Nomad Meals ($NOMD) is Europe’s main frozen meals firm. Its ERP backdrop may very well be a yummy alternative to get publicity to some family names in a strong and rising trade.

Key Highlights

Nomad Meals is a portfolio firm with sturdy manufacturers within the frozen meals trade

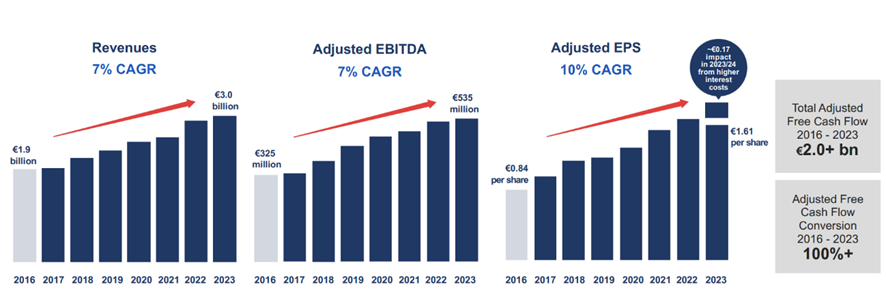

Regardless of its transitionary ERP issues the corporate exhibits a robust progress trajectory

Nomad Meals at present trades at a reduction making use of a conservative valuation mannequin

The Enterprise and the Trade

As Warren Buffett famously stated, “Corporations which have the highest share of customers’ minds have each pricing energy and model loyalty, which end in wealth creation for shareholders.” Nomad Meals is an ideal instance. Rising up in an Italian family, Captain Findus fish sticks had been all the time a staple in our weight loss program—a exceptional achievement, contemplating how explicit Italians are about meals. This exemplifies the energy of Nomad Meals: an organization that, by a collection of strategic acquisitions, has constructed a compelling portfolio of family manufacturers, now commanding 20% of the European frozen meals market.

On high of Findus, fashioned in 1941 and marketed in Italy, France, Spain, Sweden, Switzerland and Norway, the opposite manufacturers are family names with lengthy histories and native heritage of their respective markets. The Birds Eye model was established in 1922 and is primarily marketed within the UK and Eire. The iglo model, based in 1956, has a longstanding historical past and is marketed in Germany and different continental European nations. Ledo (established in 1958) and Frikom (established in 1975) are the lead manufacturers with sturdy heritage in south-eastern Europe.

Frozen meals merchandise are significantly enticing as a result of they deal with necessary international meals tendencies. Customers more and more want merchandise that enable them to organize meals shortly and with confidence and count on merchandise to be wholesome and good worth for cash. As well as, customers are more and more targeted on lowering meals waste. Frozen meals merchandise can have all of those traits. They’re simple to organize, they scale back the necessity for synthetic preservatives, they’re typically higher worth for cash than chilled alternate options and so they scale back waste in any respect factors within the provide chain and in addition in-home (because of the lengthy shelf life, and the convenience of portionability).

Nomad Meals – Investor Presentation

Competitors

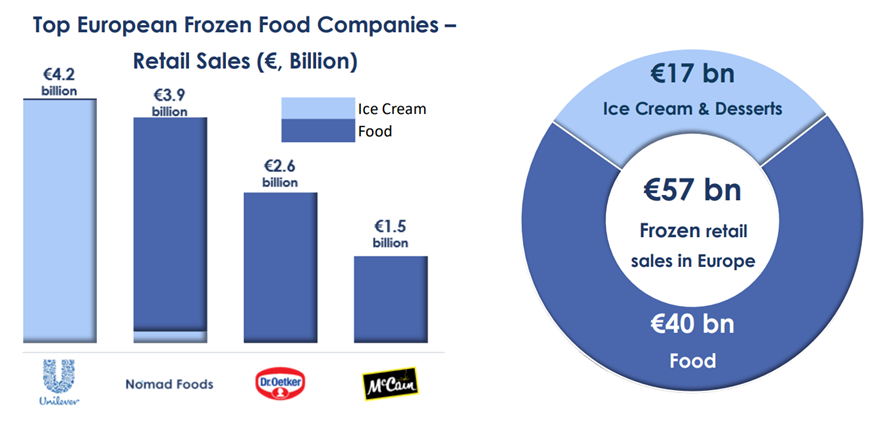

The primary frozen meals producers in Europe are Nomad Meals, Unilever, Dr Oetker and McCain. Unilever instructions the ice cream market with manufacturers like Magnum, Ben & Jerry’s and Wall’s. Dr Oetker is legendary for its frozen pizzas, whereas McCain is the most well-liked model for frozen potatoes. There are additionally plenty of personal labels, just like the grocery store chains, that provide low price frozen merchandise below their very own manufacturers.

