Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

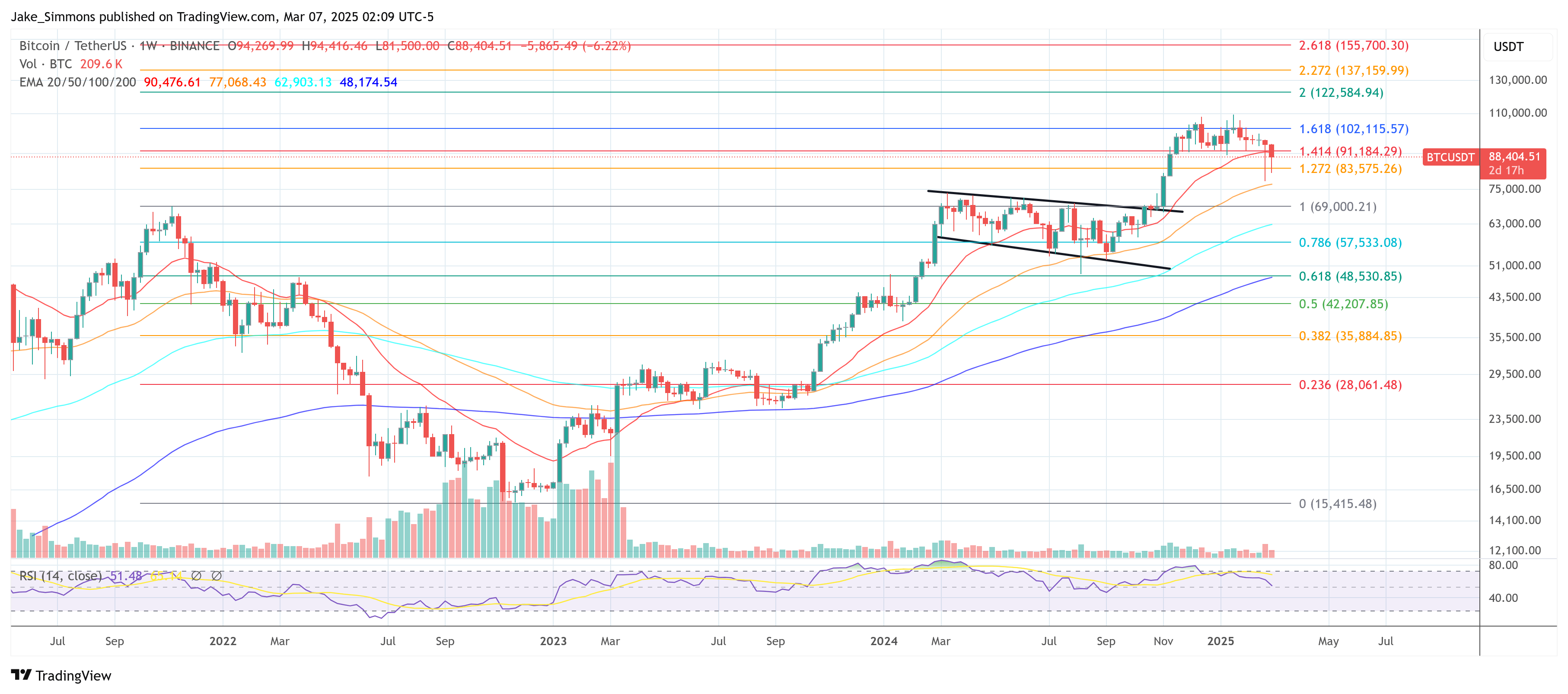

This week, the US Greenback Index (DXY) has recorded one in every of its largest three-day destructive performances in latest historical past. Since Monday, the DXY is down -5.4%, falling from 109.881 to 103.967—an occasion some market observers interpret as a bullish inflection level for Bitcoin. Jamie Coutts, Chief Crypto Analyst at Actual Imaginative and prescient, has drawn on historic comparisons to argue that the steep DXY decline may portend a big upswing on this planet’s largest cryptocurrency by market capitalization.

DXY’s Historic Drop Indicators A Main Bitcoin Rally

Coutts introduced the findings of two historic backtests on X, detailing how comparable DXY drops have coincided with pivotal moments in Bitcoin’s value cycles. He wrote: “When taking a look at this latest transfer within the DXY via a historic lens, it’s difficult to be something however bullish. I ran a sign display for 3-day destructive strikes of greater than -2% & -2.5% and located they’ve all occurred at Bitcoin bear market troughs (inflection factors) or mid-cycle bull markets (development continuations).” Though the statistical significance is restricted by Bitcoin’s comparatively brief buying and selling historical past, Coutts underscored that these information factors are nonetheless value contemplating.

Associated Studying

In his first backtest masking DXY declines of greater than -2.5%, Coutts discovered such a situation on eight events since 2013. Over a 90-day interval following these declines, Bitcoin rose each single time, giving it an ideal 100% win price. The typical return was +37%, which might translate to an estimated BTC value of round $123,000, whereas a transfer of 1 normal deviation above that common reached +63% (roughly $146,000 BTC). Even within the worst occasion, Bitcoin nonetheless managed to realize 14%, placing it round $102,000 BTC.

In his second backtest specializing in DXY declines of greater than -2.0%, there have been 18 such occurrences since 2013, and Bitcoin was up 17 out of these 18 occasions for a 94% win price. The typical 90-day return stood at +31.6%, near $118,000 BTC, whereas a one normal deviation transfer was +57.8% (round $141,000 BTC). The worst 90-day return after such a DXY drop was -14.6% (roughly $76,500 BTC).

Associated Studying

Acknowledging that these backtests can not supply ensures, Coutts acknowledged, “I made a daring name yesterday about new highs by Could. I attempt to base projections on sturdy information factors. Ofc this time is perhaps totally different. Let’s see.”

Analysts typically view a declining DXY as an indication of bettering threat urge for food in international markets, which may favor different shops of worth and threat property, together with Bitcoin and different cryptocurrencies. The US Greenback Index’s abrupt retreat comes on the heels of regulatory issues and a difficult February for Bitcoin, but Coutts maintains that the bigger development appears to be like remarkably just like historic factors of resurgence.

He additionally famous in a publish from the day prior to this: “Don’t suppose individuals perceive the importance of the DXY transfer up to now 3 days and what it means for Bitcoin. […] The DXY noticed its 4th largest destructive 3-day transfer—massively liquidity-positive. Simply as Bitcoin nuked and had its worst Feb in a decade. In the meantime, in altcoin land, the Prime 200 crypto index puked another time. The chart reveals that twelve months of New Lows hit 47%, an indicator of capitulation in a bull cycle. The stage is ready for a brand new all-time excessive in Bitcoin and Prime 200 combination market cap by Could.”

At press time, BTC traded at $88,404.

Featured picture created with DALL.E, chart from TradingView.com