Robinhood’s ($HOOD) latest “Misplaced Metropolis of Gold” occasion has triggered widespread concern amongst SoFi buyers. Nevertheless, is that this nervousness justified, or is it presenting a major shopping for alternative inside a essentially sturdy firm that Wall Road could also be overlooking?

Since reaching its January highs, SoFi shares have declined by roughly 36%. Throughout social media platforms, panic-driven commentary dominates, warning buyers to “dump SoFi ($SOFI) earlier than it’s too late.” Phrases like “Robinhood simply killed SoFi’s enterprise mannequin” are in all places. However is that this market response grounded in sound evaluation, or is it a product of emotional overreaction? Let’s look at the information.

What Did Robinhood Announce?

Throughout its “Misplaced Metropolis of Gold” occasion, Robinhood launched three bold merchandise geared toward difficult SoFi’s core enterprise pillars: wealth administration, banking, and AI-driven buying and selling insights.

1. Robinhood Methods (Wealth Administration):

Knowledgeable-managed portfolios with a 0.25% administration payment, capped at $250 for Gold members.

Administration charges drop to zero for balances over $100,000.

New options embrace tax optimization, portfolio insights, and Monte Carlo simulations to foretell returns throughout market situations.

Robinhood claims to have over 50 years of cumulative Wall Road experience amongst its funding staff.

These merchandise are aggressively priced, undercutting SoFi Make investments’s charges.

2. Robinhood Banking:

Launching in Fall 2025, providing a 4% APY on financial savings accounts.

Non-public banking companies with property planning, FDIC insurance coverage as much as $2.5 million, and 24/7 help.

Luxurious perks like tickets to occasions (Met Gala, Oscars, F1 Monaco).

Money supply companies and the power to create household accounts with parental controls.

Designed to enchantment to high-net-worth shoppers by offering personalised companies historically provided by non-public banks.

3. Robinhood Cortex (AI Funding Instrument):

Anticipated to launch later in 2025, this AI-powered software goals to ship refined market evaluation and funding methods in accessible, easy language.

Contains superior knowledge analytics and tailor-made market insights designed to reinforce consumer engagement.

A part of a broader effort by Robinhood to diversify its income streams past transaction-based earnings.

Evaluating Robinhood and SoFi: Strengths and Weaknesses

Robinhood’s latest bulletins are bold, however how a lot of this innovation is genuinely transformative versus promotional posturing? Let’s consider every firm’s strengths and weaknesses.

SoFi’s Strategy

Complete monetary companies ecosystem, together with lending, banking, and funding merchandise.

Constant income progress throughout market cycles.

Diversified enterprise mannequin supplies resilience throughout financial downturns.

Regulatory benefits resulting from SoFi’s established banking license.

Regular, albeit much less sensational, strategy to product improvement and enlargement.

SoFi Is specializing in constructing out a sturdy eco system with its core choices, not one thing RobinHood can replicate simply.

Sofi This fall 2024 IR Report

Robinhood’s Strategy

Fast enlargement into diversified monetary companies past core buying and selling operations.

Extremely efficient advertising concentrating on youthful, technology-savvy customers.

Important progress in property beneath custody and income per consumer.

Making an attempt to develop income sources by premium companies and AI-driven insights.

Branding and consumer engagement are industry-leading, although closely reliant on transaction quantity.

