On Thursday, January 23, US President Donald Trump issued the first-ever government on cryptocurrencies. The order outlines the formation of a “nationwide digital asset stockpile,” which has prompted questions on whether or not the USA intends to actively buy Bitcoin (BTC) or merely incorporate confiscated BTC right into a reserve. Moreover, the scope relating to the inclusion of altcoins on this stockpile stays unsure.

The manager order states that “The Working Group shall consider the potential creation and upkeep of a nationwide digital asset stockpile and suggest standards for establishing such a stockpile, probably derived from cryptocurrencies lawfully seized by the Federal Authorities by means of its regulation enforcement efforts.” This broad language has led to different interpretations amongst trade specialists.

Bitcoin And Altcoins? Purchase Or Simply Hodl?

Dennis Porter, founder and CEO of the Bitcoin lobbying non-profit Satoshi Act Fund, expressed help for the initiative through X, emphasizing the strategic selection of terminology. “We absolutely endorse the working group for a ‘Strategic Digital Asset Stockpile’,” Porter mentioned.

He highlighted that “it’s pragmatic for the working group to make use of the phrase “digital asset” for the very same cause that Satoshi Act Fund has utilized this strategy inside our mannequin coverage which has handed into regulation 4 occasions on the state stage.” This technique, based on Porter, facilitates a broader dialog on the significance of Bitcoin and protects its long-term viability, finally aiming to place the USA as the most important holder of Bitcoin globally.

Crypto analyst MacroScope shared insights through X, noting that the manager order lays the groundwork for a strategic Bitcoin reserve (SBR) with a transparent timeline. “Groundwork for a strategic Bitcoin reserve is underway with a transparent timeline,” he acknowledged and identified that inside 180 days, the Working Group is predicted to submit a report back to the President recommending regulatory and legislative proposals to advance the insurance policies established within the order.

Alex Thorn, Head of Analysis at Galaxy Digital, clarified that the time period “stockpile” would possibly merely seek advice from holding present belongings moderately than actively buying new ones. “‘Stockpile’ is jargon which means holding what they’ve, however not essentially shopping for something,” Thorn acknowledged.

He shared an summary of the present cryptocurrency holdings of the US authorities, and added: “I need to be clear that the EO doesn’t say the federal government WILL maintain ALL the cash it presently holds […] word that it additionally says ‘establishing standards’ — presumably not every part can be HODL’d.”

David Bailey, CEO of BTC Inc. and a key advisor to the Trump marketing campaign on crypto issues, added that the manager order leaves room for ambiguity relating to the acquisition of further Bitcoin. “I do know this may shock a few of you however Bitcoin is a Digital Asset. […] Additionally simply to level out, the EO doesn’t say the strategic stockpile cannot buy further bitcoin. It leaves it ambiguous. The Working Group will decide these particulars. We’ve six months to persuade them to ape in dimension.”

He burdened the significance of legislative help, stating that establishing a SBR on the obligatory scale would require congressional backing. Bailey referenced the Lummis BITCOIN Act, highlighting Senator Cynthia Lummis’s pivotal position in advancing crypto-friendly laws.

Senator Cynthia Lummis, appointed chair of the Senate Banking Subcommittee on Digital Property on Thursday. Notably, President Trump couldn’t have picked anybody extra pro-BTC and pro-SBR than Lummis as chair. Lummis has been actively concerned in selling Bitcoin-related laws, notably by means of the BITCOIN Act of 2024. Senator Lummis launched the Strategic Bitcoin Reserve laws – aimed toward shopping for 1 million BTC over 5 years in 2024.

In her opening assertion upon chairing the subcommittee, Lummis emphasised the long run significance of digital belongings and the necessity for bipartisan laws to ascertain a complete authorized framework. “Congress must urgently go bipartisan laws establishing a complete authorized framework for digital belongings and that strengthens the U.S. greenback with a strategic bitcoin reserve,” she acknowledged.

Lummis additional highlighted the challenges forward, noting the need for consensus-building and widespread help to codify a Strategic Bitcoin Reserve. “There’s a BIG elevate forward. It is going to require consensus constructing and loud voices. So get loud however bear in mind to codify an SBR we’d like majorities in each homes. Make associates the place you possibly can. […] Each legislator is giving this laws a critical look. The time is now. The President is a visionary chief and we’re able to get this invoice to his desk.”

Thus, President Trump has created two pathways for a Strategic Bitcoin Reserve: the “stockpile” labored on by the working group and the brand new subcommittee chaired by Lummis. She may actively improve the Bitcoin reserve by means of Congress, that means that the US would possibly purchase BTC, not simply hodl onto what’s seized by regulation enforcement.

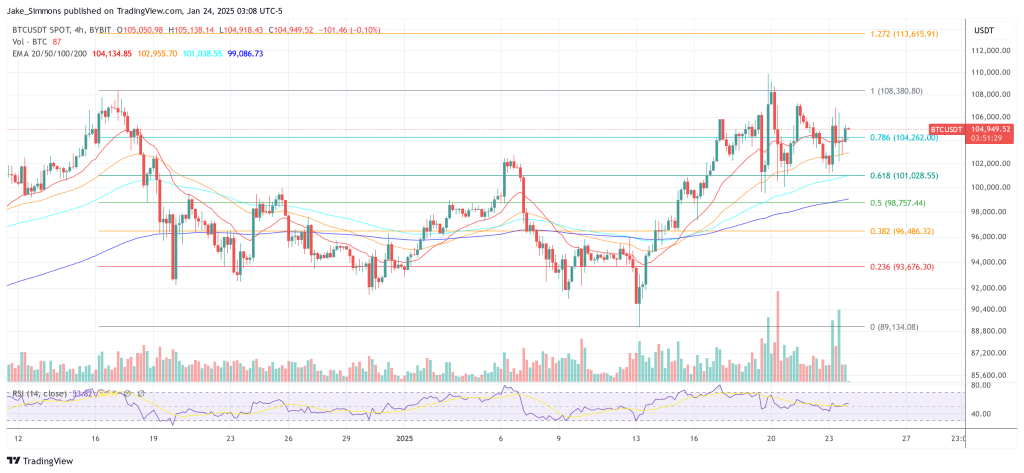

At press time, BTC traded at $104,949.

Featured picture created with DALL.E, chart from TradingView.com