Bitcoin is now setting the stage for what might grow to be an enormous bull run. After surging greater than 26% since April 9, BTC is buying and selling firmly above the $90K degree, regaining key technical floor and shifting market sentiment. Nonetheless, warning lingers. International tensions, notably across the escalating commerce battle between the US and China, and broader macroeconomic uncertainty proceed to weigh on investor confidence.

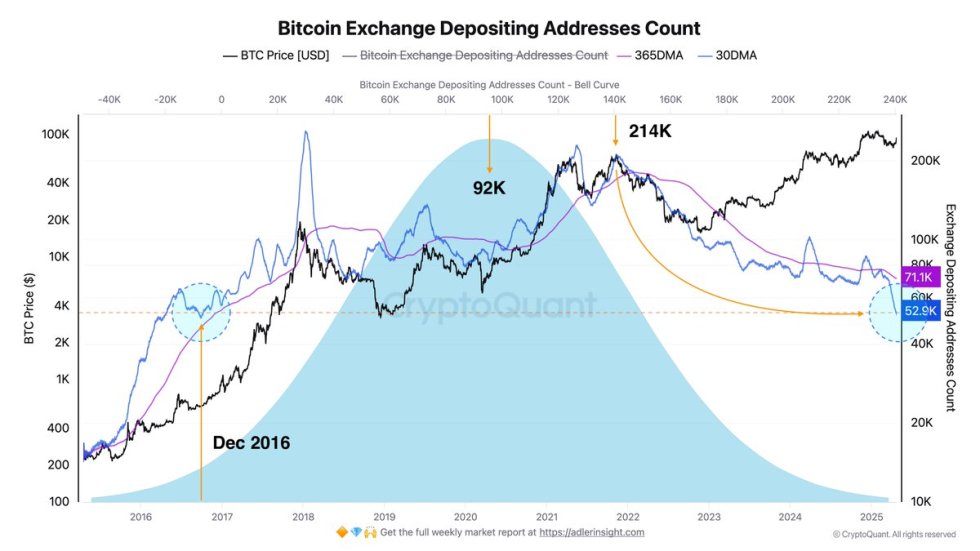

Regardless of these dangers, on-chain information paints a compelling image. Prime analyst Axel Adler shared insights on X displaying a pointy decline within the variety of Bitcoin addresses depositing to exchanges—a possible signal of diminished promoting strain. The 30-day transferring common has dropped nicely beneath the 365-day common.

Most notably, the present degree of exchange-depositing addresses is now akin to that of December 2016, simply earlier than the historic 2017 bull run. If these tendencies persist, Bitcoin might quickly break into value discovery, fueled by long-term holders and renewed institutional curiosity.

Bitcoin Decouples From Equities As HODL Sentiment Strengthens

Bitcoin is displaying indicators of macro-level power because it begins to decouple from U.S. equities. Whereas the S&P 500 and NASDAQ face continued strain attributable to mounting international tensions and investor unease, BTC has rallied—reaching an area excessive round $94,000. This divergence indicators a possible shift in market habits, the place Bitcoin is more and more seen as a hedge or various to conventional property in periods of uncertainty.

One key issue supporting this divergence is the rising conviction amongst long-term holders. In keeping with Adler’s insights, the variety of Bitcoin addresses depositing cash to exchanges has declined steadily since 2022. The 30-day transferring common has now dropped to 52,000 addresses, considerably beneath the 365-day common of 71,000. Traditionally, this determine hovered nearer to 92,000, making the present degree one of many lowest up to now decade.

What’s most placing is that immediately’s numbers resemble these final seen in December 2016, proper earlier than Bitcoin’s explosive 2017 bull run. This decline in alternate exercise implies that traders are holding, not promoting—a pattern that has diminished coin gross sales by an element of 4 over the previous three years. With promoting strain dropping and investor conviction rising, Bitcoin could also be laying the groundwork for a strong new rally.

Worth Motion Indicators Energy With Key Ranges In Sight

Bitcoin is at the moment buying and selling at $92,300 after posting a robust weekly candle that briefly pushed into the $95,000 degree. Bulls have taken management of short-term momentum, and the $95K mark now stands as a key resistance degree. A decisive breakout above it might set off a quick transfer towards the long-awaited $100K milestone, particularly if shopping for strain accelerates amid favorable macro indicators.

Nevertheless, analysts additionally counsel {that a} wholesome retracement might happen earlier than any important breakout. A pullback might supply stronger technical assist for the following leg up, particularly if Bitcoin maintains its place above the 200-day transferring common and key demand zones.

The $88,500 degree is very necessary on this context. Holding above this zone would sign short-term power and continued bullish management, even within the occasion of a consolidation section. Falling beneath it, however, might delay the uptrend and produce a retest of deeper assist.

Total, BTC’s present construction favors the bulls. However with international tensions and macroeconomic uncertainty nonetheless shaping market habits, merchants are watching intently to see if Bitcoin can construct on its current features and switch $95K into assist.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.