This week, China introduced a major financial stimulus package deal aimed toward revitalizing its slowing financial system. The measures, introduced by the Folks’s Financial institution of China (PBOC), embody a mixture of financial easing and capital market assist. These actions are designed to stimulate progress after current sluggish financial information and a property market disaster. It’s the largest stimulus package deal for the reason that pandemic. Nevertheless, when requested on CNBC about what he seems to purchase in China, billionaire and Appaloosa Administration hedge fund founder and president, David Tepper answered: “Every little thing! ETFs, I’d do futures – every thing.”

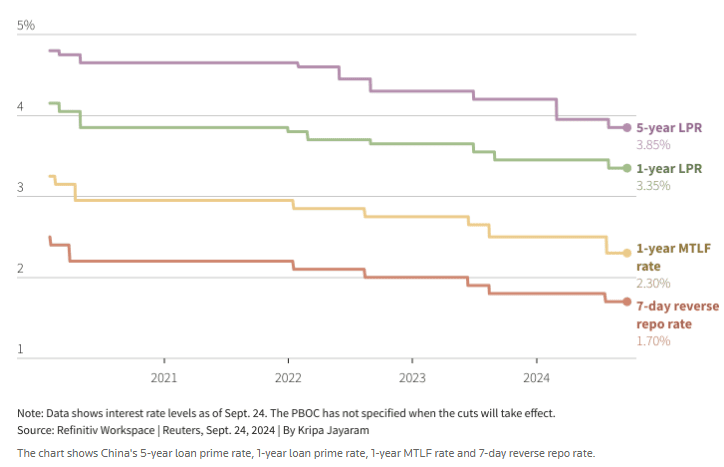

The PBOC determination comes after final week’s Fed’s hefty discount of the rate of interest and that is placing much less stress on the yuan that’s at present appreciating versus the US greenback ($USDCHN). However what are the stimulus measures?

Image supply: Etoro 1 Day chart

Key Stimulus Measures:

Financial Easing:

The PBOC will cut back the reserve requirement ratio (RRR) by 50 foundation factors, releasing up roughly $142 billion for brand new lending. Additional cuts of as much as 0.5 proportion factors could comply with later this yr.

A discount in key rates of interest, together with a 0.2 proportion level minimize within the seven-day reverse repo charge to 1.5%, will decrease borrowing prices throughout the financial system.

Mortgage and Property Market Assist:

Rates of interest on current mortgages will likely be minimize by 0.5%, with the minimal down cost for second properties decreased to fifteen%. That is a part of a broader effort to stabilize the property market, which has been in extreme decline

Capital Market Assist:

The central financial institution launched a $71 billion liquidity swap program for funds and insurers to spice up inventory market exercise and can provide low-interest loans to business banks for share buybacks and growing inventory holdings.

Image supply: Reuters

Image supply: Reuters

Funding Alternatives:

On account of these measures, a number of sectors and funding property are anticipated to learn:

