Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

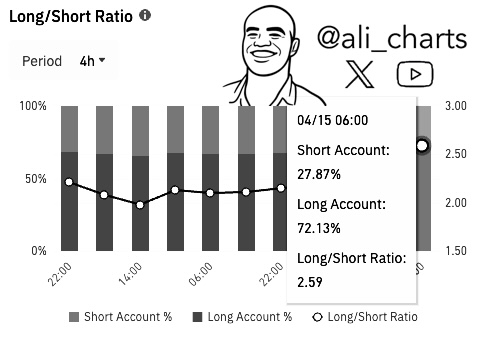

A contemporary snapshot of Binance’s futures market information reveals Dogecoin attracting a remarkably bullish stance amongst merchants. Based on a chart shared by Ali Martinez (@ali_charts) on X, 72.13% of Binance customers with open Dogecoin positions are presently lengthy, leaving solely 27.87% on the brief facet. “72.13% of merchants on Binance with open Dogecoin DOGE positions are presently lengthy!” Martinez wrote, underscoring simply how skewed sentiment is towards an upward value transfer.

What Does This Imply For Dogecoin Value?

What does such a powerful majority of longs truly imply for Dogecoin’s outlook? In lots of circumstances, a pronounced imbalance like this hints that almost all market contributors count on the worth to maintain climbing, at the very least within the brief time period. When so many merchants are betting on good points, it usually displays optimism—and even pleasure—concerning the token’s momentum. Dogecoin has repeatedly proven its means to encourage fervor amongst retail buyers and enormous speculators alike, so spikes in bullish curiosity are hardly stunning.

Associated Studying

This type of information may be interpreted as a possible signal of energy for Dogecoin. If the market aligns behind a bullish narrative, continued shopping for strain might materialize, and costs can push larger. Nevertheless, it’s not all the time that easy. When an enormous chunk of the market tilts to at least one facet, it raises the chance {that a} sudden drop may set off a wave of pressured liquidations amongst these lengthy positions. If the broader crypto market wavers—or if Dogecoin faces any surprising hurdles—merchants who jumped in anticipating a fast revenue may find yourself speeding for the exits, amplifying downward strikes.

Nonetheless, the determine “72.13%” is unambiguously excessive, which is sufficient to catch anybody’s consideration. A protracted/brief ratio that elevated doesn’t assure a continued rally; as an alternative, it paints an image of present-day sentiment amongst a selected subset of merchants. It’s one snapshot in time, drawn from the exercise of one of many world’s busiest crypto exchanges. Even so, it’s a stable reminder that, at this second, a lot of Dogecoin merchants on Binance consider the trail of least resistance is to the upside.

Associated Studying

After all, market circumstances can shift swiftly. Some merchants will preserve a detailed eye on total liquidity, the habits of Bitcoin, and any tariff information from US President Donald Trump. Dogecoin is thought for abrupt value surges, spurred by social media buzz or endorsements from influential figures, so even information as decisive as this lengthy/brief ratio doesn’t absolutely predict what comes subsequent. Nevertheless it does give us an insider’s view of how Binance contributors are positioning themselves and, in doing so, units the stage for Dogecoin’s near-term intrigue.

For now, the sheer dominance of lengthy positions appears to say: merchants stay bullish and are prepared to again that sentiment with open contracts. It could possibly be an indication of confidence in Dogecoin’s resilience, or it could possibly be a setup for surprising volatility if sentiment flips. Whichever approach it unfolds, Martinez’s chart shines a light-weight on how enthusiasm for this meme-inspired asset continues to run excessive in sure corners of the crypto market.

At press time, Dogecoin was buying and selling just under its multi-year trendline, following a rejection on the 0.786 Fibonacci retracement degree round $0.167. A renewed drop towards the pink assist zone close to $0.14 could possibly be on the desk if DOGE closes beneath the trendline. On the flip facet, the 0.786 Fib stays essentially the most vital resistance degree, adopted by a possible channel take a look at close to $0.18.

Featured picture created with DALL.E, chart from TradingView.com