Este artículo también está disponible en español.

Ethereum has skilled a large drop, shedding over 27% of its worth in lower than 5 days because the market faces excessive worry and uncertainty. The speedy sell-off has fueled hypothesis {that a} bear market could possibly be on the horizon, with many analysts calling for additional draw back within the coming months.

Associated Studying

Nonetheless, regardless of the overwhelming bearish sentiment, there may be nonetheless an opportunity for Ethereum to recuperate as the value is now testing a vital demand stage. If bulls handle to carry this space, ETH might stage a powerful rebound and shift momentum again in favor of consumers.

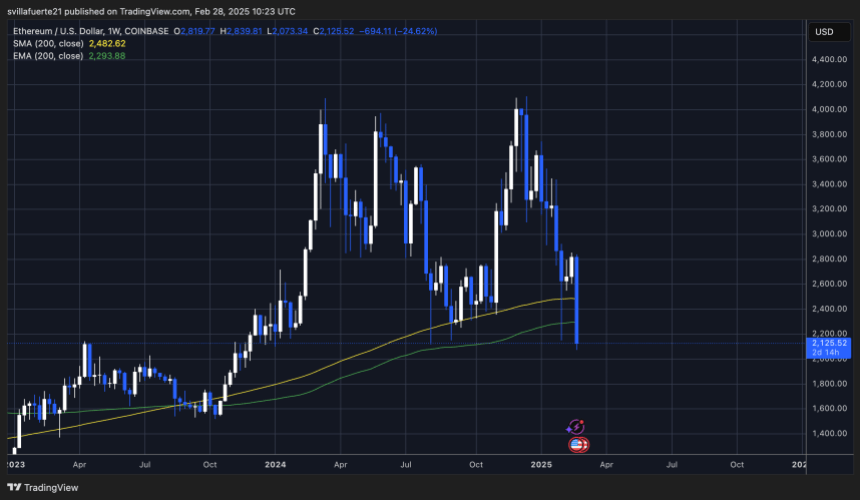

High analyst BigCheds shared a technical evaluation on X, noting that ETH is reapproaching a crucial month-to-month demand stage, which might outline Ethereum’s subsequent main transfer. Traditionally, value reactions at this stage have led to both a powerful bounce or additional capitulation, making the present market circumstances a pivotal second for Ethereum’s long-term trajectory.

The following few days will likely be essential as Ethereum makes an attempt to stabilize and reclaim key value ranges. If consumers step in aggressively, ETH might begin a restoration rally, however failure to carry help could result in additional draw back dangers.

Ethereum Struggles Beneath $2,200

Ethereum is buying and selling beneath $2,200, struggling to regain momentum after a extreme market-wide correction. The altcoin sector continues to bleed, and ETH has now misplaced practically 50% of its worth since peaking at $4,100 in mid-December. Bulls face a crucial take a look at as they have to defend key demand ranges to forestall additional promoting stress and appeal to robust shopping for curiosity.

Associated Studying

The scenario is extremely risky, with market sentiment shifting towards excessive worry. Traders fear that Ethereum might proceed its decline if bulls fail to carry help and provoke a significant restoration. Many analysts stay cautious, warning that ETH might enter a chronic consolidation section if it fails to regain misplaced floor.

BigChed’s insights on X spotlight that Ethereum is now re-approaching a key high-timeframe demand zone of round $2,000. In keeping with Cheds, this can be a must-hold stage—shedding this zone might set off a deeper correction, whereas a powerful protection might pave the best way for a possible restoration rally.

The following few days will likely be essential for Ethereum. If bulls handle to reclaim $2,200 and push towards $2,500, a reversal might happen. Nonetheless, failure to carry $2,000 might see ETH drop additional, doubtlessly testing decrease demand zones within the coming weeks.

Worth Testing Demand – Can Bulls Regain Management?

Ethereum is buying and selling at $2,120 after enduring days of large promoting stress that pushed the value to its lowest stage in months. ETH is at present holding above a high-timeframe demand stage round $2,000, a vital zone that should be defended to keep away from additional draw back. Nonetheless, sentiment stays fragile, and if Ethereum fails to carry this stage, it might set off a dramatic sell-off resulting in even decrease costs.

Bulls face an pressing problem to regain management of value motion. The $2,200 stage now acts as the primary key resistance, and a breakout above this mark can be step one towards stabilization. Past that, ETH should push above $2,500 as quickly as attainable to verify a possible development reversal and sign the beginning of a restoration rally.

Associated Studying

If bulls fail to carry the $2,000 help, Ethereum might face elevated volatility and a steep decline, doubtlessly testing decrease demand zones. The following few buying and selling periods will likely be crucial, as ETH’s capability to remain above key ranges will decide whether or not the market stabilizes or enters a deeper correction section within the coming weeks.

Featured picture from Dall-E, chart from TradingView