Regardless of a aggressive surroundings, Nomad Meals is energetic in segments completely different from its branded rivals, the place it may command a superior market share. Nomad Meals product combine is closely skewed in direction of protein and greens which account for 75% of its revenues. Its market share has laid the foundations of its aggressive benefit. Certainly, Nomad Meals advantages from economies of scale, long-term retail relationships, and a various product and geographic combine. Its well-established manufacturers give the corporate a robust model fairness technique, with main spontaneous model consciousness in a number of areas.

Furthermore, the corporate has optimized its sourcing technique. By working a centralized procurement and provide chain aligned with its geographic footprint, Nomad Meals successfully reduces distribution prices. It sources merchandise globally from a large community of suppliers, minimizing the chance of over-reliance on any single provider. Moreover, the corporate operates 18 manufacturing amenities strategically positioned close to its major markets. This diversified manufacturing setup permits for higher logistics administration, balancing manufacturing prices with excessive customer support ranges.

Nomad Meals – Investor Presentation

Market

The consumption of frozen meals is backed by clear secular tendencies. The consumption of frozen meals cuts down meal preparation, giving households again extra time for what issues most. Frozen meals is cheaper in comparison with their chilled equivalents. This issues for 93% of European customers, who modified their technique to store to handle expenditures in a price of dwelling disaster. Lastly, frozen meals are considerably extra sustainable each for retailers and closing customers. Certainly, they permit to scale back waste for his or her vital longer shelf life.

During the last ten years the European savory frozen meals market has grown round 3% whereas experiencing an enormous spike in class demand all through the COVID pandemic, pushed by the aforementioned skill to deal with international meals consumption tendencies. Moreover, the quantity of area that frozen meals as a class occupies inside the grocery retail surroundings is comparatively steady because of the mounted quantity of freezer area on the retailer that isn’t uncovered to reductions in shelf area in favor of different classes or codecs, as might be the case in shelf-stable elements of the retailer. Anyway, these different meals classes grew solely 2% in the identical time frame.

Strategic Alternatives

In comparison with their US counterparts, Europeans devour a lot much less frozen meals per capita, favoring recent choices attributable to misconceptions about their poor high quality. Per capita consumption of frozen meals within the US is eighteen.2 kg, whereas the European common is round 8 kg. Controlling for the dietary variations between European and US customers, this development remains to be vital and will slim within the close to future. This opens up compelling progress alternatives for European producers.

Nomad Meals progress initiatives focus round strategic acquisitions, geared toward figuring out and executing on enticing progress alternatives to consolidate their core product combine. Nomad Meals possesses strong acquisition experience, supported by a robust administration workforce and entry to capital.

The corporate can also be targeted on its core product classes – fish, greens, and poultry – which account for 67% of its branded retail gross sales. Efforts to reinforce these classes embody enhancing product high quality, refreshing packaging, and optimizing in-store execution by higher product assortment, show methods, and promotions. Given its present comparatively low penetration at poultry and potato markets in European nations, Nomad Meals has a lot area for additional progress.

Lastly the corporate needs to extend margins and money flows by disciplined price administration and provide chain optimization. This contains initiatives like lean manufacturing, manufacturing unit footprint optimization, and enhancing procurement productiveness, in addition to growing stronger promotional applications, worth structure, and commerce phrases. Though over the previous a number of quarters Nomad Meals’ profitability has been below stress, margins stay steady and should enhance sooner or later, offering more money for distributions to shareholders.

