On-chain knowledge exhibits the Ethereum Change Netflow has remained adverse throughout the previous week, an indication that may very well be bullish for ETH.

Ethereum Change Netflow Suggests Development Of Withdrawals

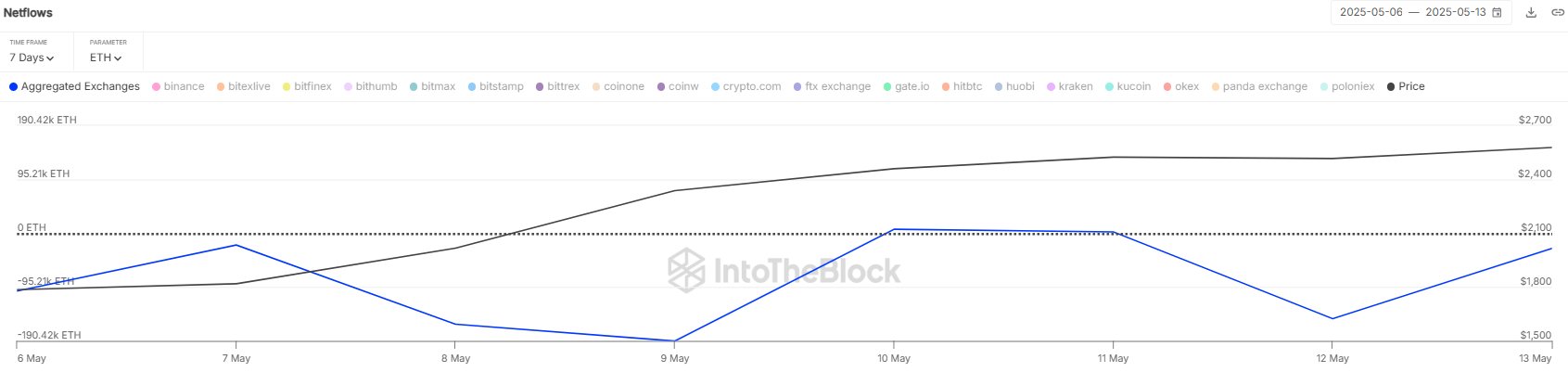

In a brand new submit on X, the institutional DeFi options supplier Sentora (previously IntoTheBlock) has talked concerning the newest development within the Change Netflow of Ethereum. The “Change Netflow” right here refers to an on-chain metric that retains monitor of the online quantity of the cryptocurrency shifting into or out of the wallets related to centralized platforms.

When the worth of this metric is constructive, it means the traders are depositing a web variety of tokens to those platforms. As one of many predominant the explanation why holders switch to exchanges is for selling-related functions, this sort of development can have a bearish affect on the ETH value.

Then again, the indicator being underneath zero suggests the outflows are outweighing the inflows. Typically, traders take their cash away from the custody of exchanges for holding into the long run, so this sort of development can show to be bullish for the asset.

Now, right here is the chart shared by the analytics agency that exhibits the development within the Ethereum Change Netflow over the previous week:

The worth of the metric seems to have been adverse in latest days | Supply: Sentora on X

As displayed within the above graph, the Ethereum Change Netflow has largely been adverse inside this window, which means the holders have been pulling provide out of the centralized exchanges.

In whole, the traders have made withdrawals price $1.2 billion with this outflow spree. “This sustained development of web outflows, intensifying since early Could, indicators continued accumulation and decreased sell-side strain,” notes Sentora.

Whereas ETH has seen this bullish growth not too long ago, the cryptocurrency might not be providing that good an entry alternative proper now, because the analytics agency Santiment has defined in an Perception submit.

The info for the 30-day and 365-day MVRV Ratios of ETH | Supply: Santiment

The indicator shared by the analytics agency is the “Market Worth to Realized Worth (MVRV) Ratio,” which principally offers a measure of the profit-loss state of affairs of the Bitcoin traders.

Within the chart, Santiment has included two variations of the indicator: 30-day and 365-day. The previous tells us concerning the profitability of the traders who bought throughout the previous 30 days and the latter that of the previous yr patrons.

As is seen within the graph, the 30-day MVRV Ratio for Ethereum has a notable constructive worth proper now, implying the latest patrons are in important revenue. Extra particularly, the metric is sitting at 32.5%, which is nicely above the 15% hazard zone for altcoins that the analytics agency recommends as a rule-of-thumb.

“It might not imply that costs are about to drop, but it surely does counsel that the rally will seemingly gradual or halt till the 30-day MVRV dips again all the way down to one thing extra affordable,” explains Santiment.

ETH Worth

On the time of writing, Ethereum is buying and selling round $2,600, up over 43% within the final week.

The development within the ETH value during the last 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.