Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

XRP has been resting on the $2 degree, however indications of motion are growing. One crypto analyst by the title of “J4b1” not too long ago said that buying XRP at $2.20 will not be too late. In truth, he thinks that it could be the right time, simply earlier than issues change dramatically. His assertions are based on historic value motion, Ripple’s present technique, and what establishments might do subsequent.

Associated Studying

XRP Worth Stored Secure By Ripple’s Month-to-month Exercise

Ripple’s dominance over XRP’s provide is a vital side of J4b1’s argument. Each month, the agency releases 1 billion XRP from escrow however sells solely a fraction of it. The remaining quantity is put again into escrow. These gross sales are inclined to happen by way of over-the-counter (OTC) channels quite than open markets. Within the analyst’s view, this follow prevents Ripple from experiencing sharp value fluctuations.

Is XRP about to blow up or already overpriced?

Is shopping for at $2.20 sensible or is it too late? Let’s break it down with information, historic context, and Ripple’s value management technique. 🧵👇 pic.twitter.com/UHvbYD4GJl

— J4b1 (@XRPJ4b1) Might 4, 2025

He used an instance: if Ripple desires to switch $200 million utilizing 100 million XRP, each coin must be price $2. If the value rises too quickly, Ripple can promote extra. If it falls too far, they could purchase some again. This technique may very well be one of many explanation why XRP has not damaged by means of the $2.20 barrier.

Institutional Demand Might Change Every little thing

J4b1 talked about a couple of issues that might drive XRP up. He cited attainable regulatory readability from a brand new US administration that may very well be extra crypto-friendly. He additionally talked about the potential for an XRP spot ETF and the expansion of tokenized belongings on the XRP Ledger.

The analyst believes that if establishments start accumulating in giant portions, Ripple’s present strategy will not be adequate to comprise the value. If demand outstrips the availability Ripple has, the value might surge.

XRP market cap at present at $125 billion. Chart: TradingView.com

XRP’s Historical past Holds Clues

XRP’s journey started in 2012, when it was price lower than a penny. It picked up tempo over time as Ripple bought it to banks as a way of constructing cross-border funds sooner and cheaper. That momentum took XRP to a excessive of $3.80 within the 2017 bull run.

Associated Studying

However every part modified when regulators stepped in. In 2015, Ripple was fined by FinCEN. Then, in 2020, the SEC lawsuit struck, slowing down XRP’s adoption and conserving the value below management. However, Ripple continued to construct, buying firms like Metaco and acquiring licenses throughout the globe.

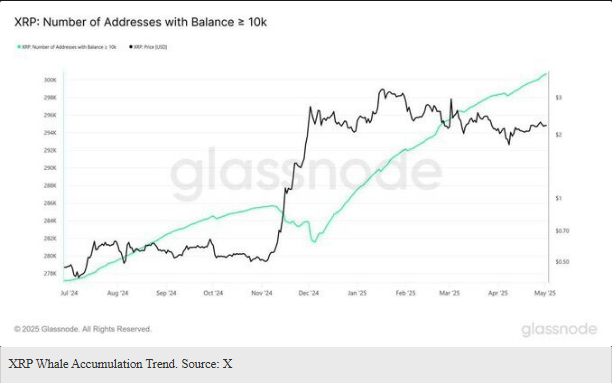

Whale Wallets Are Rising Quickly

In the meantime, as XRP’s value stays stagnant, the massive holders are filling up. In line with current statistics, there at the moment are greater than 300,000 addresses holding a minimal of 10,000 XRP. That’s a rise from round 281,000 as of December 2024. Whale wallets proceed to rise though the value stays largely flat round $2.20.

That kind of buildup tends to point a way that costs might rise additional sooner or later. It’s occurring as international uncertainty will increase, which can be encouraging buyers to prepare for the subsequent main transfer.

In the interim, XRP merchants are paying shut consideration. A fast transfer on the upside will not be far-off.

Featured picture from Gemini Imagen, chart from TradingView