Bitcoin examined the $92,000 degree yesterday after falling from a weekly excessive of $102,000 as promote pressures mounted

Macroeconomic components trigger doubts concerning the market energy as sticky inflation turns into a priority

Spot crypto ETFs logged massive outflows on Wednesday following the discharge of the Fed assembly notes

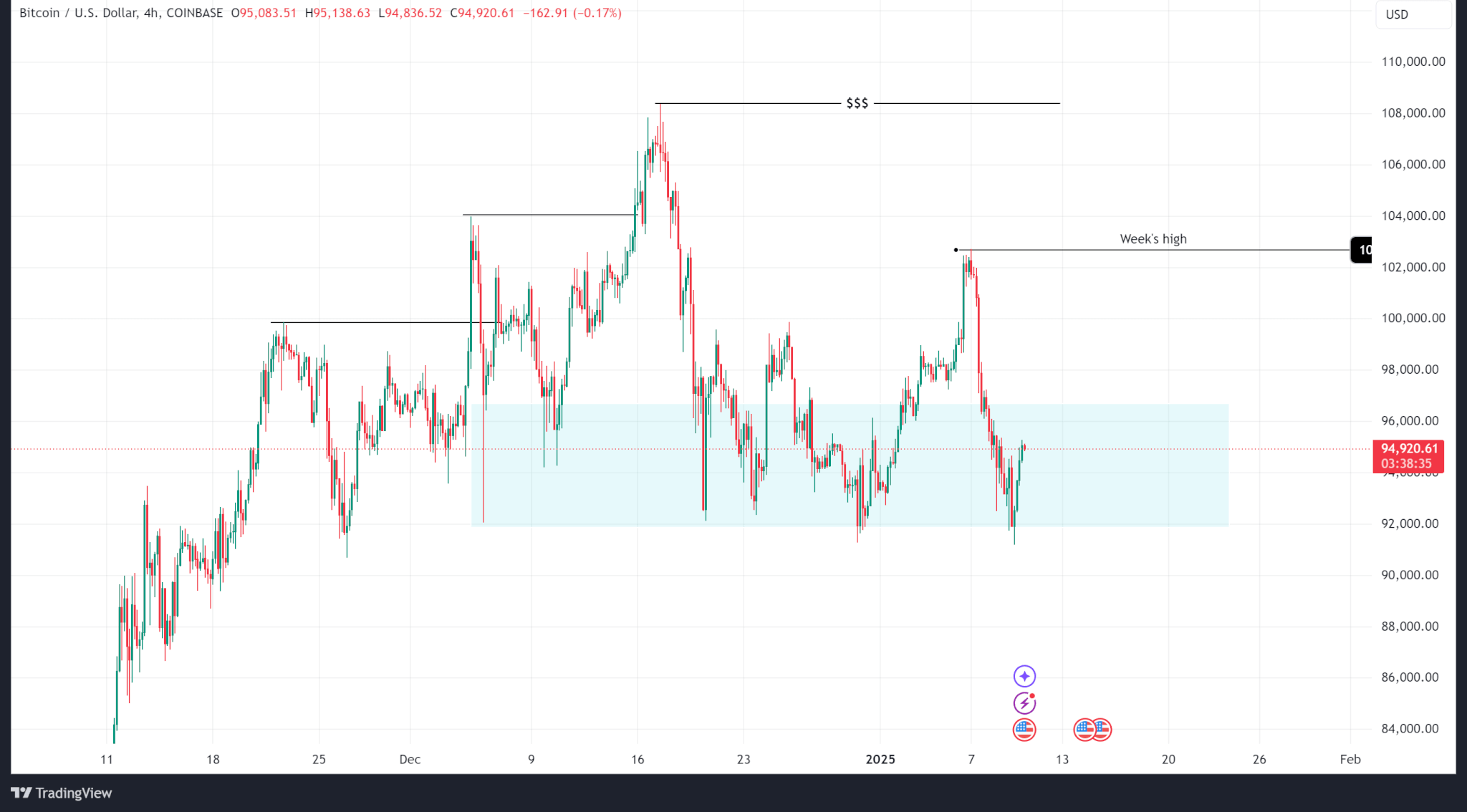

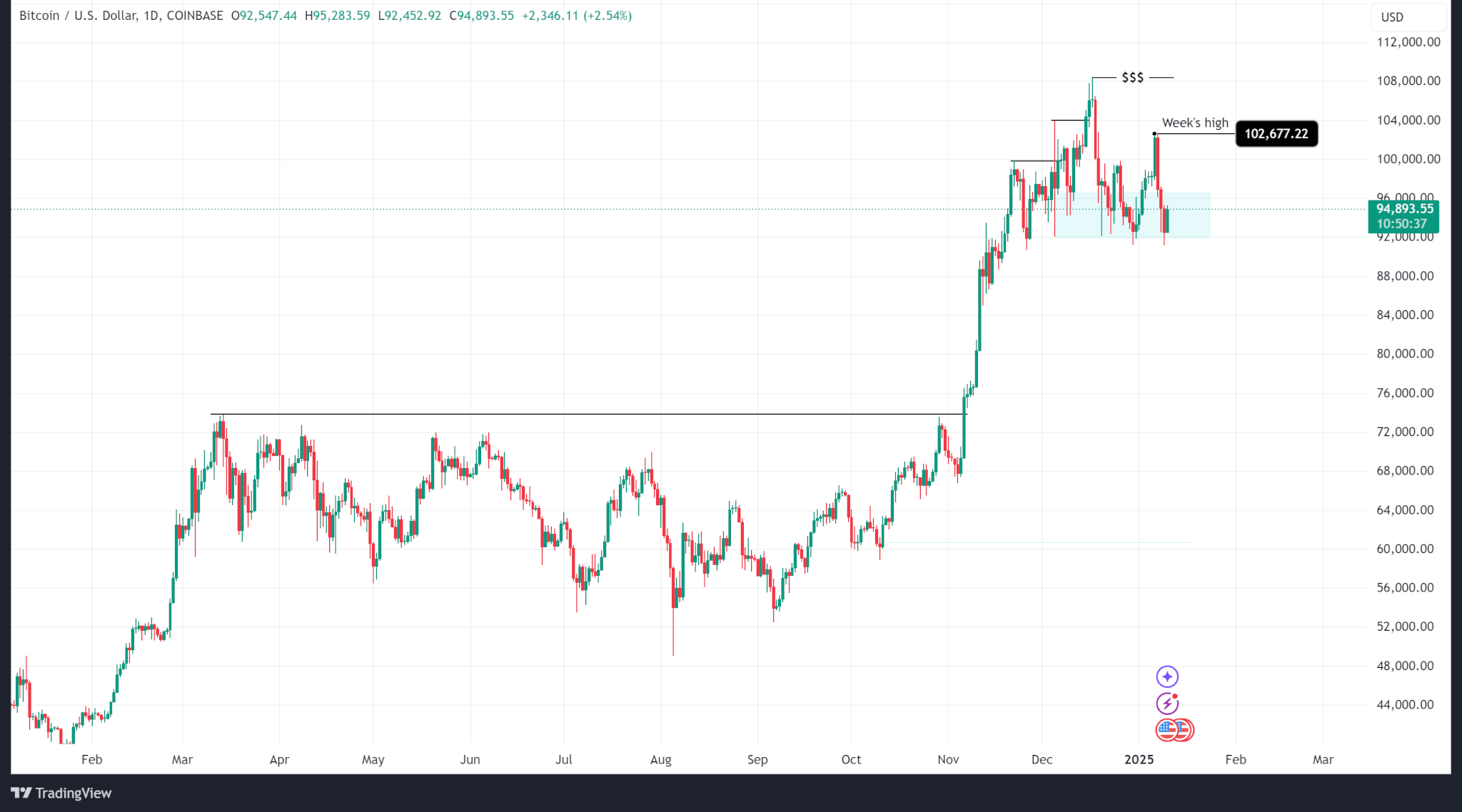

Bitcoin’s worth has fallen from a excessive of $102,667 reached on Tuesday, January 7 to $94,890.00 as of publishing, however stays throughout the final H4 demand zone.

