BlackRock’s Head of Digital Property, Robert Mitchnick, says the explosive success of the iShares Bitcoin Belief (IBIT) is barely the start. Talking with Bloomberg’s ETF IQ on June 9, Mitchnick described the Bitcoin ETF phenomenon as being in its “very early” section, with institutional capital nonetheless steadily working via onboarding and due diligence pipelines.

“Very Early” For Bitcoin ETFs

“There was nothing like this,” Bloomberg’s Eric Balchunas mentioned, citing IBIT’s unprecedented development. The ETF reached $70 billion in property below administration in simply 341 days—a record-breaking tempo in comparison with the earlier quickest, GLDY, which took 1,691 days. “Simply ridiculous numbers right here,” Balchunas added.

Mitchnick credited this historic influx to a mixture of retail enthusiasm and the start levels {of professional} allocation. “It’s plenty of issues coming collectively,” he mentioned. “You don’t get a chart like that with out a confluence of actors all occurring on the similar time.”

He continued: “Out of the gate it was retail and investor demand, and that ran the gamut of small retail traders to extremely internet value. Now, extra just lately, now we have seen regular progress of extra wealth advisor adoption, extra institutional adoption.”

However regardless of IBIT’s dominance and the sector-wide momentum, Mitchnick careworn that institutional penetration stays low. “Very early,” he mentioned when requested how far wealth advisor adoption is. “What now we have seen is a concerted effort by a lot of the largest corporations to progress via their diligence and analysis and approval course of… You’ve seen that fast-tracked by a lot of corporations. We’re speaking by quarters, not months.”

That timeline displays the structural actuality of conventional asset administration, the place new ETF approval entails multi-year workflows. “Slowly however certainly,” Mitchnick famous, “you’ve seen an acceleration, significantly within the final couple months, of extra notable corporations reducing boundaries, granting approval to their advisors to make use of this, and that’s set to proceed.”

Past regulatory consolation, Bitcoin’s evolving danger profile is taking part in a pivotal function in institutional curiosity. “Bitcoin is a unstable asset,” Mitchnick acknowledged. “On the similar time, its danger and return drivers are markedly totally different from a lot of the remainder of the property in a standard portfolio. That’s necessary.”

He underscored the attraction of Bitcoin’s low correlation with conventional property. “When establishments are this, they’re closely centered on that correlation—whether or not it’s zero or, even in some durations, detrimental. Then the portfolio development case is compelling to them,” he defined. “If you take a look at this as a world scarce rising financial different with a complete set of danger and return components, that correlation is what ought to prevail.”

Requested whether or not the crowded Bitcoin ETF market—with a dozen merchandise now buying and selling—would possibly want consolidation, Mitchnick responded optimistically. “A whole lot of them have been very profitable. IBIT has been the chief by a good margin, however there’s such demand that it’s thrilling… That could be a good factor.”

And Ethereum?

With reference to Ethereum and the forthcoming iShares ETH ETF, Mitchnick was extra cautious. “It is a bit more of a retail-concentrated investor base than now we have seen with IBIT,” he mentioned. “The institutional funding thesis with Bitcoin as a rising world different is resonating fairly strongly. However after we speak about Ether, there may be an thrilling story there, however it’s extra a couple of know-how story. That could be a a lot tougher case for lots of establishments to underwrite, particularly in comparison with different know-how issues.”

Finally, Mitchnick framed BlackRock’s digital asset technique not as a short-term advertising and marketing play, however as a gradual integration of Bitcoin into world portfolio principle. “Lots of our shoppers are watching intently,” he mentioned. “We imagine that is just the start of a multi-year journey that may redefine asset allocation globally.”

With IBIT persevering with to steer the pack in flows and efficiency—up 121% since inception—BlackRock seems well-positioned not solely to experience the ETF wave however to form its route. “That is nonetheless the very early days,” Mitchnick reiterated. “The story is much from over.”

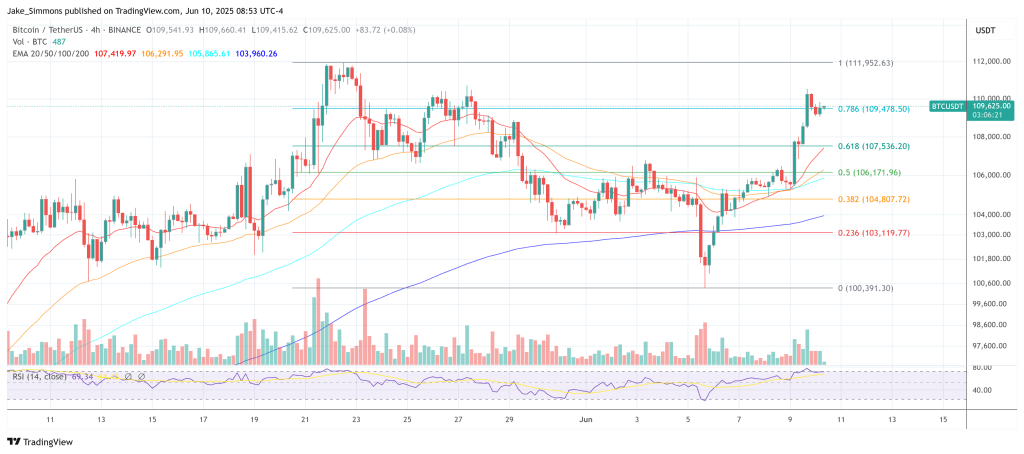

At press time, BTC traded at $109,625.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.