The Day by day Breakdown takes a take a look at the rebound in tech, particularly inside the Magnificent 7, as this group is powering the latest rally.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our each day insights, all that you must do is log in to your eToro account.

Friday’s TLDR

Tech lagged badly in Q1

Nevertheless it has led the latest rally

What’s Taking place?

At one level, tech was one of many worst-performing sectors within the S&P 500 this yr, down greater than 10%. Whereas tech remains to be down on the yr — decrease by about 1.5% — it’s not scraping the underside of the sector-performance barrel.

(Sadly, that belongs to the power, healthcare, and client discretionary sectors, all three of that are down about 5% thus far in 2025).

The rebound in tech might be attributed to the Magnificent 7. Aside from Apple, each holding within the Magazine 7 is outperforming the S&P 500 over the previous month — and bear in mind, about 30% of the S&P 500 is tech.

Nvidia, Tesla, Microsoft and Meta have been main leaders amid the latest rally, significantly Microsoft and Nvidia given their measurement (with a mixed market cap of greater than $6.6 trillion).

The year-to-date readings are a bit of lumpy, highlighting the robust efficiency from this group in Q1, whereas the one-year efficiency is combined; a mixture of large outperformers, and some delicate under-performing stragglers.

The information doesn’t inform the entire story, both.

As an example, TSLA stays almost 30% beneath its document excessive, almost twice as a lot as the subsequent worst-performer by that metric — Alphabet. In actual fact, 5 of the Magazine 7 elements are down greater than 10% from their document highs, whereas the S&P 500 is down rather less than 5% from its document.

The Backside Line: It’s been a tricky stretch for mega-cap tech, each in Q1 2025 and after we look again over the previous few quarters (notice: solely three Magazine 7 names have outperformed the S&P 500 over the previous yr).

Like the general market, these shares are liable to volatility. Nonetheless, if this group maintains momentum, it’s attainable that the Magnificent 7 nonetheless has room to the upside on condition that many are nonetheless down notably from their highs. And in the event that they proceed to rally, this group might very properly buoy US shares, given their outsized weighting within the indices.

Wish to obtain these insights straight to your inbox?

Enroll right here

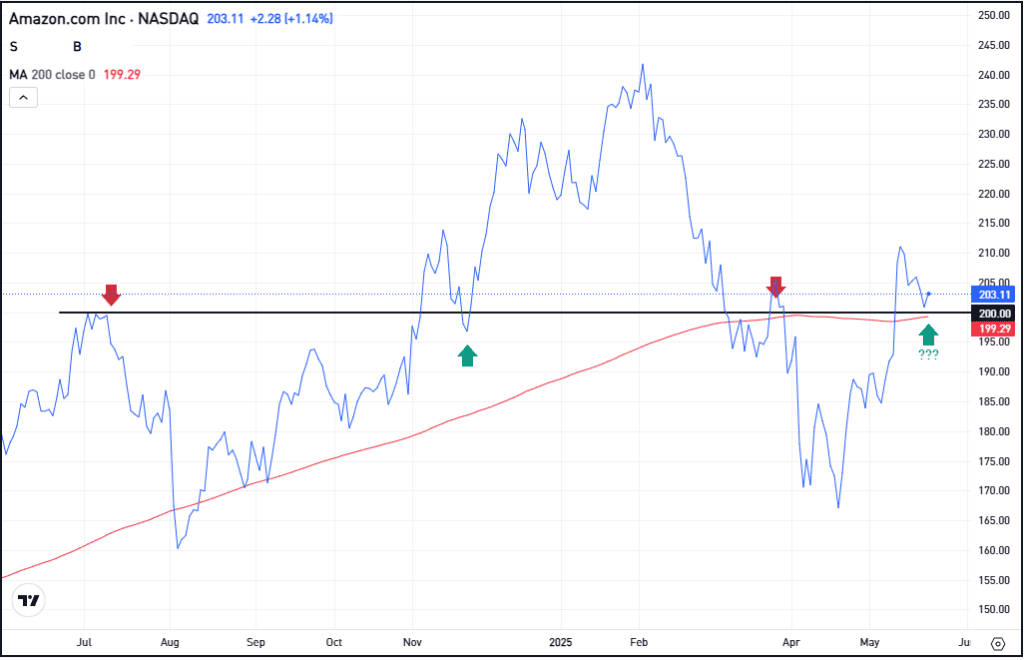

The Setup — Amazon

The one inventory we didn’t point out above? Amazon. And apparently, its chart actually stands out. That’s as shares have loved a robust rebound from the latest lows, up about 25%, however have since pulled again to search out assist close to $200.

Not solely is $200 a key technical space on the charts — having served as each assist and resistance prior to now — however it’s close to the place the 200-day shifting common additionally comes into play.

Amazon was in give attention to Thursday on stories that Invoice Ackman’s Pershing Sq. acquired a place within the inventory.

Whereas Amazon has achieved nice these days, think about simply how far the inventory fell from its excessive in Q1. In actual fact, shares are nonetheless down greater than 16% from the highs.

Bulls need to see the inventory maintain close by assist (~$200 and the 200-day). If AMZN can do this, traders will hope for extra upside within the coming weeks. If assist doesn’t maintain, extra draw back is feasible.

It’s vital to notice that, simply because assist holds, doesn’t essentially imply AMZN will hurry again to document highs. Nor does it imply that failure to carry this degree will ship shares again to the latest low. The $200 space is only one spot on the chart for energetic traders to keep watch over.

Choices

That is one space the place choices can come into play, as the chance is tied to the premium paid when shopping for choices or possibility spreads.

Bulls can make the most of calls or name spreads to take a position on a rebound, whereas bears can use places or places unfold to take a position on extra draw back ought to assist break.

For these seeking to be taught extra about choices, think about visiting the eToro Academy.

Disclaimer:

Please notice that as a consequence of market volatility, among the costs might have already been reached and situations performed out.