Predicting Bitcoin’s value has at all times been a sizzling matter for buyers. Matt Crosby, lead market analyst at Bitcoin Journal Professional, explores this matter in his current video, “Reality About Bitcoin Inventory To Movement, Energy Legislation & Value Fashions”. Right here, we break down Crosby’s key insights to assist buyers improve their Bitcoin methods.

Inventory-to-Movement (S2F): A Helpful Software, Not a Crystal Ball

The Inventory-to-Movement (S2F) mannequin is among the hottest methods to foretell Bitcoin costs, and Crosby explains its advantages and downsides clearly.

Key Takeaways:

What Is S2F? S2F assesses Bitcoin’s shortage by evaluating the “inventory” (present provide) to the “circulate” (newly mined cash), much like how uncommon commodities like gold are evaluated.Up to date Predictions: The Cross-Asset S2F mannequin initially forecasted Bitcoin hitting $288,000 between 2020 and 2024. Extra just lately, it recommended a attainable valuation of $420,000 by April 2025.Limitations: S2F works till sudden occasions—like world financial adjustments—disrupt Bitcoin’s normal patterns. Crosby aptly factors out, “S2F works till it doesn’t.”

Whereas S2F is a useful information, it is important for buyers to think about broader market situations and macroeconomic influences alongside it.

Bitcoin Energy Legislation: The Lengthy-Time period View

Crosby additionally explores the Bitcoin Energy Legislation, a mannequin that makes use of a log-log chart as an instance Bitcoin’s historic value patterns.

Why It Issues:

Logarithmic Scaling: By utilizing logarithmic scaling, the Energy Legislation highlights Bitcoin’s long-term development of decreased volatility and moderated development.Limitations: This mannequin affords insights for the lengthy haul however is much less useful for short-term predictions or market surprises.

For buyers aiming to diversify their portfolios and strategically time their investments, the Energy Legislation supplies context however must be used with different, extra dynamic instruments.

Actual-Time Metrics: The Key to Adaptability

Crosby emphasizes the bounds of static fashions like S2F and the Energy Legislation, advocating for real-time, data-driven approaches as an alternative.

Instruments Traders Ought to Use:

MVRV Z-Rating: Measures market cap towards realized cap, figuring out when Bitcoin is overvalued or undervalued. SOPR (Spent Output Revenue Ratio): Supplies insights into market sentiment by monitoring profit-taking habits.On-Chain Metrics: Metrics like Bitcoin’s realized value and value-days-destroyed assist detect market turning factors.

These metrics give buyers the instruments to adapt their methods to the market’s habits in real-time moderately than relying solely on predictions.

Why Exterior Components Matter

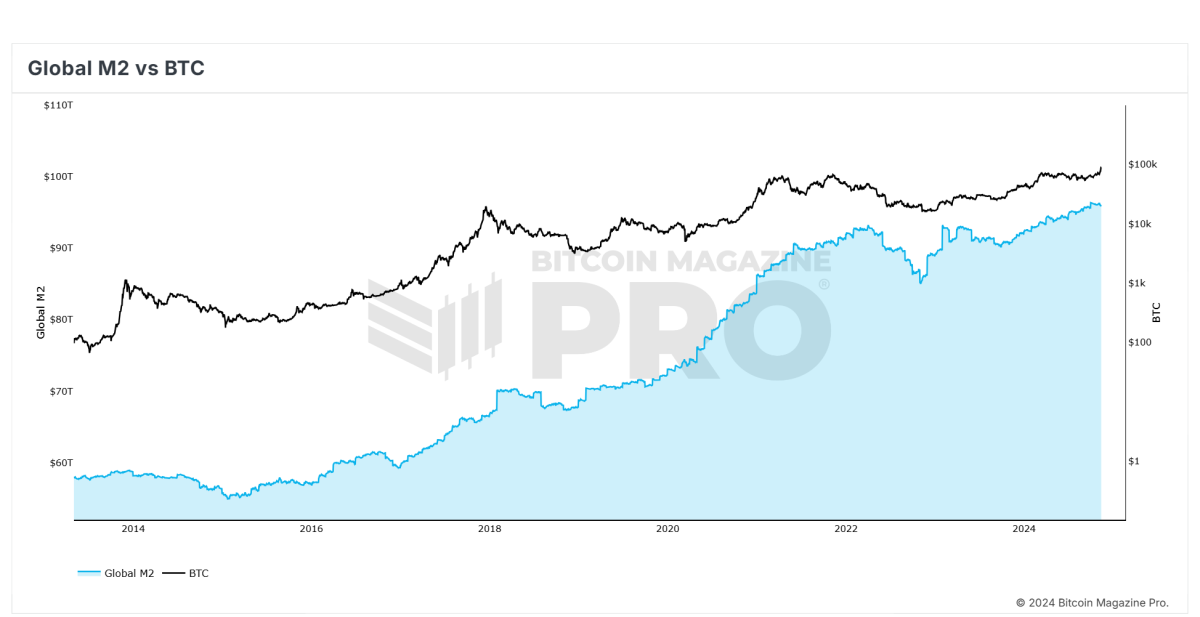

Crosby cautions towards relying solely on Bitcoin-specific knowledge, emphasizing the significance of exterior components:

World Liquidity: Bitcoin’s value typically strikes with world liquidity cycles, making macroeconomic consciousness essential.Institutional Adoption: Actions by main gamers akin to sovereign wealth funds, company treasuries, or institutional asset managers can drastically affect Bitcoin’s value.Regulatory Adjustments: Authorities choices to control or undertake Bitcoin can considerably have an effect on its valuation.

Incorporating each macroeconomic components and Bitcoin-specific metrics is vital for a well-rounded evaluation.

Ultimate Ideas: Keep Pragmatic

Crosby concludes by reminding buyers that no single mannequin can predict Bitcoin’s value with certainty. As an alternative, these instruments must be used to supply construction and perception into an unpredictable asset.

Sensible Ideas for Traders:

Use A number of Fashions: Cross-check predictions utilizing totally different fashions to achieve a clearer understanding of the market.Embrace Actual-Time Information: Depend on metrics like MVRV Z-score and SOPR for well timed, actionable insights.Adapt to Change: Be prepared to regulate methods based mostly on each inner knowledge and exterior influences.

Bitcoin Journal Professional affords superior analytics and real-time knowledge to assist buyers navigate this fast-paced market. To dive deeper into Crosby’s insights, watch the total video right here: Reality About Bitcoin Inventory To Movement, Energy Legislation & Value Fashions.