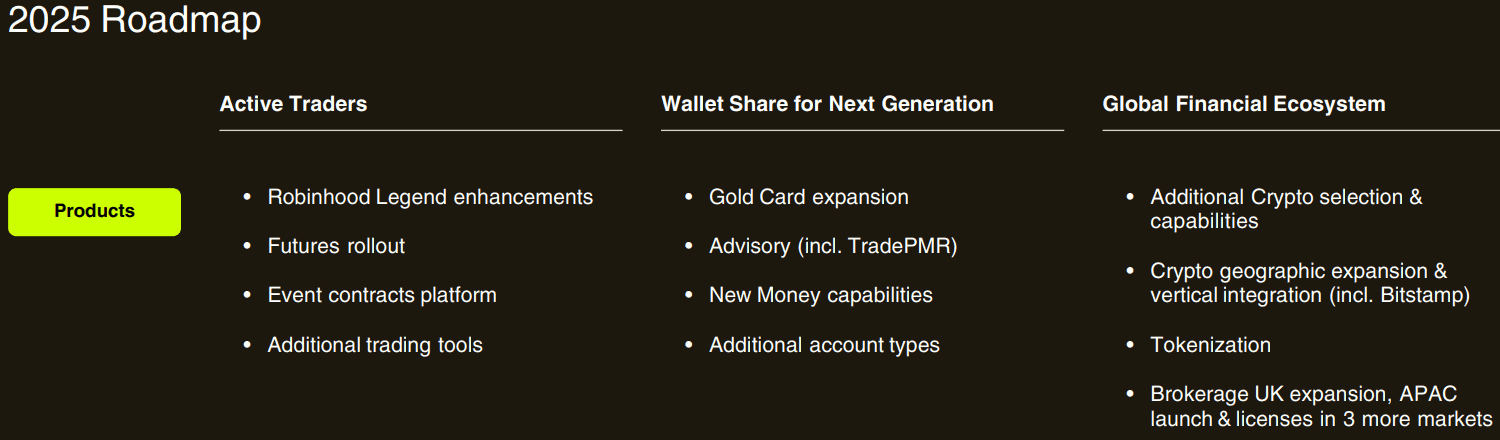

Primarily RobinHood has been focussed on offering extra merchandise to their investing platform apart from Tax Heaps and Gold playing cards. their This fall 2024 highway map for 2025 on their investor relations web page we will see most of their future merchandise are nonetheless geared in direction of that consumer base.

The just lately promoted merchandise lean closely in direction of this investing focus, the place because the banking merchandise they need to provide aren’t all of the distinctive. They do provide a extra healthful cash administration resolution although.

Evaluating Enterprise Fashions

Whereas Robinhood is concentrating on SoFi’s core enterprise sectors, it’s vital to notice the variations of their enterprise fashions:

SoFi: Depends on secure income era by diversified choices corresponding to loans, funding platforms, and banking merchandise. This built-in mannequin supplies a gentle progress trajectory, much less influenced by market fluctuations. SoFi needs to be your One-Cease store for every part from scholar loans to mortgages. Being a regulated financial institution, SoFi can present companies Robin Hood isn’t in a position to.

Robinhood: Nonetheless closely reliant on buying and selling quantity, making its income extra unstable and cyclical. Nevertheless, its push towards extra secure income streams are promising. Their advertising can also be very efficient, they take a barely completely different strategy to SoFi on this, making their product appear unique and, in a manner, addictive. Their whole consumer expertise is designed to provide you these little dopamine hits that preserve you coming again. Sofi targets a barely extra mature viewers, younger professionals and high-income earners whose focus is getting their monetary life so as.

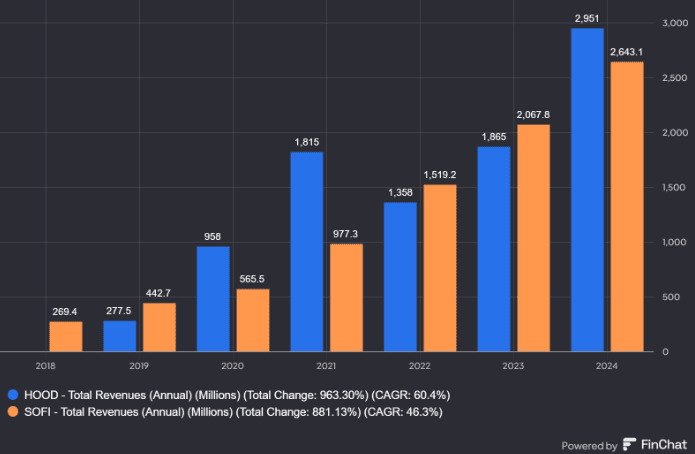

The chart under reveals the distinction between SoFi’s regular Income progress and the cyclical nature of RobinHoods. Robinhood just lately posted over $1 billion in quarterly income the place Sofi Continues to be looking for that milestone however it’s potential that might be within the bag for Q1 2025.

Curiously, Robinhood’s efforts to copy SoFi’s diversified strategy recommend an acknowledgment of the inherent weaknesses in a purely transaction-based mannequin. The query stays whether or not Robinhood’s new initiatives can genuinely compete with SoFi’s established infrastructure.

Ought to Buyers Be Involved?

The market’s unfavorable response to Sofi resulting from Robinhood’s bulletins doesn’t appear justified. The brand new options Robinhood is introducing is not going to be obtainable till late 2025, giving opponents ample time to reply. Furthermore, the impression of those improvements stays speculative till they’re absolutely operational.

Whereas Robinhood’s advertising methods are undeniably efficient, a lot of the introduced performance stays theoretical. Buyers can be sensible to concentrate on fundamentals somewhat than react impulsively to well-crafted promotional campaigns.

