In the summertime of 2024, Crowdstrike made the headlines however not for the explanations traders would anticipate or hope. Whereas many seemed ahead to beginning their well-earned holidays, a serious IT disruption received the planes caught on land & many companies froze. The explanation? A routine software program replace which quickly escalated into a worldwide digital disaster. Which software program? You guessed it proper! CrowdStrike’s Falcon sensor program.

supply: IT outage – picture from Wikipedia

Has the corporate collapsed after the incident? Probably not. Right this moment, its inventory listed on NASDAQ trades round an all-time excessive.

Is there a justification for the efficiency of the inventory?

Let’s dive in & discover! 🔍

What’s CrowdStrike?

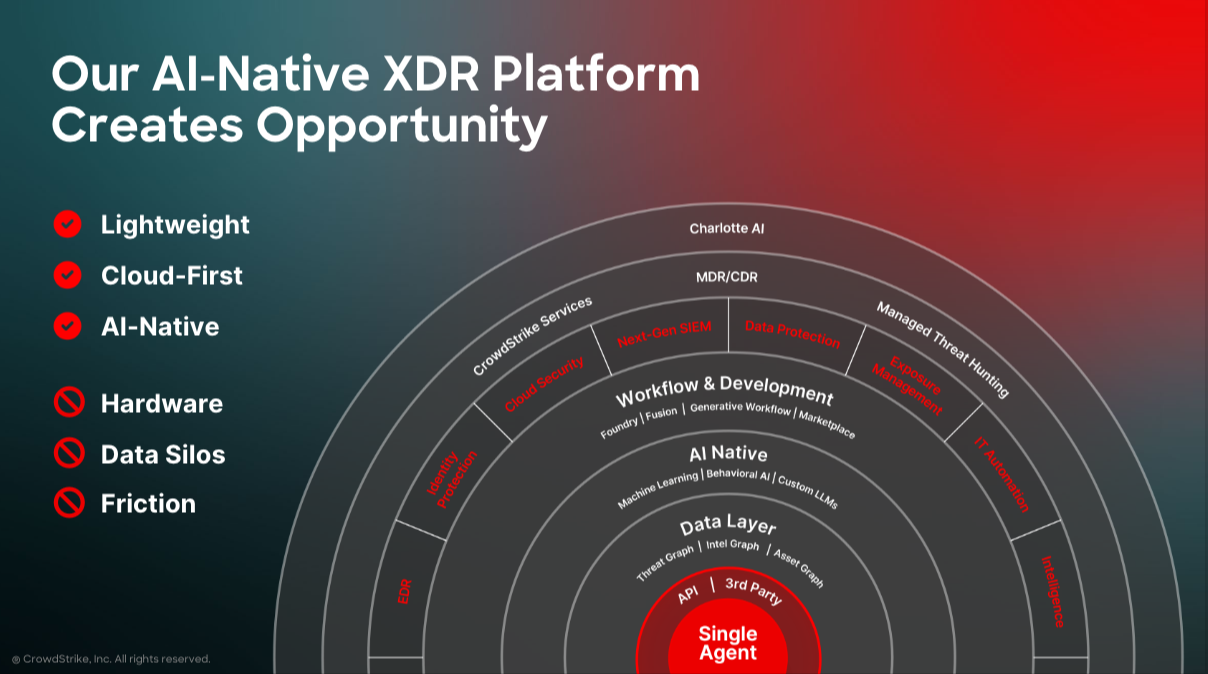

CrowdStrike Holdings, Inc. is an American cybersecurity expertise firm headquartered in Sunnyvale, California, and was based in 2011. Famend for its progressive strategy to cybersecurity, CrowdStrike focuses on cloud-native endpoint safety, risk intelligence, and proactive incident response providers. The corporate is finest identified for its Falcon platform, which leverages synthetic intelligence to detect and stop cyber threats in realtime. As a number one supplier of cloud-delivered endpoint safety, CrowdStrike’s latest earnings report and monetary metrics spotlight its robust market place and future development potential.

supply: CrowdStrike firm presentation

Monetary Efficiency

CrowdStrike’s fiscal yr runs from February 1 to January 31 of the next yr. For instance, the fiscal yr 2024 ended on January 31, 2024.

In response to NASDAQ, CrowdStrike is estimated to report subsequent earnings on 03/04/2025. So we’ll dive into the final report.

