The Bitcoin (BTC) market proved reasonably turbulent prior to now week after a worth decline under $75,000 was adopted by a rebound to above $83,000. With the premier cryptocurrency displaying indications of a sustained uptrend, blockchain analytics agency CryptoQuant has recognized two potential key resistance zones mendacity in wait.

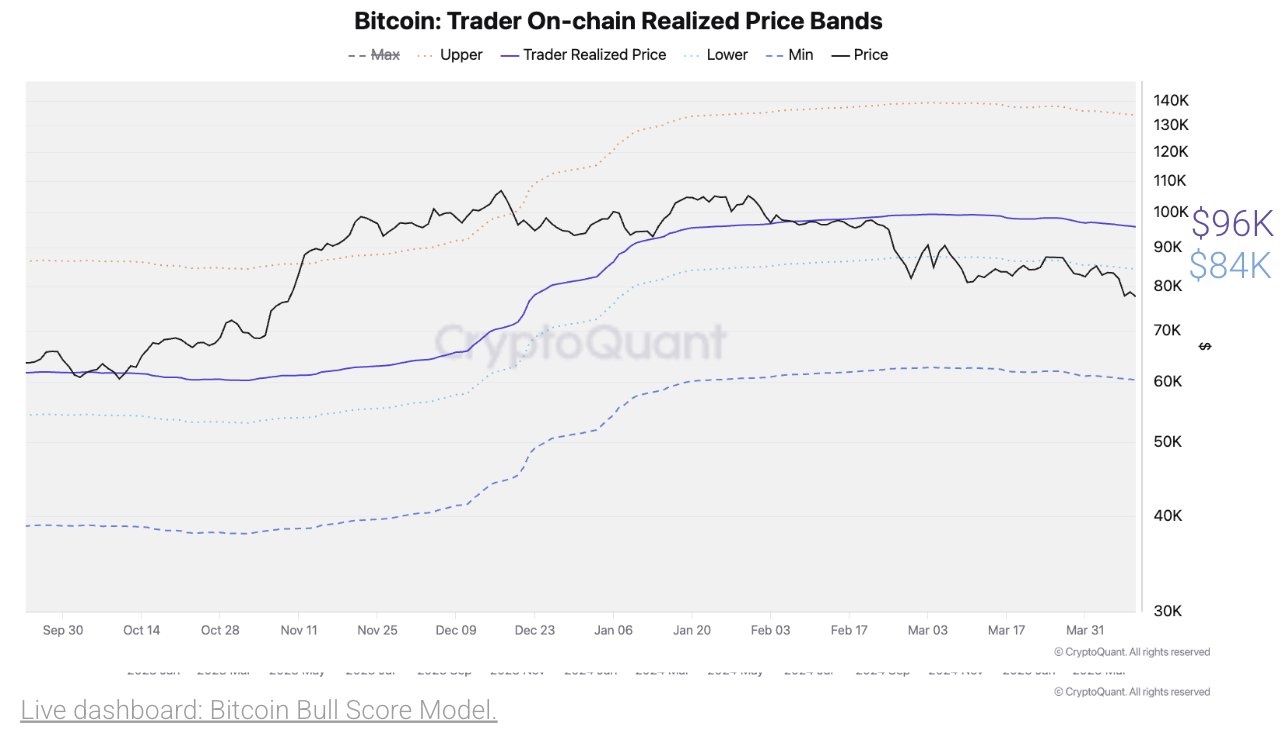

Bitcoin Realized Value Reveals Potential Robust Limitations At $84,000 And $96,000

In an X submit on April 11, CryptoQuant shared an on-chain report on the BTC market indicating a possible encounter with two main resistances at $84,000 and $96,000 if Bitcoin maintains its present upward trajectory. These worth limitations are revealed by the Realized Value metric which displays the common worth at which the present provide of BTC final moved on-chain thereby figuring out the market-wide price foundation.

When Bitcoin trades above this stage, it signifies a wholesome bullish momentum with nearly all of holders in revenue. Conversely, when BTC is under the edge, it suggests underwater sentiment as most buyers are holding a loss. Due to this fact, the Realized worth usually capabilities as an important market pivot performing as sturdy help throughout bull markets and stiff resistance in bear phases. In accordance with Julio Moreno, Head of Analysis at CryptoQuant, BTC’s present on-chain realized worth is $96,000 with a right away lower cost band of $84,000.

Curiously, these two worth ranges have served as key help zones within the earlier bullish part of the present market cycle. Nonetheless, there may be potential for each zones to behave as resistance amidst the continued market correction. Nonetheless, if Bitcoin is ready to transfer previous $84,000 and $96,000, it may signify the resumption of the bull market with the potential for the premier cryptocurrency to commerce as excessive as $130,000. This projected acquire would characterize a 55% improve in present market costs.

BTC Value Overview

At press time, Bitcoin continues to commerce at $83,180 reflecting a 3.65% acquire prior to now day. In the meantime, each day buying and selling quantity is down by 11.99% and valued at $39.19 billion.

Amidst steady macroeconomic developments pushed by the US Authorities tariff adjustments, the crypto market continues to exhibit a robust stage of uncertainty and property fail to ascertain a transparent momentum. Nonetheless, blockchain analytics Glassnode experiences that Bitcoin buyers have shaped a robust help zone at $79,000 and $82,080 at which over 40,000 BTC and 51,000 BTC have been collected respectively.

Within the introduction of any downtrend, each worth ranges are to supply short-term help and stop an additional worth fall. With a market cap of $1.66 trillion, Bitcoin stays the most important digital asset accounting for over 60% of the crypto market cap.

Featured picture from CNN, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.