Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee, Fundstrat’s head of analysis, says Bitcoin may climb to $250,000 by the tip of 2025. In line with an interview on CNBC’s Squawk Field at this time, Lee identified that Bitcoin lately dipped from its all-time excessive of $111,970 right down to about $104,000. He nonetheless thinks that the market is holding up round that degree.

Associated Studying

Lee’s Brief-Time period Outlook

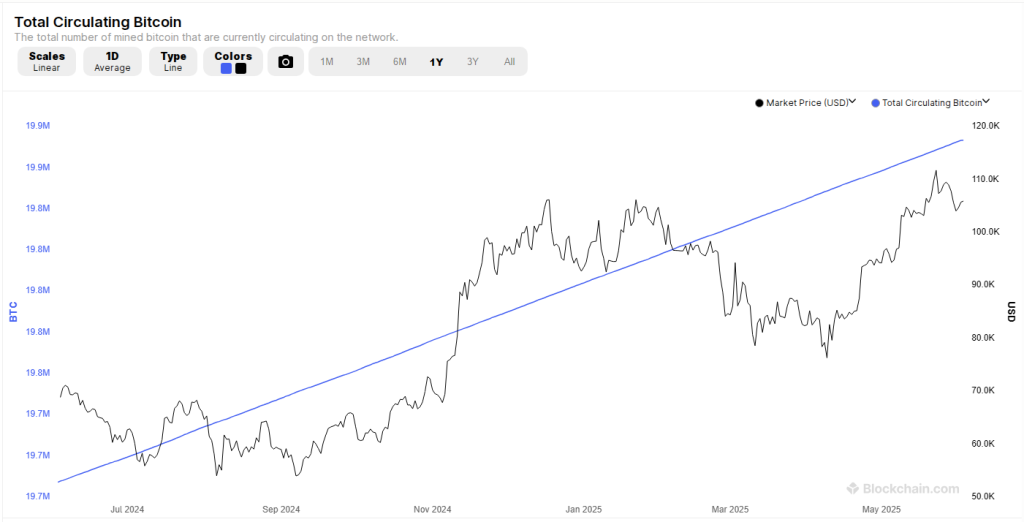

Lee informed Squawk Field’s host Joe Kernen that 95% of all Bitcoin—about 19.80 million cash—has already been mined out of a most of 21 million. That leaves roughly 1.13 million cash ready to be produced. He sees that as a good provide setup.

He additionally famous that whereas practically all Bitcoin exists, 95% of the worldwide inhabitants doesn’t personal any. Primarily based on studies, that hole between provide and potential patrons may push costs larger within the months forward.

To achieve $250,000 from round $104,000 now, Bitcoin would want to leap about 140%. Lee nonetheless believes it could actually hit $150,000 by December and will even stretch towards $200,000 to $250,000 if demand heats up.

Provide And Demand Hole

Lee highlighted the truth that most individuals on this planet haven’t purchased any Bitcoin. He mentioned this creates an imbalance. On one aspect you’ve got an almost mounted provide. On the opposite, there could also be hundreds of thousands of recent patrons within the subsequent 10 years. He defined that if even a fraction of these individuals resolve to purchase Bitcoin, the value may transfer so much larger.

Proper now, solely about 5% of all cash stay to be mined. Which means new provide is slowing down quick. On the similar time, extra wallets, apps, and simple methods to purchase may usher in recent cash. Lee thinks this mismatch is an enormous a part of why Bitcoin may maintain climbing.

Lengthy-Time period Valuation Targets

When requested about Bitcoin’s terminal worth—which means its worth when all cash are mined by 2140—Lee mentioned he expects it to match gold’s roughly $23 trillion market cap. That works out to at the least $1.15 million per Bitcoin if there are 20 million cash in circulation.

He selected 20 million as an alternative of 21 million as a result of assumed losses (misplaced keys, forgotten wallets) imply not each coin will ever be spent. Lee went additional, saying he sees room for Bitcoin to hit $2 million or $3 million per coin. That will put his common “bull case” at $2.5 million, which is roughly a 2,300% rise from at this time’s ranges.

Associated Studying

Different Analyst Projections

VanEck’s head of digital asset analysis, Matthew Sigel, additionally has a long-range prediction. Primarily based on what Sigel informed buyers, VanEck sees Bitcoin hitting $3 million by 2050. That forecast traces up with Lee’s thought of Bitcoin matching and even beating gold over time. Each calls assume regular development in demand, plus wider use by large establishments like hedge funds or pension plans.

Featured picture from Gemini, chart from TradingView