On-chain information exhibits the Bitcoin long-term holders have shed a big quantity of the cryptocurrency from their holdings not too long ago.

Bitcoin Lengthy-Time period Holders Have Been Realizing Notable Earnings Just lately

In its newest weekly report, the on-chain analytics agency Glassnode has mentioned about how provide has shifted between BTC short-term holders and long-term holders not too long ago.

The “short-term holders” (STHs) and “long-term holders” (LTHs) right here consult with the 2 predominant divisions of the Bitcoin market carried out on the premise of holding time. The buyers who purchased their cash throughout the previous 155 days fall within the former cohort, whereas those that have been holding for longer than this era are put within the latter one.

Statistically, the longer an investor holds onto their cash, the much less probably they change into to promote stated cash at any level. Thus, the STHs might be thought of to incorporate the weak palms of the market, whereas the LTHs characterize the resolute entities.

Now, right here is the chart for the provides of the 2 teams shared by the analytics agency within the report:

As displayed within the above graph, the Bitcoin LTHs have participated in a selloff not too long ago, as their complete holdings have decreased by round 1.1 million BTC. This implies the worth explosion past $100,000 has been too good for even these diamond palms to take a seat out on.

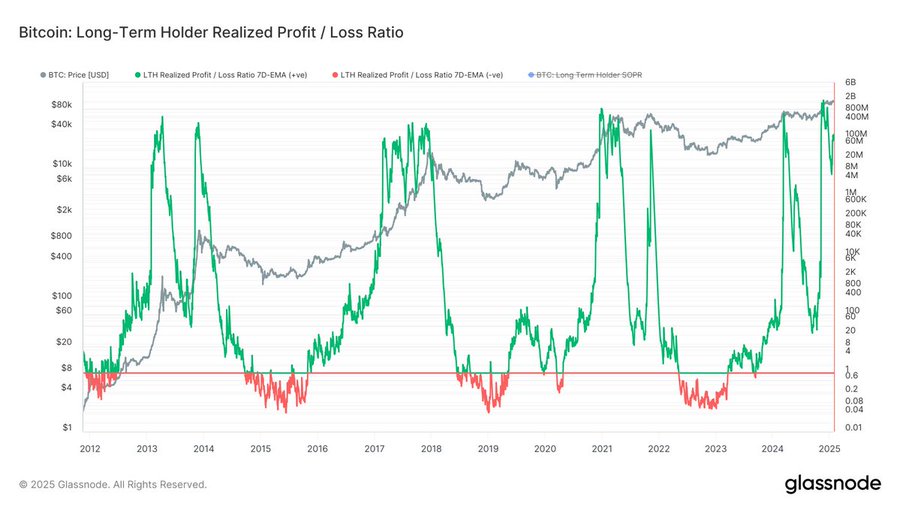

In a publish on X, Glassnode has shared the info of how the ratio between the revenue and loss locked in by the LTHs has in contrast has not too long ago.

From the graph, it’s seen that the Bitcoin LTHs have seen a way more huge profit-taking quantity than loss-taking one not too long ago. This development was additionally witnessed in every of the previous bull runs.

The sample isn’t shocking, because the LTHs are inclined to amass such an enormous quantity of features via their persistence that by the point the bull run rolls round, they’re prepared to reap massive numbers.

Naturally, as the most recent promoting from the LTHs has occurred, the STH provide has elevated by the identical quantity. Each time the LTHs promote, some new purchaser is available in to take their cash.

Throughout bull markets, a excessive quantity of recent demand tends to movement in that absorbs the profit-taking from the LTHs. As long as the stability available in the market maintains, the rally continues. As soon as the demand runs out, nevertheless, the worth reaches a prime.

It now stays to be seen how lengthy the Bitcoin market can proceed to soak up the aggressive profit-taking spree from the HODLers.

BTC Value

On the time of writing, Bitcoin is buying and selling round $105,100, up greater than 2% during the last week.