Spot Ethereum ETFs noticed $333 million in inflows on Friday, November twenty ninth, which exhibits institutional curiosity within the second-largest cryptocurrency.

Specialists attribute this renewed curiosity to expectations for clearer crypto rules within the US and a optimistic outlook on DeFi.

The highest 10 spot Ethereum ETFs within the US recorded $333 million in inflows on Friday, following a optimistic week of inflows totalling $466.5 million, outpacing Bitcoin which recorded $318.60 million on Friday and a weekly internet outflow of $136.5 million.

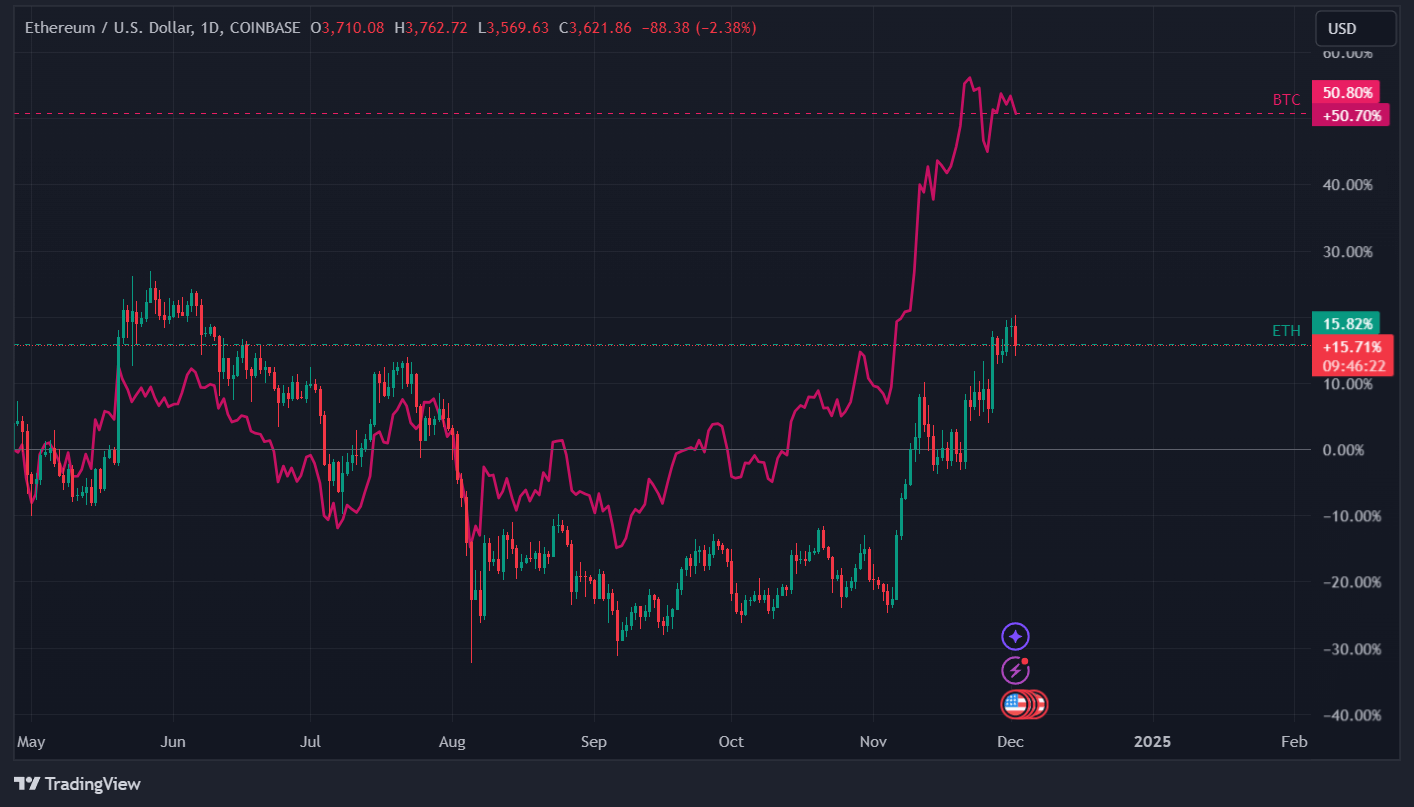

Since Ethereum spot ETFs have been authorized by the SEC in July 2024, the crypto’s value has lagged behind Bitcoin’s and the broader crypto market regardless of the business’s clamour for approval. Ethereum’s value fell roughly 32% within the first 15 days after approval in comparison with Bitcoin’s which fell solely 15.02% throughout the similar interval after the Bitcoin ETF approval in January 2024.