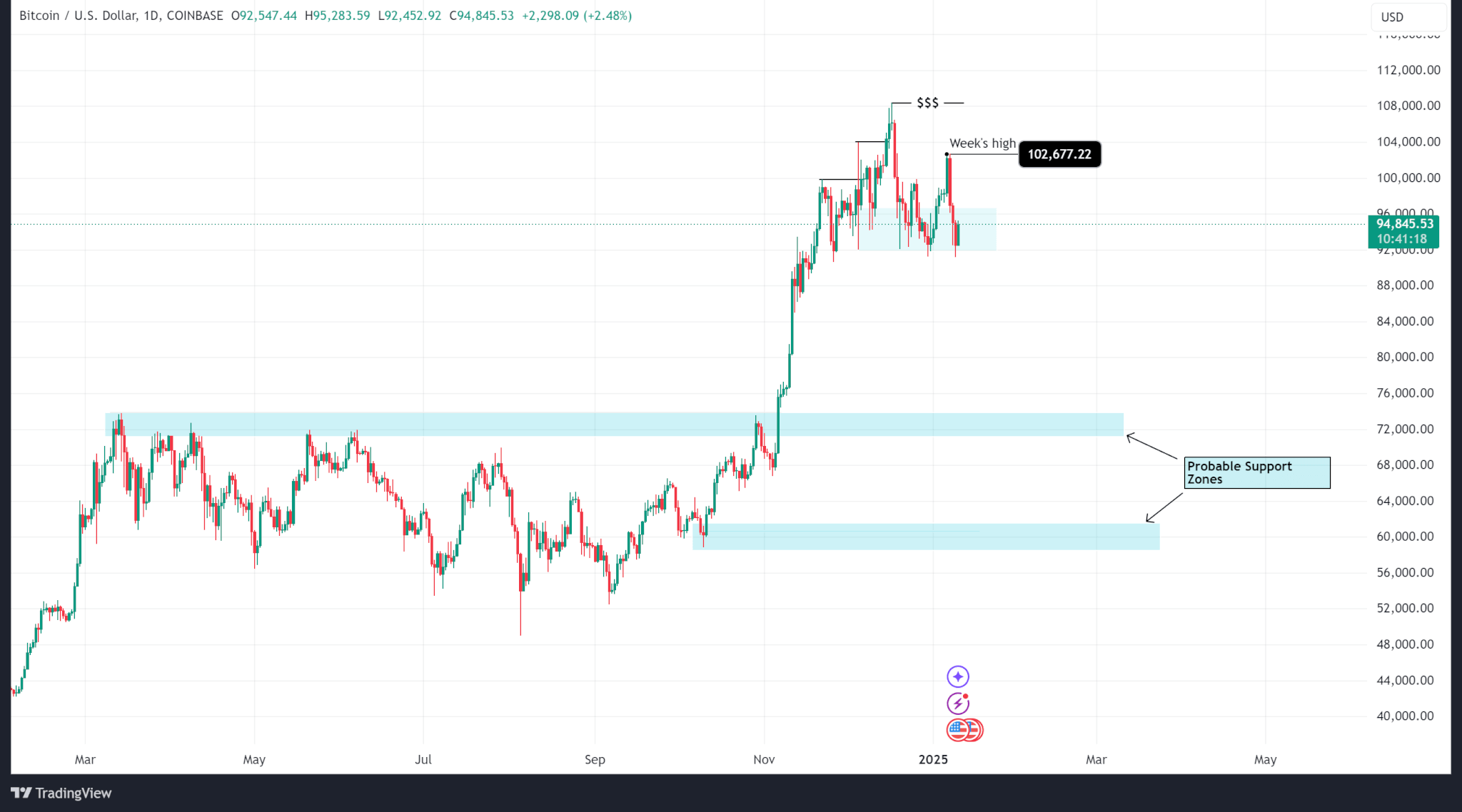

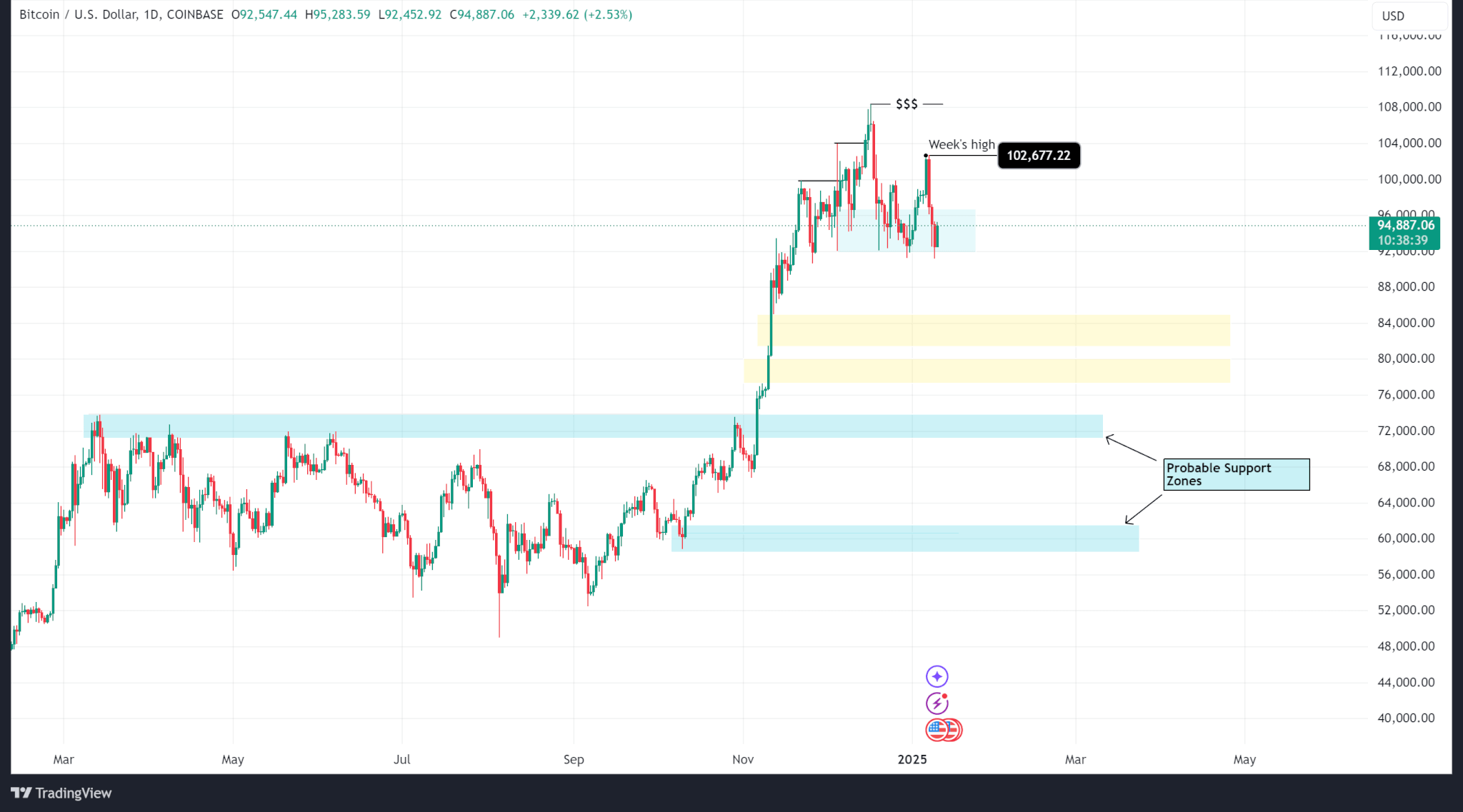

Whereas the demand zone between $92,000 and $97,000 often is the final help degree on the H4 timeframe, a broader market view exhibits that BTC is in a premium zone on the day by day timeframe. Because of this, a push beneath $92,000 nonetheless places the value in bullish territory.

One of the best technical purchase ranges would both be on the final break of construction on the day by day timeframe or on the 50% Fibonacci degree from the bottom level to the break.

There are two honest worth gaps from which the value might react. Whereas they don’t seem to be main zones, they might help a continuation again to the exterior excessive at $108,000 or a quick reduction rally earlier than continued promote to the primary possible help zone as famous in a current TradingView evaluation of BTC.

That is all predicated on Bitcoin breaking beneath the $91,000 degree.

In the meantime, spot crypto ETFs recorded outflows on Wednesday, January 9 after the discharge of the US Federal Reserve’s assembly minutes. These confirmed that the Fed is cautious about inflation and the consequences of Trump’s incoming insurance policies.

BTC ETFs bled $568.8 million on Wednesday whereas ETH ETFs misplaced $159.4 million with the most important outflows from Constancy ($258.7 million for BTC and $147.7 million for ETH).