The most recent on-chain knowledge reveals that the Bitcoin community exercise has been waning over the previous few months, with the blockchain metric reaching a brand new low not too long ago.

Why Is The Bitcoin Community Exercise Falling?

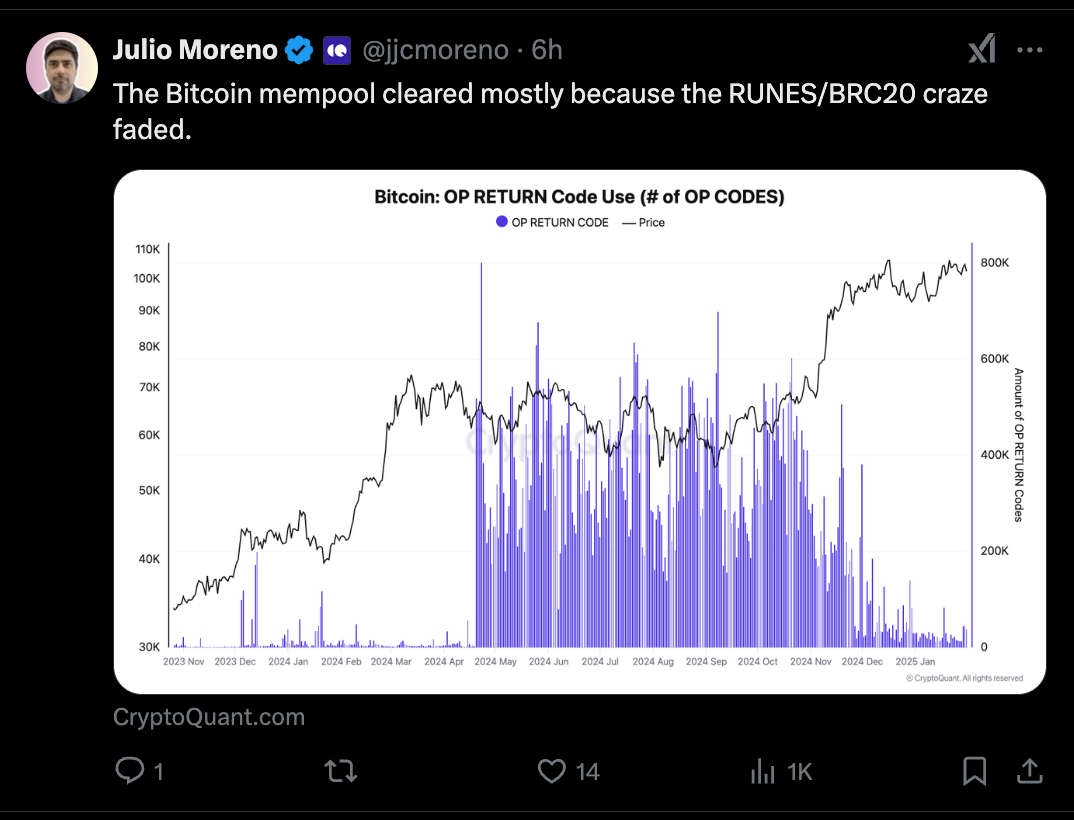

In a brand new submit on the X platform, CryptoQuant head of analysis Julio Moreno mentioned how Bitcoin is witnessing an uncommon interval of low transaction exercise, with the mempool nearly empty and transaction charges falling to 1 sat/vB. This represents the bottom stage of community exercise since March 2024, indicating a notable decline in on-chain demand.

For context, the mempool refers to a short lived storage space the place pending Bitcoin transactions await processing. The mempool often stays congested in periods of elevated on-chain demand and community exercise. Nonetheless, new on-chain knowledge reveals that the majority transactions have been confirmed, leaving the mempool practically empty.

Supply: JJCMoreno/X

A virtually empty mempool is a uncommon phenomenon usually related to waning on-chain exercise or shifting market dynamics. In keeping with Moreno, the key contributor to this decline is the fading pleasure round Runes and BRC-20 tokens.

Runes and the BRC-20 token commonplace are protocols that enabled the creation and minting of fungible and non-fungible tokens on the Bitcoin blockchain. Whereas these protocols had been met with vital hype upon launch, the preliminary pleasure didn’t translate to sustained use.

Supply: JJCMoreno/X

Nonetheless, on the peak of the Runes and BRC-20 frenzy, the variety of confirmed transactions on the Bitcoin community crossed the 1.5 million milestone in a single day. Particularly, the pioneer blockchain processed over 1.6 million distinctive transactions between sender and receivers on April 23, 2024, with the launch of Bitcoin Runes taking part in a pivotal function.

The decline in transaction rely has broader implications for varied parts of the pioneer blockchain, together with miner revenues. Miners depend on transaction charges as one other supply of earnings, particularly as block rewards have been additional slashed because the current halving occasion. Therefore, an prolonged interval of low charges might affect mining profitability, doubtlessly influencing community hash charge distribution.

Implications On BTC Worth

An almost-empty mempool and low transaction exercise will not be precisely one of the best mixtures for constructive worth motion. Particularly, it might recommend low speculative curiosity and lowered investor enthusiasm, resulting in a consolidation of the Bitcoin worth.

As of this writing, BTC is valued at round $100,450, with a virtually 2% decline up to now 24 hours. In keeping with CoinGeko knowledge, the premier cryptocurrency has misplaced roughly 3.5% of its worth within the final seven days.

The worth of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture created by Dall-E, chart from TradingView