Renewed curiosity in Ethereum

Regardless of Ethereum’s paltry efficiency, current information exhibits rising curiosity as establishments and merchants flip their eyes to crypto.

The Future Finance Report from Sygnum Digital Financial institution, which measures market sentiments and the behaviours {of professional} and institutional traders, confirmed that 90% of the 405 conventional traders surveyed have been presently invested in blockchain protocol cash (that are largely Layer 1 cash).

The report additionally confirmed that 31% of the respondents who already maintain crypto deliberate on rising their allocation in This autumn-2024 whereas 32% deliberate to extend their portfolio within the subsequent six months.

Of the respondents who didn’t presently maintain cryptocurrency of their portfolios, 43% deliberate to extend allocation throughout the subsequent 12 months. General, 79% of all respondents deliberate to extend allocations throughout the subsequent 6 months.

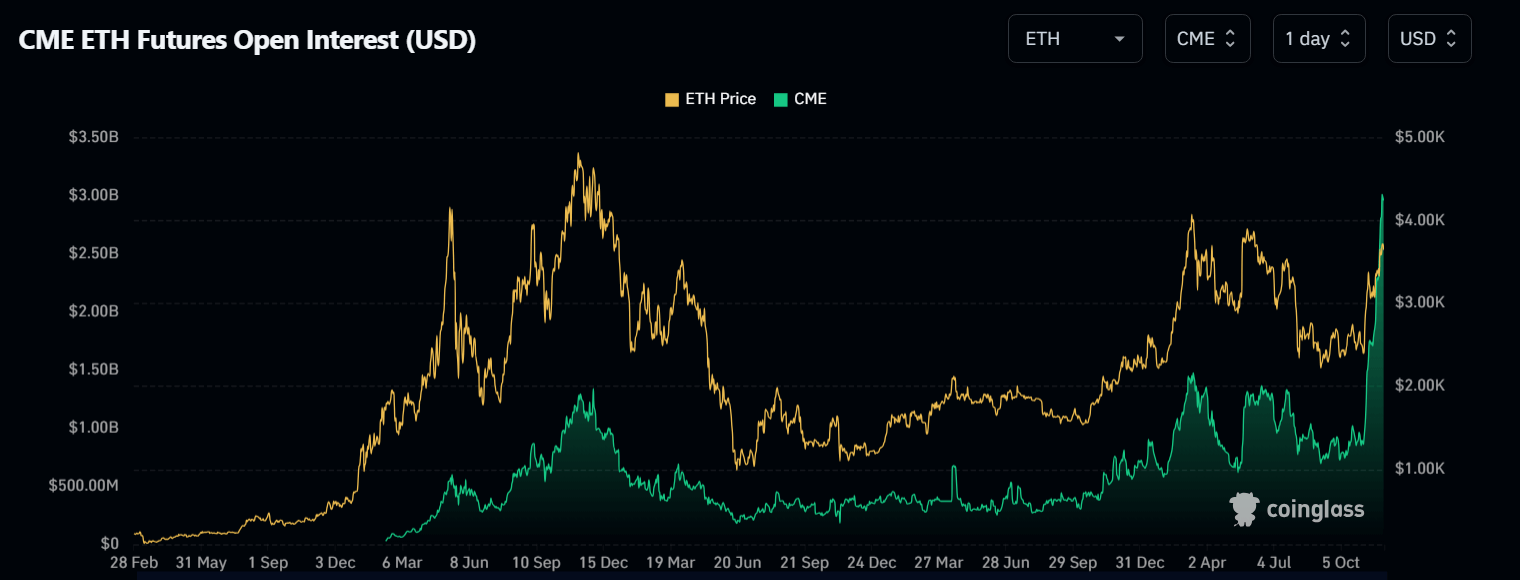

Ethereum’s open curiosity grows

CME OI historicals for Ethereum present that open curiosity has been on the rise since Nov. 4th and is at $3.01 billion as of publishing, signalling extra institutional curiosity in Ethereum.

