Introduction

Ray Dalio’s All Climate Portfolio is likely one of the most well-known funding methods designed to carry out properly throughout numerous financial environments whether or not in occasions of progress, inflation, recession, or deflation. The core precept behind the All Climate technique is threat parity, which balances asset lessons based mostly on their threat contributions quite than capital allocation alone.

Nonetheless, the unprecedented rise in rates of interest in 2022 triggered by the Federal Reserve’s aggressive financial tightening posed vital challenges to this technique. Bonds, historically a stabilizing drive within the portfolio, suffered historic losses, whereas equities additionally declined on account of recession fears.

On this article, we are going to:

Look at the unique composition of the All Climate Portfolio.

Analyze the way it carried out in 2022 amid rising charges.

Talk about changes that would enhance its resilience in a high-rate atmosphere.

Consider whether or not the All Climate technique stays viable for long-term traders.

1. The Authentic All Climate Portfolio: A Threat-Parity Strategy

Ray Dalio’s All Climate Portfolio was designed to ship regular returns no matter financial situations by balancing 4 key financial environments:

Rising Progress (Financial growth)

Falling Progress (Recession)

Rising Inflation

Falling Inflation (Deflation)

The normal allocation is:

30% Shares (e.g., S&P 500 or world equities)

40% Lengthy-Time period Treasury Bonds (for deflation safety)

15% Intermediate-Time period Treasury Bonds (for stability)

Extra allocations to gold (7.5%) and commodities (7.5%) for inflation hedging.

The logic was that:

Shares carry out properly in progress environments.

Lengthy-term bonds thrive in deflationary/recessionary intervals.

Gold & commodities shield in opposition to inflation.

