Not way back, Bitcoin was seen as a dangerous gamble—an unpredictable asset recognized for large value swings and fixed threats of presidency crackdowns. As we speak, the story has modified. The cryptocurrency has gone from being a fringe thought to a critical matter of dialogue world wide.

Folks are actually asking whether or not Bitcoin, with its fastened provide and independence from any authorities, might tackle a brand new position: turning into a world reserve forex.

The thought could seem far-fetched, however it’s gaining consideration. Governments and monetary leaders are beginning to view Bitcoin as a potential solution to defend in opposition to inflation. Within the U.S., Donald Trump’s plan to create a nationwide Bitcoin reserve has sparked conversations in all places. On the similar time, international locations just like the Czech Republic, Bhutan, and Hong Kong are wanting into utilizing Bitcoin of their reserves.

In a world going through rising financial challenges, political conflicts, and fears about rising costs, adopting Bitcoin as a world reserve forex would introduce dynamics that may alter the monetary panorama perpetually.

However can Bitcoin actually change conventional currencies just like the U.S. greenback, or at the least work alongside them?

Earlier than we are able to assess whether or not Bitcoin is able to grow to be a world reserve forex, it’s necessary to first perceive what this position includes. A reserve forex is a international forex that central banks and monetary establishments maintain as a part of their international alternate reserves. These reserves are essential for stabilizing economies, supporting worldwide commerce, and making certain liquidity in international markets. To serve this objective, a reserve forex have to be secure, extensively accepted, and simply tradable on a world scale.

There are eight main reserve currencies, together with the U.S. greenback, Australian greenback, British pound sterling, Canadian greenback, euro, Chinese language Yuan, Japanese yen, and Swiss franc. Nevertheless, for many years now, the U.S. greenback has been the dominant reserve forex. It accounts for roughly 59% of world international alternate reserves.

For a forex to keep up its standing as a reserve forex, it should meet a number of key standards:

Stability: A reserve forex should keep its buying energy over time. Extreme value fluctuations make it unreliable as a retailer of worth and unsuitable for worldwide commerce.

Liquidity: The forex have to be extremely liquid, that means it may be exchanged in massive quantities with out disrupting the market. Excessive liquidity ensures it’s efficient for worldwide commerce, funding, and debt funds.

Acceptability: A reserve forex have to be trusted and extensively utilized by governments, companies, and people globally. It must function a reliable medium of alternate in cross-border transactions and a secure funding possibility.

These standards set a excessive bar for any forex aiming to realize reserve standing. So, does Bitcoin have the qualities to satisfy or surpass the requirements set by conventional reserve currencies?

Let’s discover its strengths and weaknesses.

One in every of Bitcoin’s most placing qualities is its decentralized nature. In contrast to conventional fiat currencies, that are managed and controlled by central banks, Bitcoin operates on a blockchain—a decentralized, open community. This implies no single entity or authorities has the ability to regulate its issuance or manipulate its worth. For people and governments who mistrust centralized monetary methods, particularly in nations with fragile economies, Bitcoin affords a way of autonomy and monetary safety.

Take into account international locations like Zimbabwe and Argentina, the place runaway inflation has worn out the worth of residents’ financial savings. Zimbabwe, as an example, recorded a staggering inflation charge of 560.98% in 2024. In such conditions, Bitcoin’s fastened provide of 21 million cash turns into an interesting different. In contrast to fiat currencies that may be devalued by overprinting, Bitcoin’s shortage acts as a built-in safeguard in opposition to inflation, preserving worth in ways in which unstable nationwide currencies can’t.

Bitcoin’s borderless nature is one other highly effective benefit, particularly for worldwide commerce. In contrast to conventional reserve currencies that depend on intermediaries like banks for cross-border transactions, Bitcoin permits direct peer-to-peer funds. This characteristic can considerably decrease transaction prices and streamline international commerce, notably for small companies and international locations with much less developed monetary infrastructures.

A world, decentralized forex like Bitcoin has the potential to democratize entry to worldwide markets, enabling smoother and more cost effective transactions with out the pink tape of conventional banking methods.

Transparency and safety additional strengthen Bitcoin’s attraction. Each transaction is recorded on the blockchain—a public, immutable ledger accessible to anybody. This transparency ensures that transactions can’t be altered or tampered with, fostering belief in a means that many standard monetary methods wrestle to realize.

An actual-world instance of Bitcoin’s potential might be seen in El Salvador. In 2021, the nation grew to become the primary to undertake Bitcoin as authorized tender, initially buying 200 cash, El Salvador has now grown its holdings to six,044 Bitcoin, valued at $617 million. This transfer has not solely positioned the nation as a pioneer in embracing cryptocurrency however has additionally opened doorways for elevated monetary inclusion and funding alternatives.