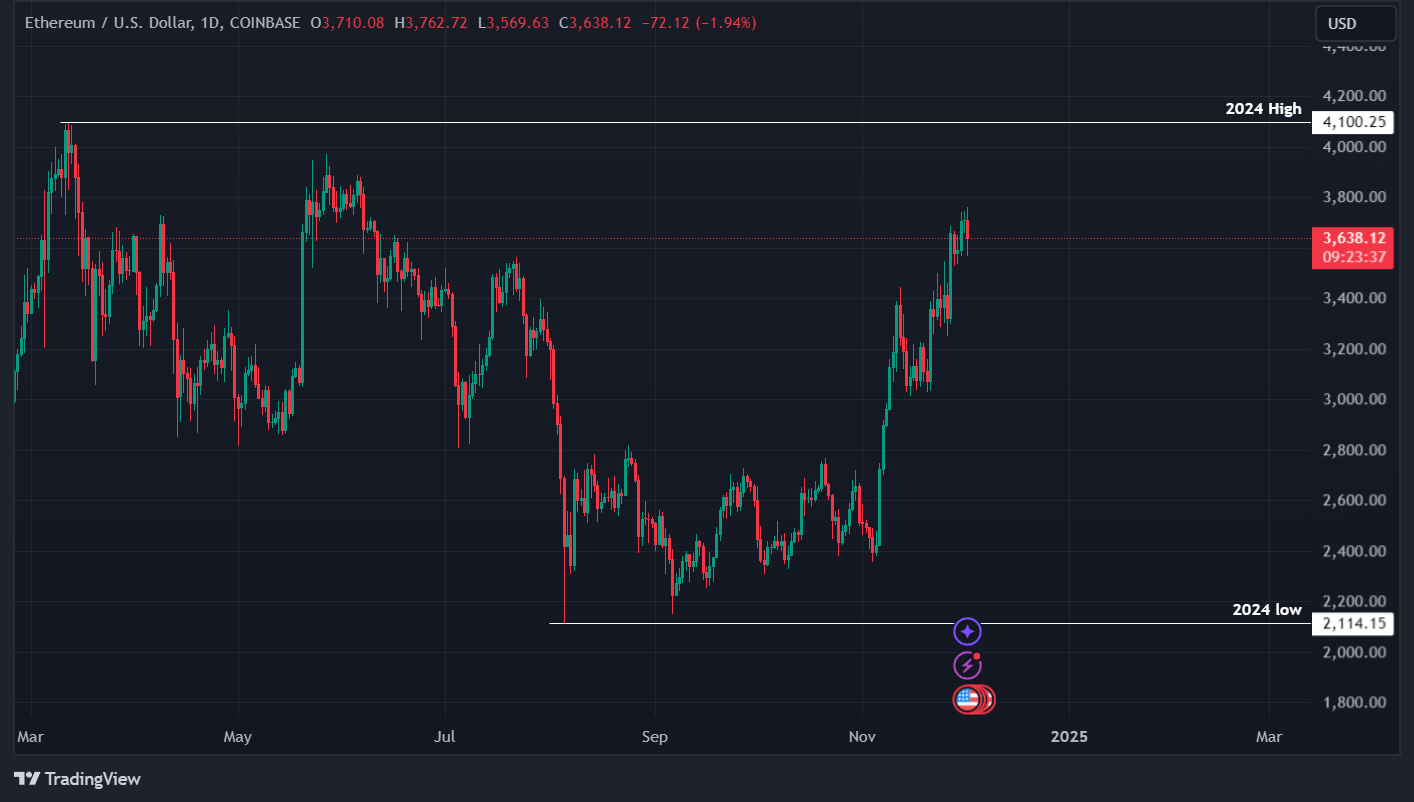

Ethereum has been on an uptrend since reaching a yearly low of round $2,100 in August and is now nearer to its yearly excessive at $4,100.

Ethereum trades at $3,600 as of writing, near its yearly excessive.