdomTree Copper, to diversified miners (ANTO.L, GLEN.L, RIO.L) and broader pure sources funds (BRWM). Every brings completely different sensitivities to copper worth shifts and to the coverage dangers now baked into the commerce.

Supply: Bloomberg, information as of Might 18, 2025.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.