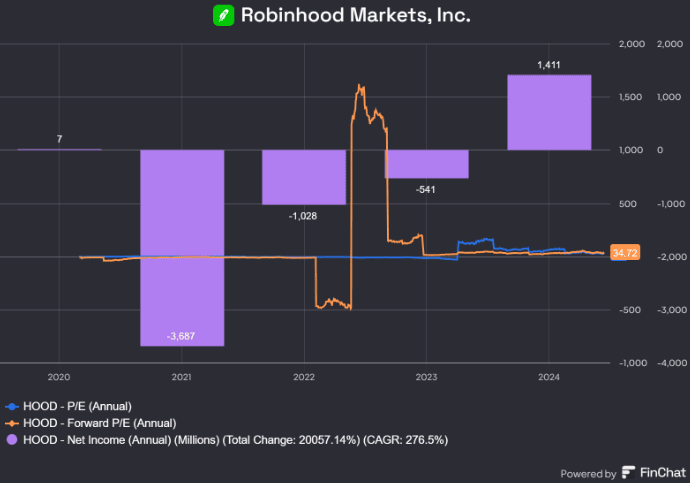

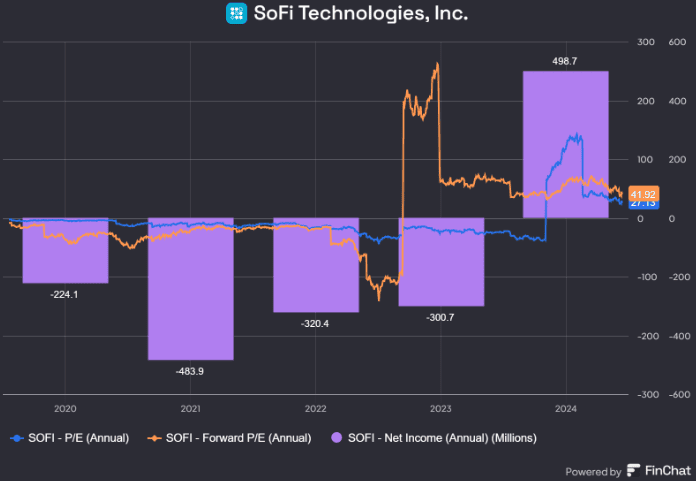

Valuations

I wouldn’t say that both of those corporations have been low-cost by any traditional metric. Each have a P/E greater than their friends, the identical will be mentioned of their ahead P/E’s however I do assume every firm has progress engines that aren’t mirrored in these numbers. Each corporations turned worthwhile once more in 2024 after pivoting their enterprise significantly and each are nonetheless aggressively increasing their worthwhile service choices. A value to earnings ratio is usually a considerably unreliable measurement of a enterprise that’s nonetheless in its progress part for quite a lot of causes corresponding to, reinvesting income into tech, advertising, and buyer acquisition. These investments suppress short-term revenue however can increase long-term worth. Which is strictly what I need to see.

As soon as these corporations have constant profitability with secure margins, P/E will grow to be extra significant. That mentioned, many buyers will nonetheless complement it with different ratios to account for progress and an alarmingly excessive P/E would definitely set off some alarm bells.

Conclusion

Robinhood’s daring initiatives exhibit its capacity to develop past transaction-based income, however they don’t seem to be the existential risk to SoFi that many worry. In truth, Robinhood’s strategic pivot towards a diversified mannequin solely serves to validate SoFi’s long-term strategy. The 2 corporations are taking part in completely different video games: Robinhood is chasing engagement and fast consumer acquisition, whereas SoFi focuses on constructing a complete, resilient monetary ecosystem designed for sustained progress.

Whereas Robinhood’s advertising is aggressive and its new options intriguing, a lot of their performance stays hypothetical till launch. In contrast, SoFi’s built-in mannequin continues to ship regular progress, bolstered by a well-regulated banking infrastructure and diversified income streams.

For buyers, the actual alternative lies in discerning advertising hype from substantive worth. The present panic surrounding Robinhood’s bulletins could also be extra of a mirrored image of short-term sentiment than long-term fundamentals.

Personally, I view SoFi as a steady-growth play, with a sturdy capacity to adapt throughout market circumstances, notably by its increasing tech platform and progressive mortgage platform-as-a-service. Robinhood, whereas a more moderen addition to my portfolio, has already rewarded me with important returns in 2024. Its fast go-to-market technique and enchantment to new buyers place it properly for future progress—although whether or not its new merchandise will convert that enchantment into profitability stays unsure. I’m nonetheless assured of their potential based mostly solely on present merchandise.

Finally, each corporations deliver distinctive strengths to the market. Robinhood is an investment-first platform pushing into banking. SoFi is a bank-first platform pushing into funding. Each are comparatively younger and disruptive and Buyers who can look past the noise and concentrate on fundamentals might discover compelling alternatives in each.

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.