CrowdStrike’s monetary efficiency within the third quarter of fiscal yr 2025 caught the eyes of traders, because it showcased important development and operational effectivity. Listed below are some key highlights from the newest earnings name and monetary reviews:

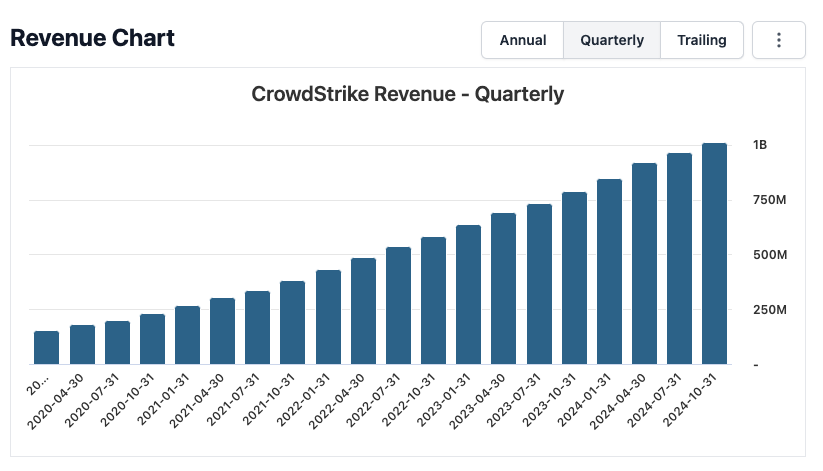

Income Progress: CrowdStrike achieved a milestone by surpassing $1 billion in quarterly income for the primary time, marking a 28.5% year-over-year development. The corporate’s whole income for the twelve months ending October 31, 2025, was $3.74 billion, reflecting a 31.4% development fee.

Annual Recurring Income (ARR): The corporate reported an ARR exceeding $4 billion, rising 27% year-over-year, making it the quickest pure-play cybersecurity software program firm to achieve this milestone.

Free Money Circulate: CrowdStrike generated $231 million in free money move, representing 23% of its income, and achieved a Rule of 51 on a free money move foundation.

EPS: The earnings per share (EPS) for the quarter ending October 31, 2025, was reported at -$0.07. Nevertheless, for the twelve months ending the identical date, the EPS was $0.52, indicating a constructive development in profitability.

supply: CrowdStrike income development by stockanalysis.com

Valuation Metrics

CrowdStrike’s valuation metrics present insights into its market notion and development expectations:

Ahead P/E Ratio: based on GuruFocus, CrowdStrike’s ahead P/E ratio was 95.99 (as of Feb. 08, 2025), reflecting excessive development expectations from traders.

Value to Gross sales Ratio: The corporate’s value to gross sales ratio stood at 26.8 for the quarter ending October 31, 2025, indicating a premium valuation according to its development prospects.

A ahead P/E ratio above 90 is extraordinarily excessive however not unusual. In response to GuruFocus, the very best $Meta traded up to now 13 years was at 108.4.

Curiously, based mostly on numerous metrics together with firm and business development, Merely Wall Avenue states that CrowdStrike is traded at 16.9% beneath their estimated truthful worth. SeekingAlpha additionally describes the corporate as a top quality one in a rising business.

Whereas these figures look staggering for worth traders who’re searching undervalued companies, development traders usually are not shying away from the corporate!