Why It Labored Earlier than 2022

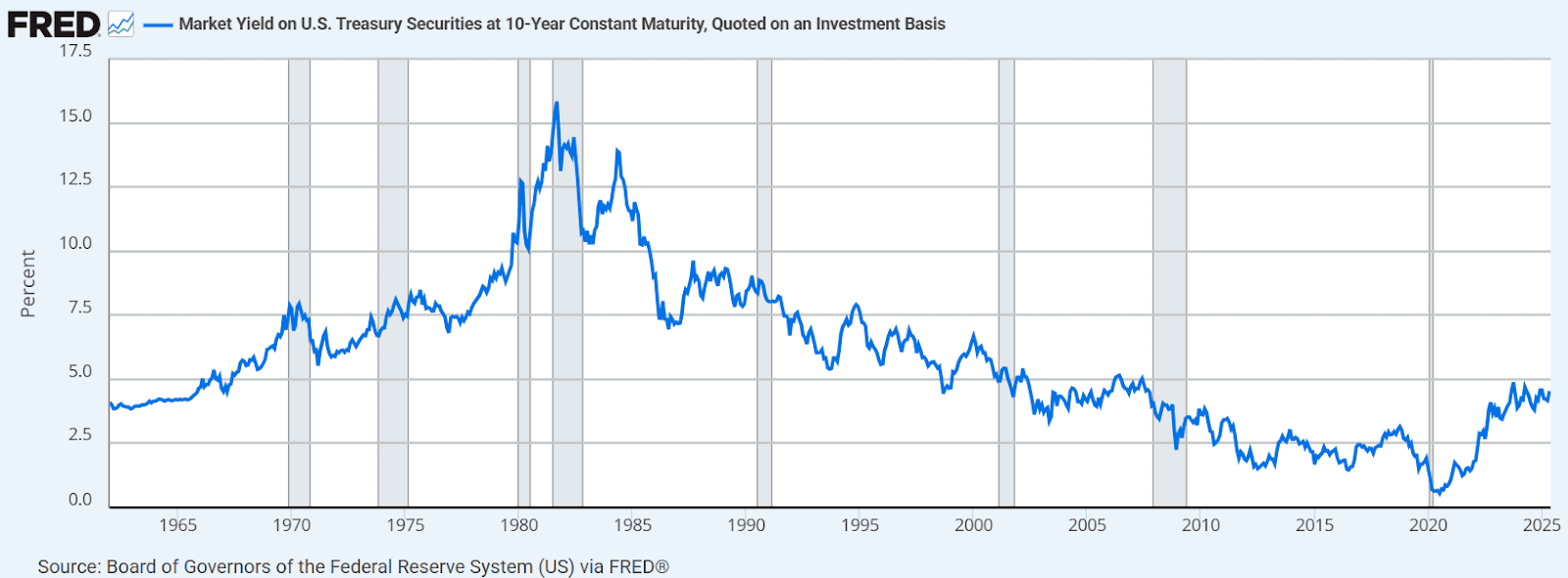

From the Eighties to 2020, the All Climate technique benefited from:

Falling rates of interest, which boosted bond returns.

Low inflation, which saved volatility in test.

Secure financial progress, supporting equities.

Nonetheless, the 2022 market regime shift disrupted this steadiness.

2. The 2022 Stress Take a look at: Rising Charges and Portfolio Drawdowns

In 2022, the Federal Reserve raised rates of interest from close to 0% to over 4% to fight inflation, the quickest tightening cycle in many years. This had extreme penalties for the All Climate Portfolio:

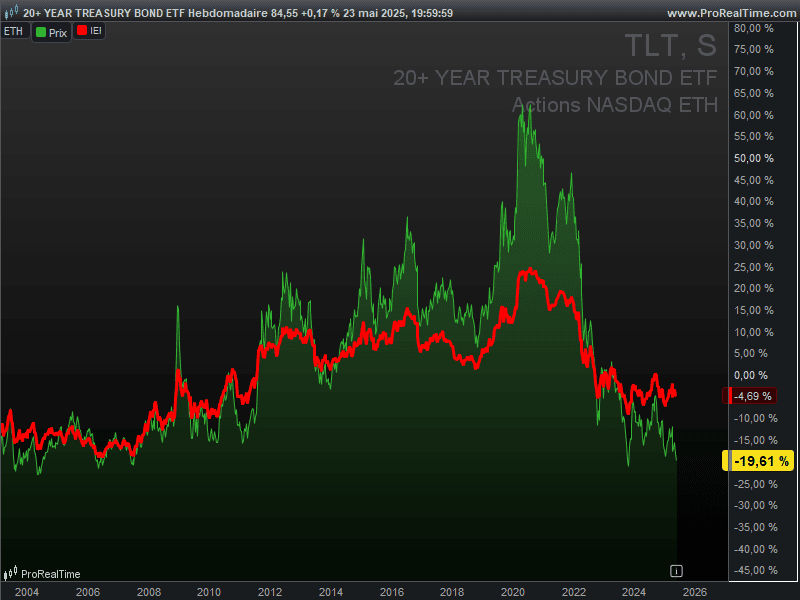

A. Bonds Suffered Historic Losses

Lengthy-term Treasuries (TLT in inexperienced) fell ~30%, their worst yr on document.

Intermediate bonds (IEF in purple) dropped ~10%.

