Bitcoin is testing the $110,000 stage, a essential threshold that would outline the subsequent main part of the market cycle. With value hovering just under all-time highs, BTC faces a decisive second — both push into uncharted territory or danger a correction that would shake bullish momentum. The stakes are excessive, and merchants are watching intently as volatility begins to compress earlier than the subsequent main transfer.

A breakout above $112K would mark the beginning of a brand new value discovery part, probably triggering an expansive rally that would carry all the crypto market. Nevertheless, failure to interrupt larger might result in a sweep of liquidity under, notably as key ranges like $105K stay inside attain.

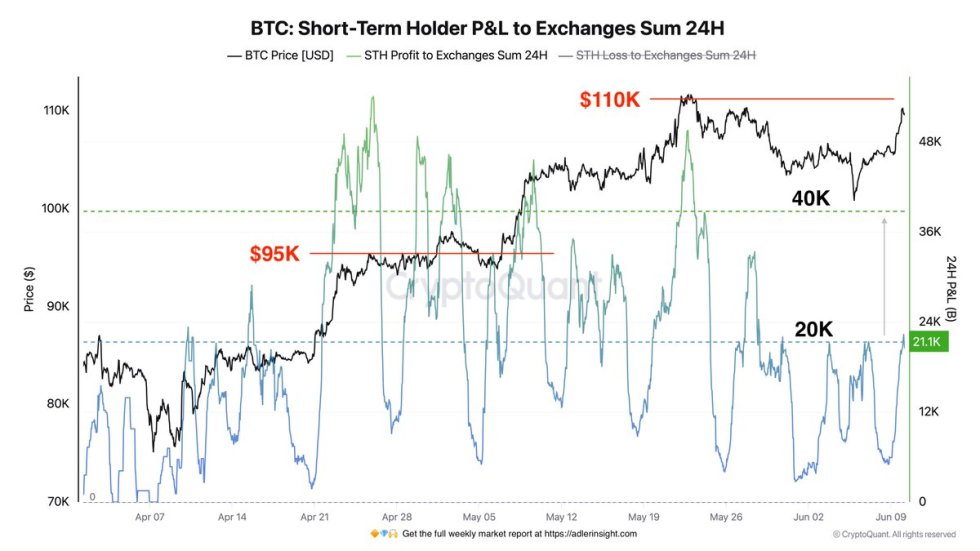

Regardless of the high-stakes setup, present market conduct exhibits shocking restraint. Based on knowledge from CryptoQuant, Brief-Time period Holders have been promoting a mean of round 21,000 BTC per day through centralized exchanges (CEX) over the previous 24 hours, notably under historic norms. This indicators a state of relative calm, the place buyers should not dashing to lock in income, at the same time as BTC trades close to report ranges.

Bitcoin Prepares For Worth Discovery

Bitcoin is on the verge of coming into value discovery, buying and selling just under its all-time excessive close to $112,000. After weeks of consolidation and bullish resilience, BTC is positioned for a decisive transfer that would both launch the asset into uncharted territory or set off a short-term correction to clear liquidity under. This week will probably be pivotal, as compression on the high quality typically precedes enlargement, and with macroeconomic and technical components aligning, volatility might return in power.

The broader market stays on edge attributable to ongoing macroeconomic uncertainty. US Treasury yields proceed to climb, reflecting elevated systemic dangers and tighter monetary circumstances. These rising yields have traditionally utilized stress to danger belongings, however Bitcoin’s stability close to all-time highs suggests rising investor conviction.

Prime analyst Axel Adler shared insights from CryptoQuant, revealing that Brief-Time period Holders (STHs) have been promoting a mean of 21,000 BTC per day through centralized exchanges over the previous 24 hours — a determine notably under historic norms. This means that STHs are displaying restraint and should not dashing to safe income, at the same time as Bitcoin approaches report ranges.

The following main psychological milestone is the $120,000 mark. Traditionally, round-number ranges like this have triggered waves of profit-taking and short-term volatility. Whether or not Bitcoin breaks larger this week or pulls again to construct extra assist, the trail ahead is prone to be explosive. If confirmed, a breakout above $112K might sign the start of a full-blown enlargement part not just for BTC however for the broader crypto market. Merchants and buyers alike are watching intently — the subsequent transfer might outline the rest of 2025’s crypto cycle.

BTC Approaches Resistance With Momentum

Bitcoin is buying and selling at $109,318 on the 3-day chart, up 3.33% because it pushes again towards the higher Bollinger Band and checks resistance close to the $112,000 all-time excessive. The transfer comes after a powerful bounce from the mid-band assist round $103,600 — a key stage that has acted as a launchpad a number of instances this cycle. With BTC now sitting above all main shifting averages (50 SMA at $94,748, 100 SMA at $86,238, and 200 SMA at $70,609), the construction stays firmly bullish.

The value motion is tightening inside the higher vary of the Bollinger Bands, a basic signal that volatility is compressing earlier than enlargement. If Bitcoin can decisively break by way of the $112K stage, the market would enter value discovery, probably setting off an explosive part not only for BTC however throughout the crypto area.

Quantity has been regular however not but euphoric, indicating that momentum is constructing with out extreme hypothesis. Nevertheless, merchants ought to look ahead to reactions across the $109,300–$112,000 zone. A rejection right here might ship BTC again towards $103,600 for one more take a look at, whereas a breakout above the higher band might affirm development continuation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.