For the reason that crypto market shifted in the direction of constructive territory, Bitcoin, the most important digital asset, has maintained a bullish stance throughout this era, igniting hopes of a continued bull market part. Following the renewed upward development, a number of components of BTC’s market dynamics are starting to see constructive outcomes, reminiscent of the general provide in revenue.

Market Euphoria Brewing With Bitcoin Profitability Rise

Bitcoin is constantly capturing market consideration as bullish momentum builds. With BTC’s value sustaining an upward efficiency, Kyle Doops, an on-chain professional and host of the Crypto Banter present, has outlined a notable shift in its market dynamics.

Particularly, Kyle Doops reported that the share of BTC’s general provide held in revenue has elevated alongside the current value rally, which is a basic precursor to heightened investor pleasure. Traditionally, momentum has accelerated, and costs have incessantly reached parabolic territory when most Bitcoin holders are sitting on features.

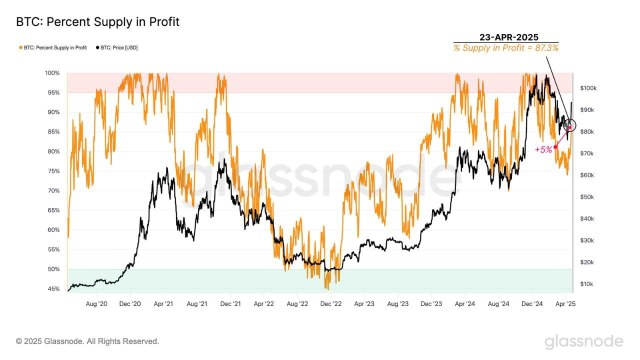

Information exhibits that the share of provide in revenue has rebounded to 87.3% from the March lows as BTC pushed to the $94,300 stage. It’s price noting that the final time BTC hit about $94,000, simply 82.7% of the whole provide was worthwhile.

This suggests that nearly 5% of the availability was modified at lower cost ranges, which is a transparent indication of accumulation. A persistent rise in BTC’s profitability may spur demand for the flagship asset amongst retail and institutional buyers within the following days, bolstering the present uptrend.

Since costs are inclined to go parabolic when most holders are in revenue, Bitcoin could also be setting the stage for an explosive rally. With sentiment enhancing and profitability metrics hovering, Kyle Doops is assured that sustained profitability above 90% may spark the “subsequent true euphoria part,” if historical past is to be believed.

A Wave Of First And Momentum BTC Consumers

Throughout this era, Glassnode, a number one monetary and on-chain information platform, has highlighted waning curiosity in profit-taking at the same time as BTC’s value grows. After analyzing the cumulative provide per cohort, Glassnode revealed that first consumers and momentum consumers proceed to exhibit excessive ranges of engagement, whereas revenue takers‘ involvement continues to be gentle.

Based on the on-chain platform, that is encouraging because it signifies steady demand from new merchants and trend-following gamers with out placing loads of pressure on distribution. The robust conviction amongst these cohorts additional helps the sturdiness of the current rally.

This shift in investor conduct alerts a rising perception in additional upside potential. With buyers demonstrating bullish sentiment amid a value rise, BTC’s market dynamics could also be making ready for a steadier and steady ascent.

On the time of writing, Bitcoin was buying and selling at $94,903, exhibiting a rise of greater than 8% up to now week. Buyers are closely betting on a continued value appreciation, as evidenced by a virtually 76% surge in buying and selling quantity up to now day.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.