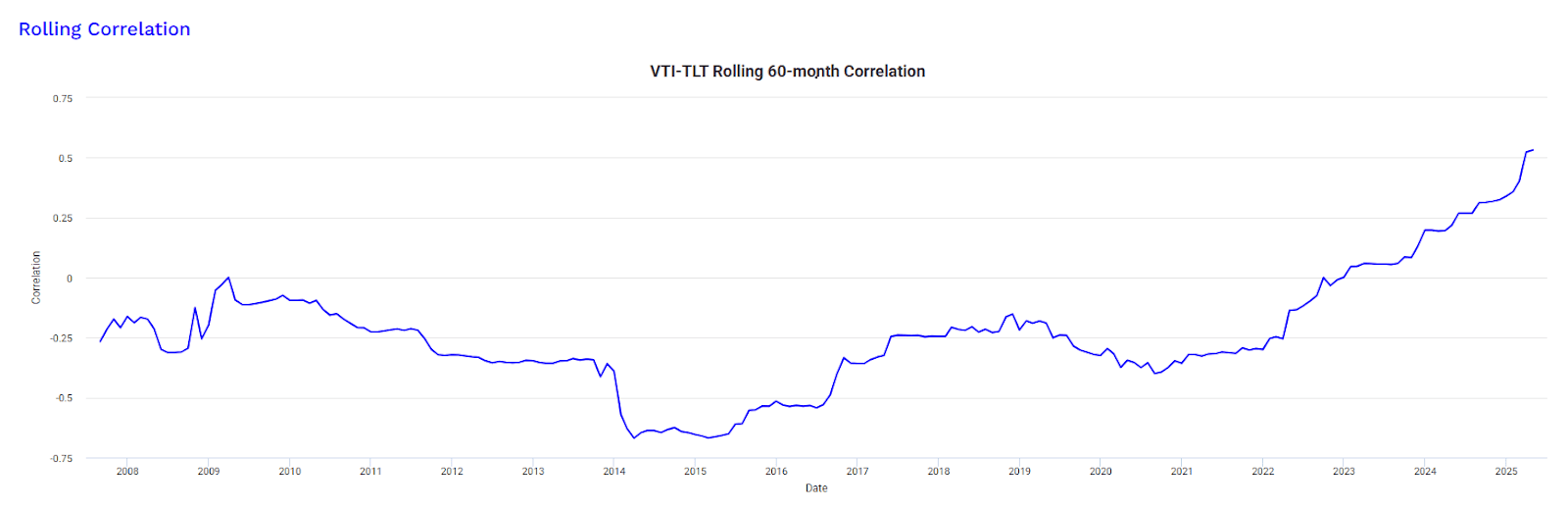

Usually, bonds act as a hedge in opposition to inventory declines, however in 2022, each shares and bonds fell concurrently, breaking the standard 60/40 portfolio’s diversification advantages.

This chart reveals a big shift: the decades-long unfavourable correlation between TLT and VTI has disappeared since 2022.

B. Shares Declined Attributable to Recession Fears

The S&P 500 dropped ~20% in 2022.

Progress shares (particularly tech) have been hit hardest as larger charges diminished their future money movement valuations.

C. Gold & Commodities Have been Combined

Gold was flat to barely unfavourable (no yield in a rising-rate atmosphere).

Commodities (oil, metals) surged early in 2022 however later corrected.

