Este artículo también está disponible en español.

The constant retail demand for Bitcoin on the $100,000 mark, which signifies excessive investor confidence, has lately drawn discover. Nonetheless, as a result of short-term holders are driving the current accumulating pattern, market watchers are warning of a doable fall to $95,000.

Associated Studying

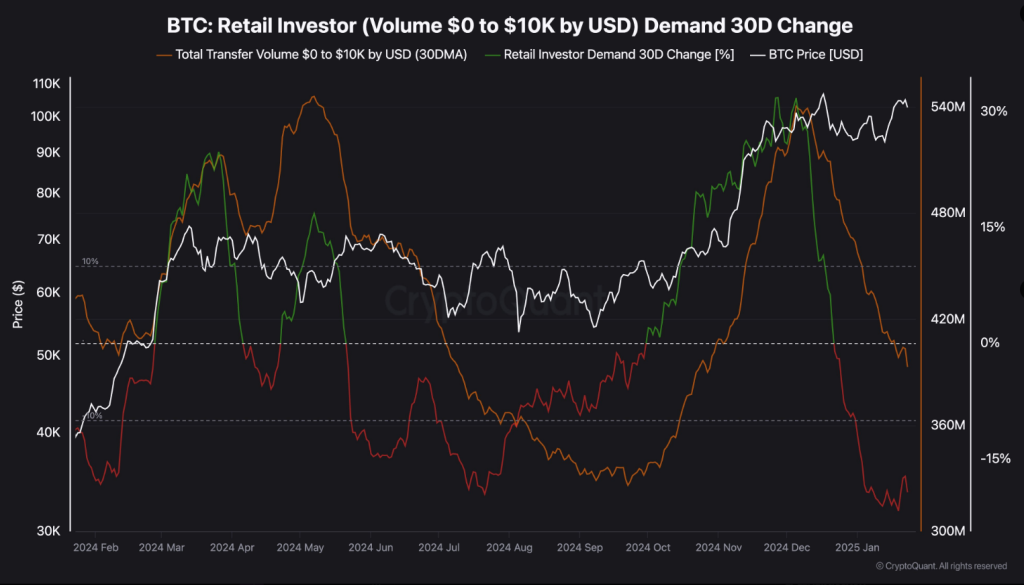

Retail Traders Accumulate At File Tempo

Retail traders, which embrace smaller holders termed as “Shrimps” and “Crabs,” have been enthusiastically accumulating Bitcoin. Within the final month, Glassnode reviews that these teams collectively added 25,600 BTC to their portfolios. That’s practically twice the quantity of newly mined Bitcoin over the identical interval, an indication of great demand for the “digital gold” at its value peaks.

Demand from retail traders for #Bitcoin at costs round $100K stays robust – The Shrimp-Crab cohort (as much as 1 and 10 #BTC, respectively) absorbed 1.9x the newly mined Bitcoin provide final month, a complete of +25.6k $BTC: https://t.co/l0sjVN2Toi pic.twitter.com/UdzcCWXAGo

— glassnode (@glassnode) January 23, 2025

The buying exercise of those smaller traders highlights an much more basic retail enthusiasm pattern. Nonetheless, specialists should nonetheless train warning. Though this diploma of accumulation is outstanding, the dominance of short-term holders (STHs) on this surge introduces a component of danger for market stability.

Brief-Time period Holders Pose A Danger

Typically promoting off throughout slight declines to ensure positive factors, STHs are famend for his or her quick responses to market adjustments. Notably in circumstances of sudden volatility for Bitcoin, this reflexive habits might set off increased promoting stress. Teddy, a market analyst, underlined that the existence of STHs might need a serious impression on momentary value swings.

Whereas STHs (Brief-Time period Holders) have certainly absorbed a good portion of the newly mined Bitcoin provide, it’s essential to think about the behavioral tendencies of this group. STHs are traditionally extra inclined to panic throughout minor market fluctuations, usually leading to… pic.twitter.com/dasfRgjOFR

— Teddy (@TeddyVision) January 23, 2025

Traditionally, the markets are additionally extra delicate to the downtrends with STH. Analysts really feel that together with this prevailing pattern, at such ranges, warning for traders could be prudent.

Glassnode: Slim Bitcoin Vary

One other anomaly which Glassnode picked out within the value motion of Bitcoin is an unusually tight vary over the previous 60 days. Such occasions have been precedents for risky occasions forward.

This coincides with historic traits, which counsel that the market will expertise both a breakout or a breakdown quickly. Whereas the sustained $100,000 value stage displays optimism, the market’s slender vary provides an air of unpredictability.

Associated Studying

A Potential Pullback Quickly?

Given all of those elements, some specialists imagine Bitcoin could also be due for a slight value adjustment within the close to future. Some specialists, like market veteran Michaël van de Poppe, predict a retreat to $95,000, primarily on account of STHs promoting within the face of market uncertainty.

In the intervening time, retail demand stays a strong supply of assist at $100,000. Traders ought to, nevertheless, brace themselves for volatility and maintain an eye fixed out for market indicators. As Bitcoin trades close to its peak, the interplay of retail euphoria and market dangers will decide its subsequent strikes.

On the time of writing, Bitcoin was buying and selling at $105,141, up 3.2% and three.2% within the every day and weekly timeframes.

Featured picture from Vecteezy, chart from TradingView