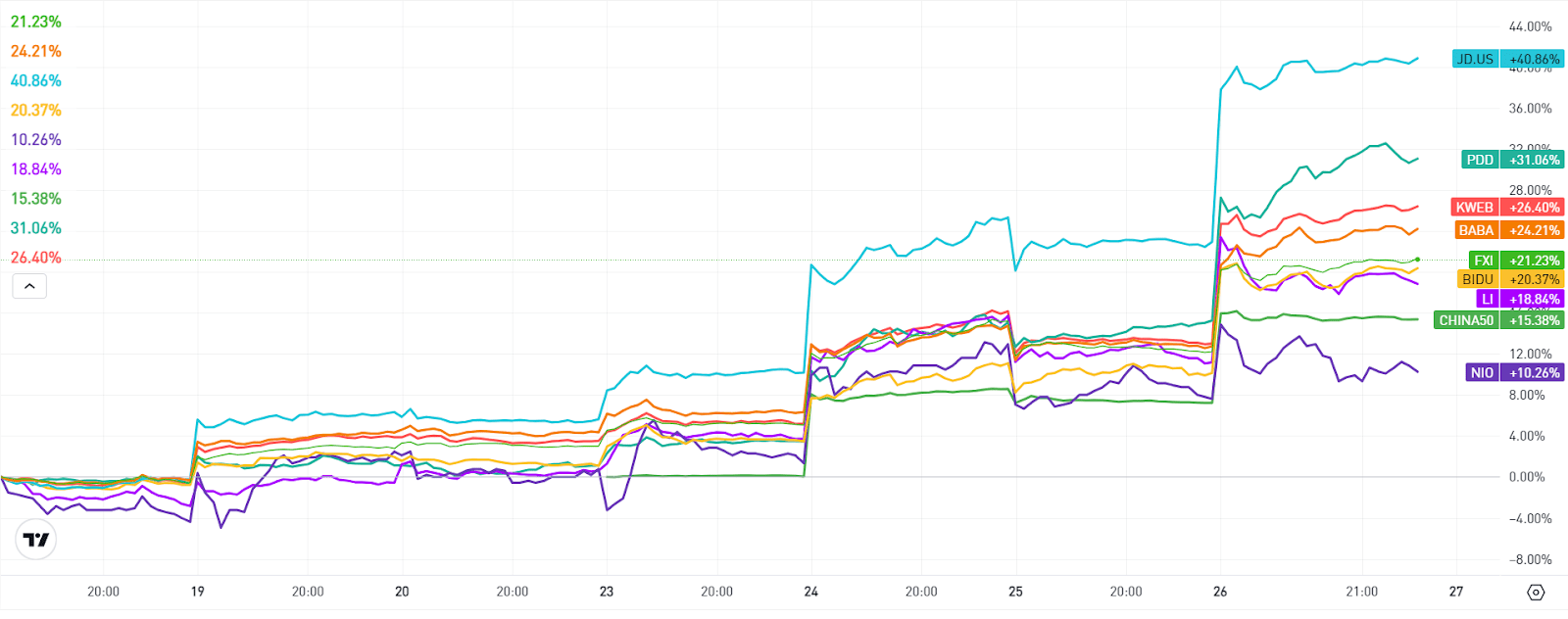

Chinese language Expertise Corporations: U.S.-listed shares of main Chinese language companies like Alibaba ($BABA), PDD Holdings ($PDD), and Li Auto ($LI) have surged following the announcement, with will increase of as much as 12% in some instances.

Metals and Commodities: China’s stimulus is boosting world demand for uncooked supplies. Copper costs have risen as a result of China’s position as the biggest client of business metals.

Chinese language Property Shares and Actual Property Funds: The property market measures, significantly the mortgage charge cuts, may gain advantage Chinese language actual property companies and funds with publicity to the sector, although these investments stay high-risk.