Dangers

Nomad Meals – Investor Presentation

There are some dangers related to a profitable execution of Nomad Meals’ plans. For instance, an elevated consolidation within the frozen meals market would possibly scale back the gross sales of the corporate. On the identical time, an inflationary surroundings might scale back the power of the corporate to cross by worth will increase to customers. Anyway, the vertically built-in operations of Nomad Meals give it an edge within the complicated pipelines of chilly provide chains in opposition to its rivals in addition to higher worth management capabilities.

Lastly, Nomad Meals depends on gross sales to a restricted variety of giant meals retailers. The meals retail segments are extremely concentrated, with Nomad Meals’ high 10 retail clients accounting for about 32% of its annual income. Ought to these retailers carry out poorly, the corporate’s enterprise may very well be adversely affected. Regardless of this being a severe menace, Nomad Meals managed to extend its revenues annually during the last ten years, that means that its gross sales channels and advertising capabilities can face varied challenges.

Nomad Meals Valuation

However what’s the worth of Nomad Meals?

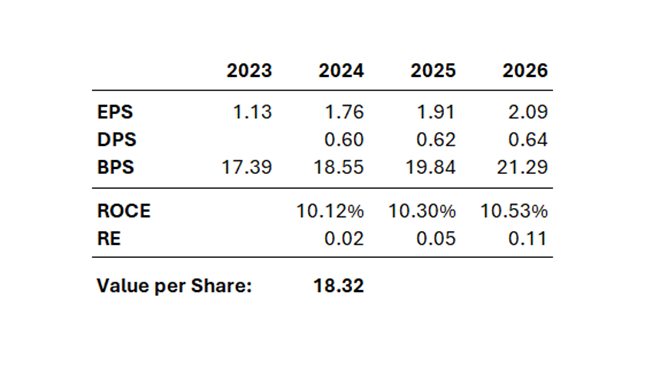

I’ll use the Residual Earnings Mannequin to worth the enterprise, detailed in Accounting for Worth by Stephen Penman (Columbia Enterprise Faculty Publishing, 2010). Some main advantages from utilizing this mannequin are the low variety of inputs, low quantity of hypothesis added and strict connection to the fundametals.

I’ll assume EPS of €1.76, €1.91 and €2.09 for FY 2024, FY 2025 and FY 2026. These are essentially the most up to date estimates of the monetary analysts following the corporate. Plus, I’ll assume DPS (Dividend per Share) of €0.60, €0.62 and €0.64, in keeping with the corporate’s dedication. I’ll assume a ten% Price of Capital, that’s cheap contemplating the present risk-free rates of interest. I will even assume a 0% progress charge for the RE (Residual Earnings). This strategy has two key advantages: it considerably reduces the chance of overpaying for progress and aligns with market idea, which means that residual earnings are inclined to diminish over time. Given a BPS (Guide Worth per Share) in FY 2023 of €17.39, we are actually able to compute the worth per share of the corporate:

The BPS for FY 2024 and FY 2025 is computed including the EPS and subtracting DPS from earlier yr BPS. We compute ROCE (Return on Frequent Fairness) because the ratio of EPS and former yr BPS. The Residual Earnings are computed subtracting the Price of Capital from the ROCE, permitting us to concentrate on the Financial Earnings of the corporate. The result’s then multiplied by the earlier yr BPS. Lastly, we low cost future Residual Earnings with a ten% Price of Capital, assuming no progress for the long run intervals, and we add it to the bottom BPS.

As we will see the ensuing worth per share is €18.32, exhibiting roughly a 17% premium from the present worth of Nomad Meals. This valuation is very conservatory, that means that it might be enough for the corporate to ship their commitments to see this appreciation mirrored within the inventory worth.

Conclusion

The present ERP headwinds have led to a downward revision of steerage for the top of 2024. This follows a difficult interval for the frozen meals trade, marked by inflationary pressures and the cost-of-living disaster. Regardless of these difficulties, Nomad Meals not solely maintained its profitability but in addition elevated its revenues—a formidable testomony to the corporate’s resilience and energy.

With its industrial flywheel gaining momentum and its enterprise mannequin supported by clear secular tendencies, the transitional challenges confronted by this exceptional firm could current a beautiful alternative for buyers in search of publicity to a rising trade inside the European market.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.