Bitcoin is consolidating just under its all-time excessive close to $112,000, sustaining a bullish construction as momentum builds throughout the broader crypto market. After a robust rally in latest weeks, BTC is exhibiting indicators of energy and stability, buying and selling in a decent vary that many analysts view as a launchpad for the following main transfer. The setup factors to additional upside, with rising confidence that Bitcoin may break into new highs quickly.

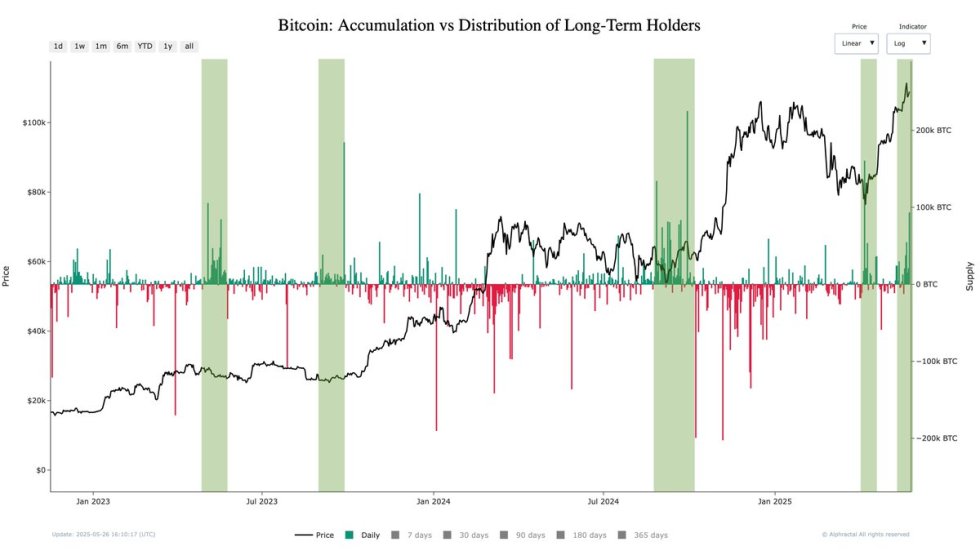

Analysts are more and more optimistic, calling for an expansive summer time as capital begins to circulation again into crypto markets. Each technical resilience and compelling on-chain knowledge are fueling the sentiment shift. In response to insights from Alphractal, long-term holders (LTHs)—these holding BTC for greater than six months—proceed to build up however not distribute. Actually, the availability held by LTHs is steadily growing, an indication of deep conviction and lowered liquid provide available in the market.

This habits from skilled holders reinforces the bullish thesis: when LTHs aren’t promoting into energy, it usually units the inspiration for sustainable rallies. With a robust technical base, rising institutional curiosity, and long-term holders tightening provide, Bitcoin seems primed for a strong summer time forward.

Bitcoin Consolidates As Market Dynamics Shift

Bitcoin is at the moment consolidating just under the $110,000 degree, holding regular after an aggressive rally that introduced it near its all-time excessive of $112K. Regardless of the pause in upside momentum, bulls stay firmly in management. Each the day by day and weekly charts present a well-defined uptrend construction, with increased highs and better lows persevering with to construct. The consolidation seems to be a wholesome cooldown earlier than the following main transfer.

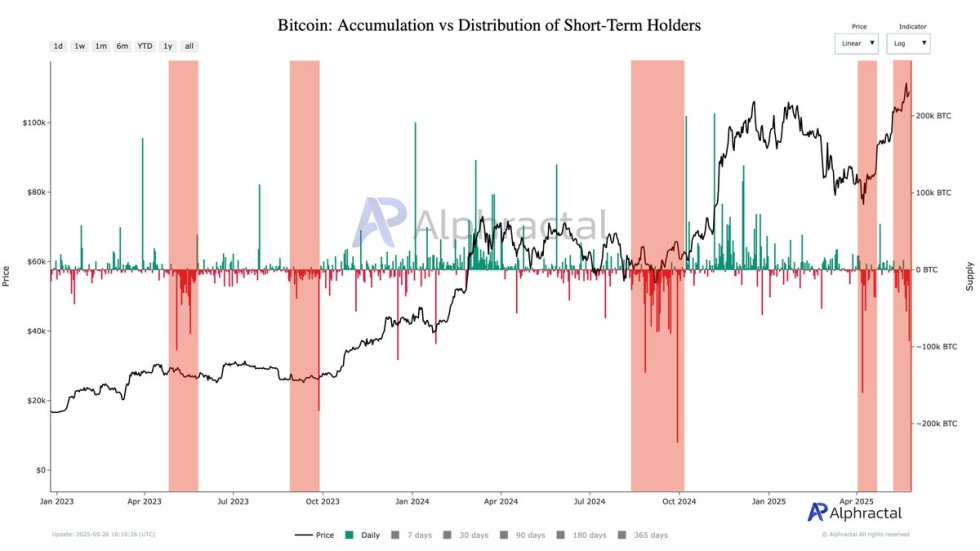

Prime analyst Darkfost just lately shared insights into the market’s underlying construction, specializing in the habits of Lengthy-Time period Holders (LTHs) and Quick-Time period Holders (STHs). In response to Darkfost, LTHs aren’t distributing their cash—in truth, they’re doing the alternative. The availability held by LTHs is steadily growing, signaling conviction and reinforcing the concept that seasoned traders anticipate extra upside.

Apparently, the habits of STHs paints a really totally different image. Darkfost expressed shock on the knowledge, which exhibits that STHs are actively distributing. Not like previous situations the place STH promoting occurred throughout corrections, this time the promoting is happening at an all-time excessive. It suggests a attainable switch from sturdy palms (LTHs) to weaker palms (STHs), a dynamic that usually precedes elevated volatility.

Whereas STHs could also be locking in income on the high, Darkfost notes it’s laborious to say they’re mistaken—in any case, BTC is at an ATH, not in a mid-cycle dip. Nonetheless, with LTHs persevering with to carry and scale back obtainable provide, the broader pattern stays bullish. The approaching days may outline whether or not BTC reclaims $112K and enters value discovery or retreats beneath rising short-term strain.

Value Motion Particulars: Key Ranges To Watch

Bitcoin is at the moment buying and selling at $109,863 on the day by day chart, holding agency just under its all-time excessive of $112,000. Value motion stays bullish, with BTC consolidating in a decent vary after a strong breakout above the $103,600 resistance zone, now performing as a key assist degree. This consolidation seems wholesome and managed, as patrons proceed to defend increased lows.

The 34-day EMA sits at $101,928 and is rising steadily, confirming sturdy short- to mid-term momentum. BTC can also be comfortably above the 50, 100, and 200-day SMAs, all of which are actually aligned to the upside—a basic sign of pattern energy. Quantity has barely decreased throughout this section, which is typical for consolidation after a breakout.

This value habits suggests bulls aren’t exhausted however relatively making ready for the following leg up. A day by day shut above $112K with quantity affirmation would probably push BTC into value discovery, with potential upside targets round $120K to $125K.

Till then, the $103,600–$105,000 zone stays the vital space to carry. So long as BTC stays above this area and maintains its increased construction, the broader uptrend stays intact, and the bullish outlook is unchanged.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.