Image supply: eToro quarter-hour chart

Image supply: eToro quarter-hour chart

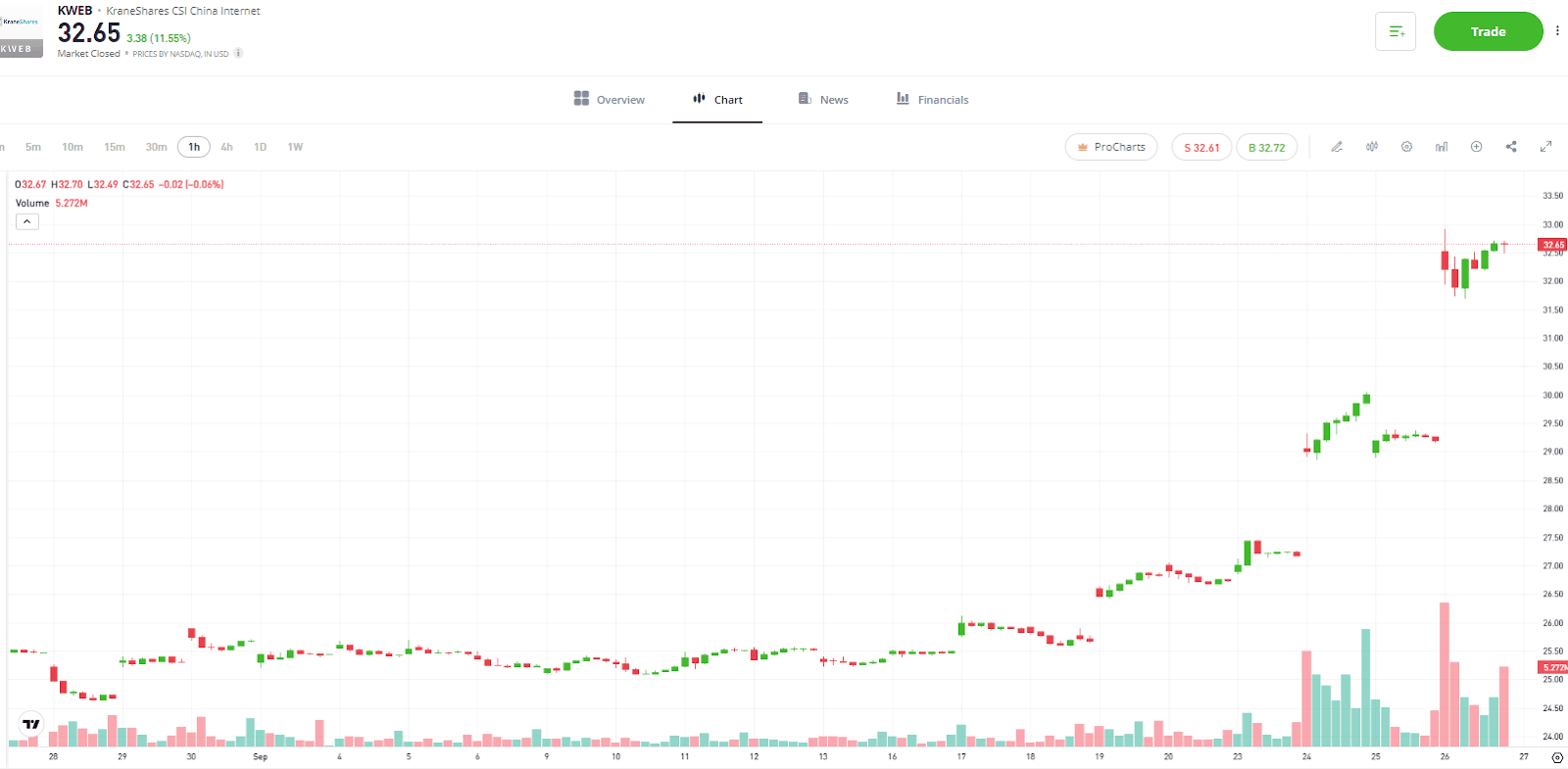

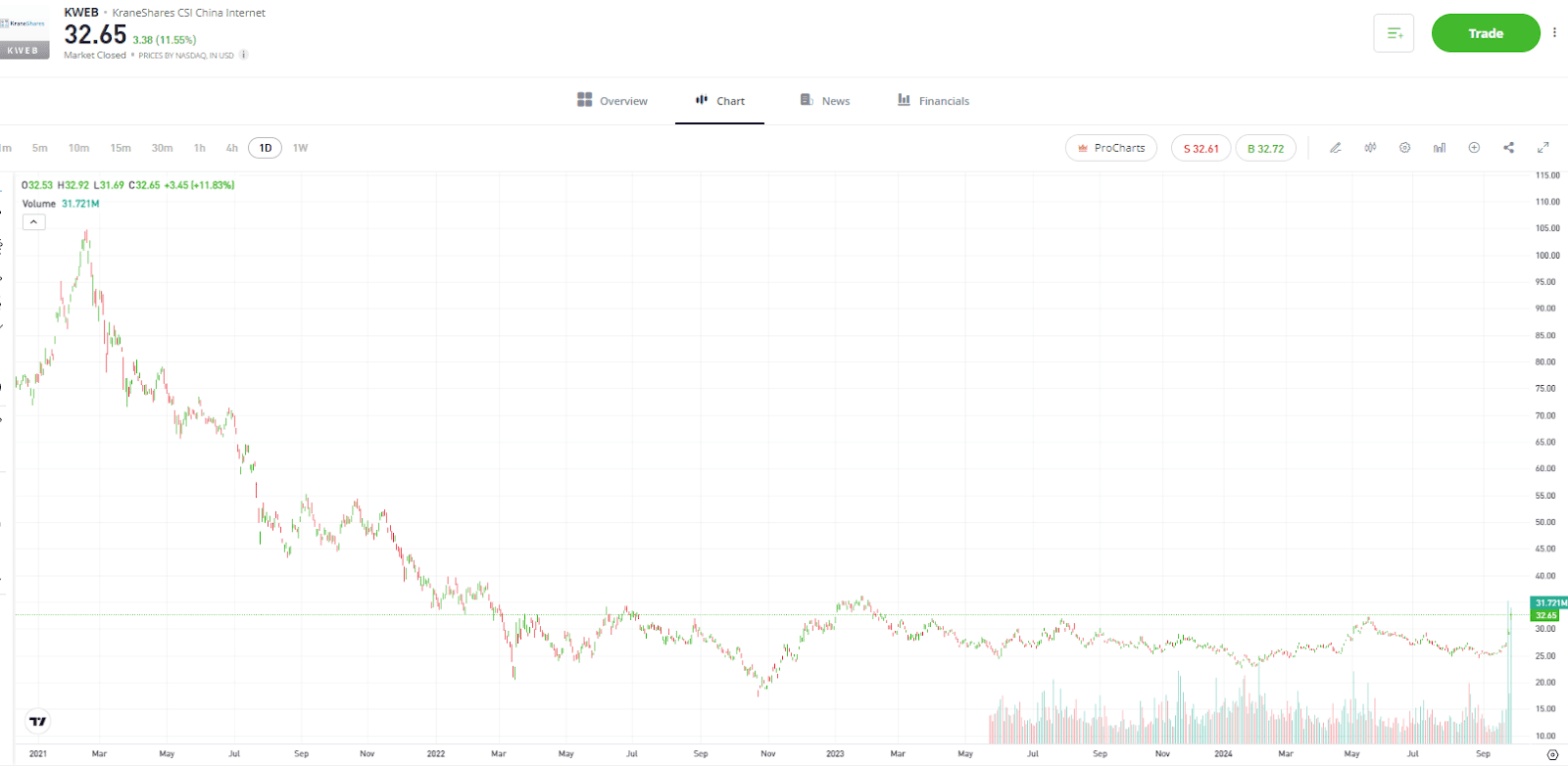

To discover particular investments benefiting from these strikes, you possibly can have a look at exchange-traded funds (ETFs) monitoring Chinese language shares like KraneShares CSI China Web ($KWEB) or particular person U.S.-listed shares of firms like Alibaba ($BABA), JD.com ($JD), Baidu ($BIDU), NIO ($NIO) and Li Auto ($LI). The market already reacted positively to the stimulus package deal and we have now seen a surge (see image above) in all these property.

Charts supply: eToro

Charts supply: eToro

KraneShares CSI China Web ETF ($KWEB) tracks and mirrors the outcomes of publicly traded Chinese language firms that concentrate on web companies. Up to now month the index gained 28%, with over 22% improve up to now week (see charts above), as a result of market expectations that we are going to lastly see a stimulus package deal aimed toward combating the slowdown within the Chinese language financial system. However a look at the long run chart reveals that the fund traded at a excessive of 104 USD in 2021. Normally such stimulus have long run implications on the financial system and firms efficiency.

David Tepper, founder and president of Appaloosa Administration. Cameron Costa | CNBC

David Tepper, founder and president of Appaloosa Administration. Cameron Costa | CNBC

Billionaire and Appaloosa Administration hedge fund founder David Tepper mentioned his large guess after the Federal Reserve’s charge minimize was to purchase Chinese language shares. What’s David Tepper shopping for in China? “Every little thing,” he says.

Tepper additionally famous the Chinese language market is cheaper than U.S. equities. “You’re sitting there with single a number of P/Es with double-digit progress charges for the large shares that commerce over right here,” Tepper mentioned. “That’s sort of versus what, , the 20-plus on the S&P.”