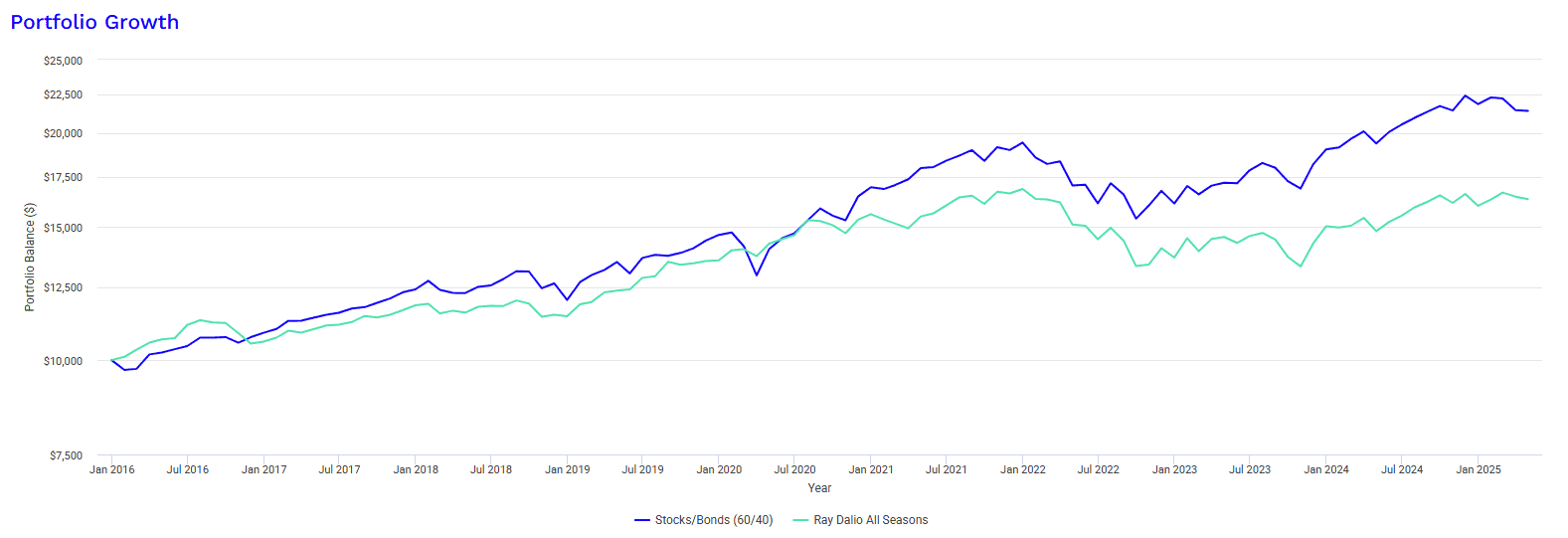

Consequence: The All Climate Portfolio Underperformed

Whereas it nonetheless fared higher than a pure 60/40 inventory/bond portfolio, the All Climate technique noticed vital drawdowns (~15-20%), difficult its repute as a “set-and-forget” strategy.

3. Changes for a Greater-Fee Surroundings

Given the regime shift, ought to traders abandon the All Climate technique? Not essentially however some changes might enhance resilience:

A. Length Threat Administration

Shorter-duration bonds sometimes exhibit much less sensitivity to rate of interest adjustments

TIPS are particularly designed to regulate for inflation, although their efficiency varies

B. Actual Asset Allocation

Commodities have traditionally proven resilience throughout inflationary intervals

REITs might supply twin advantages of earnings and potential inflation correlation

C. Diversification Approaches

Pattern-following methods demonstrated effectiveness throughout latest unstable markets

Present yield atmosphere makes money devices extra enticing than lately

D. Adaptive Portfolio Development

Macroeconomic indicators can inform allocation changes, although timing is difficult

Common portfolio critiques assist align with altering market situations

Word on Implementation

These observations symbolize common market rules. Precise portfolio choices ought to incorporate particular person circumstances, threat tolerance, {and professional} steering. Market situations and funding outcomes are by no means assured.

4. Is the All Climate Technique Nonetheless Viable?

Regardless of the 2022 challenges, the All Climate Portfolio stays a strong long-term technique as a result of:

It’s designed for all cycles, not simply low-rate environments.

Greater bond yields now enhance future returns (10-year Treasuries at ~4.5% supply higher earnings than in 2020).

Inflation might stabilize, restoring bonds’ hedging position.

Nonetheless, traders ought to:

Anticipate decrease returns than within the 2010s.

Be ready for larger volatility in a world of elevated charges and inflation.

Contemplate a extra versatile model of threat parity (e.g., Bridgewater’s present strategy).

Conclusion

Ray Dalio’s All Climate Portfolio confronted its hardest check in 2022 as rising charges disrupted each shares and bonds. Whereas its efficiency was disappointing, the core rules of diversification and threat balancing stay sound.

Going ahead, traders might have to:✔ Shorten bond length to scale back rate of interest threat.✔ Inflation linked bond (TIPS) to profit from surprising inflation rise.✔ Improve actual belongings (commodities, REITs).✔ Keep versatile with tactical changes.

The All Climate technique isn’t damaged however like several portfolio, it should adapt to altering market regimes. For long-term traders, it stays a priceless framework, offered they perceive its limitations in a high-rate world.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.