With decentralization, a hard and fast provide, borderless utility, and unparalleled transparency, Bitcoin presents a compelling case as a possible reserve forex. However whereas these benefits are vital, they’re just one facet of the equation. Challenges like volatility and regulatory hurdles stay main obstacles to its broader adoption.

The European Central Financial institution has lengthy argued that Bitcoin fails as a reserve asset as a result of its lack of liquidity, security, and stability. The financial institution emphasised that its design flaws and technological limitations make it an unreliable technique of fee and ineffective reserve forex.

It’s not simply the ECB, many different central banks are understandably cautious of an asset that would lose half its worth in a matter of weeks. Russian officers have pointed to Bitcoin’s value swings as a dealbreaker for reserve adoption.

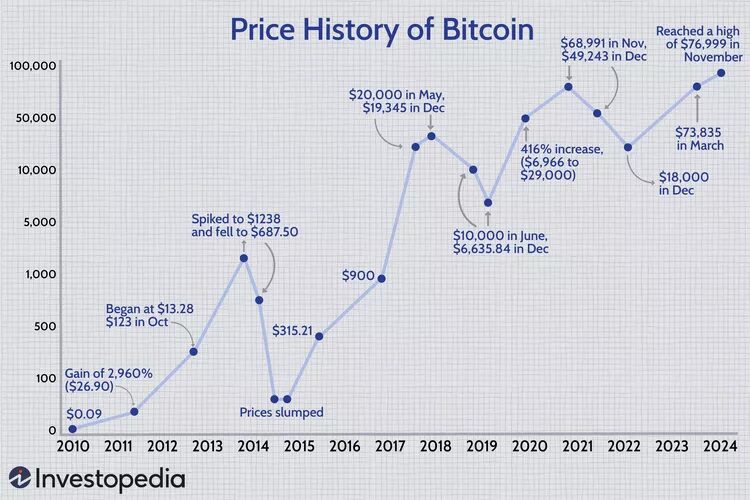

Although it has delivered spectacular development at occasions, the cryptocurrency’s worth can plummet simply as shortly. Take 2022, for instance—Bitcoin’s went from $39,773.83 in April 2022 solely to crash right down to $16,000 in December inside months.

Bitcoin’s Value Historical past Since 2009.

Such drastic fluctuations make it unreliable as a secure retailer of worth, a cornerstone requirement for any reserve forex.

Then there’s the difficulty of regulation. Whereas a number of areas, like Switzerland and Hong Kong, have adopted crypto-friendly insurance policies, many international locations stay cautious—or outright hostile. Within the U.S., as an example, Federal Reserve Chair Jerome Powell stated:

“We’re not allowed to personal Bitcoin. The Federal Reserve Act says what we are able to personal, and we’re not in search of a regulation change.”

Different nations like China have gone even additional, imposing strict restrictions or banning Bitcoin outright. These regulatory inconsistencies create uncertainty, additional complicating Bitcoin’s path to international reserve standing.

RELATED: Assessing The Influence of China’s Crypto Crackdown

Bitcoin’s decentralized nature, one in all its largest strengths, additionally poses challenges within the context of world financial coverage. In contrast to fiat currencies backed by governments, Bitcoin operates with out a government. In occasions of financial disaster or geopolitical instability, central banks usually intervene by adjusting rates of interest or controlling the cash provide. With Bitcoin, such interventions aren’t potential. This lack of centralized management makes it tough to coordinate responses to international monetary crises.

Safety is one other vital concern. Whereas Bitcoin’s blockchain is theoretically safe, managing huge reserves of the digital asset brings distinctive dangers. Cyberattacks, stolen personal keys, and custodial failures are actual threats. Governments would wish to speculate closely in strong digital safety measures to guard Bitcoin reserves. Questions round custody—whether or not to depend on third-party custodians, self-custody, or multi-signature wallets—add one other layer of complexity, requiring cautious planning and substantial assets.

In brief, whereas Bitcoin affords compelling benefits, its volatility, regulatory uncertainties, lack of central oversight, and safety challenges stay vital boundaries to its adoption as a world reserve forex. These hurdles elevate vital questions on whether or not Bitcoin can realistically meet the stringent calls for of the position—or if it’s destined to stay another asset for the foreseeable future.

Perhaps the true query isn’t whether or not Bitcoin is able to be the worldwide reserve forex—it’s whether or not the world is prepared for Bitcoin in that position. Japan’s Prime Minister Shigeru Ishiba lately expressed skepticism, pointing to the dearth of enough data on Bitcoin reserve methods being thought of by different nations. Primarily, there are nonetheless too many unknowns. We typically don’t like such conditions.

Nevertheless, the regular creep of Bitcoin into institutional and sovereign portfolios means that it is probably not a matter of if however when Bitcoin earns its place within the international financial system. It’s now not only a rebellious upstart; it’s rewriting the foundations of world finance, one block at a time.

Disclaimer: This piece is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of monetary loss. At all times conduct due diligence.

If you want to learn extra articles like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.