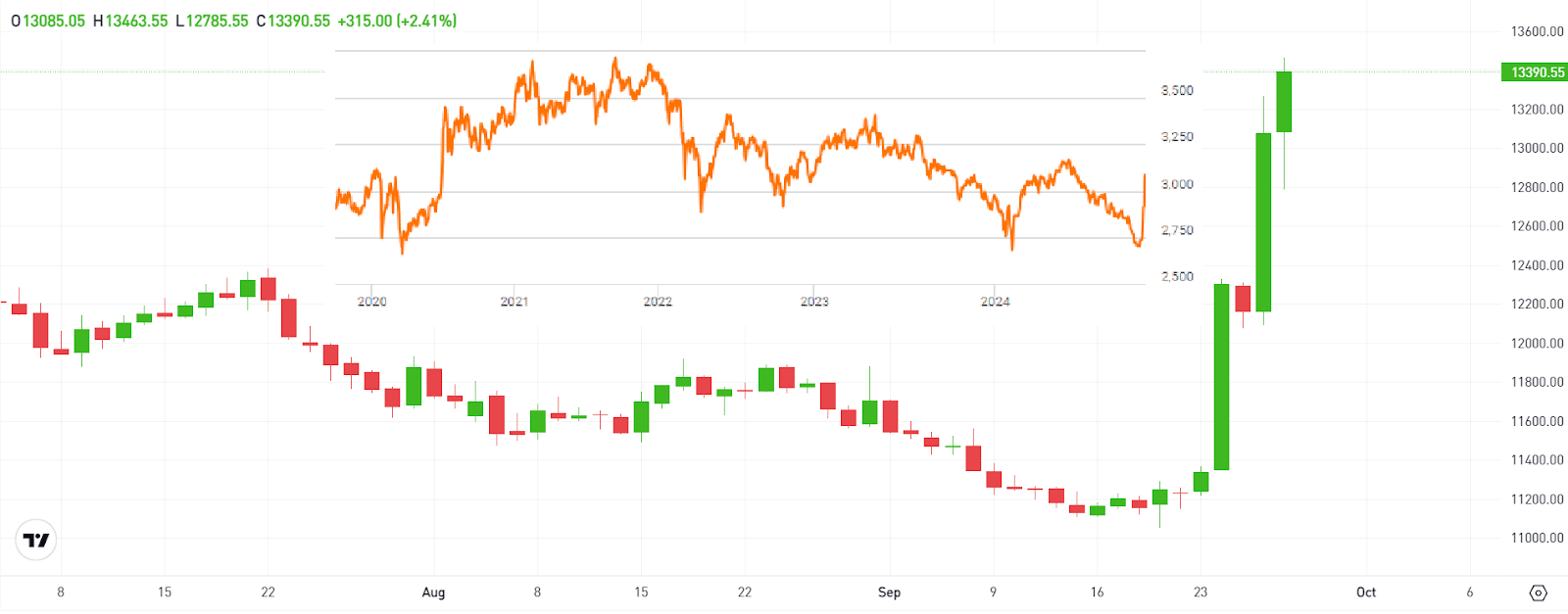

Supply: eToro CHINA50 1 Day chart, In search of Alpha 5Y chart

Supply: eToro CHINA50 1 Day chart, In search of Alpha 5Y chart

The Shanghai Index ($CHINA50) – see image above – gained over 12% up to now 5 days, and the stimulus measures are having a optimistic impression on different Asian markets as properly, because the regional economies expect to learn from revitalization of the Chinese language financial system.

Yr to this point the Shanghai Index returned virtually a 3% improve however it’s at -1% up to now 12 months and at solely 5% progress up to now 5 years. However there may be nonetheless room for progress for the Chinese language monetary markets if you happen to have a look at the 5 years chart (the orange chart within the nook of the above image), because the index continues to be properly under the 2021 heights. Whereas wanting on the alternatives, buyers must also fastidiously contemplate the dangers that they might face and make their very own evaluation.