A have a look at insider buying and selling

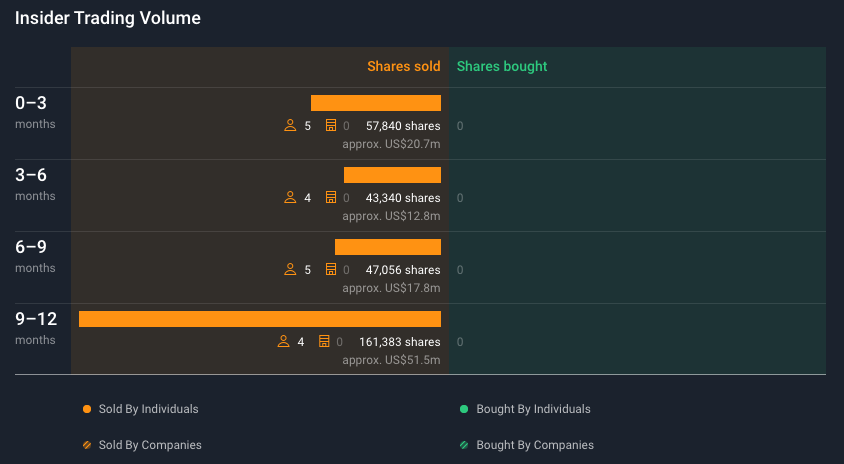

Up to now six months, insider buying and selling at CrowdStrike Holdings, Inc. has been fairly dynamic, reflecting strategic selections by key stakeholders. Notably, George R. Kurtz, the Founder, CEO, and Director, bought 1.1 million shares, decreasing his holdings by 14.5%. In response to him, final gross sales “have been made to cowl tax withholdings due on vesting of restricted inventory unit awards, as required underneath the Issuer’s administrative insurance policies”.

supply: CrowdStrike insider buying and selling quantity by Merely Wall St.

Whereas it’s important to contemplate the broader context of insider buying and selling actions (there might be many causes for insiders to promote impartial of the corporate efficiency), it’s value keeping track of such developments. As a normal rule, seeing insiders promoting at a considerably larger value than market value or considerably shopping for shares might be seen as constructive indicators. Alternatively, once we see a number of insiders promoting large chunks of their shares, particularly if underneath market value, then we must always rapidly examine as an investor. This can be a potential crimson flag!

Future Prospects

CrowdStrike’s future appears to be like promising, pushed by its progressive platform and strategic initiatives:

Falcon Flex Mannequin: The Falcon Flex subscription mannequin is enhancing platform adoption, growing each the share of pockets and enterprise actual property. This mannequin is predicted to drive sooner and bigger ARR uplift over time.

Product Innovation: CrowdStrike continues to guide in innovation throughout cloud safety, identification safety, and next-gen SIEM, disrupting legacy markets and creating new classes.

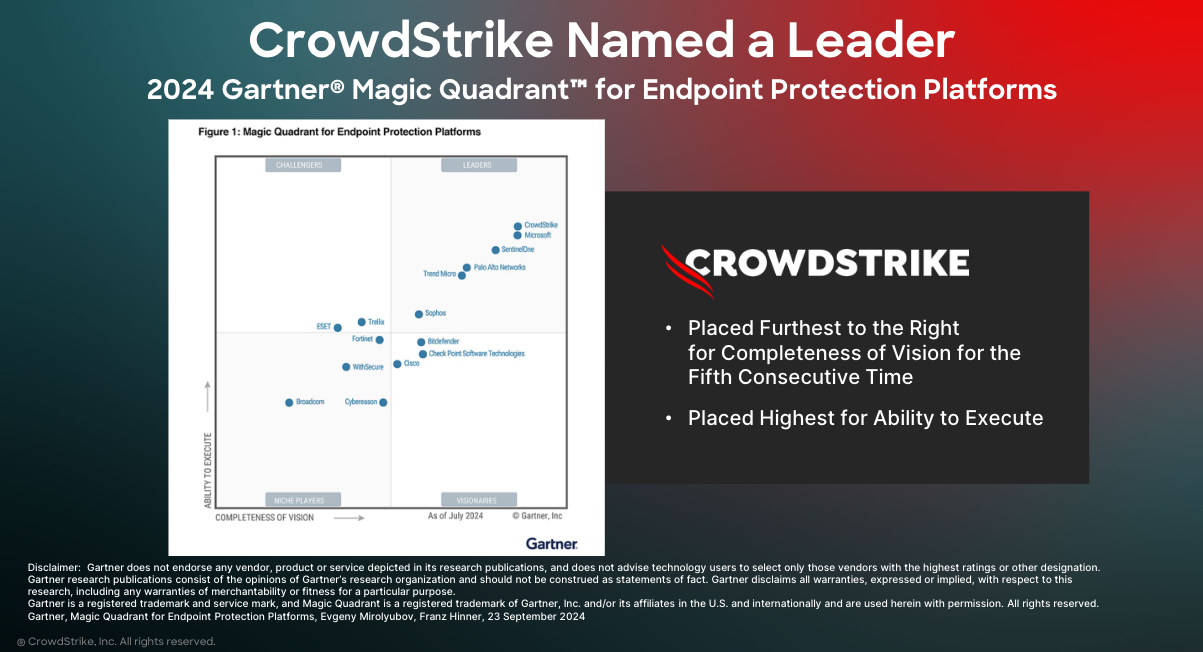

CrowdStrike was named chief for five instances in a row within the Endpoint Safety Platforms by Gartner, forward of Microsoft.

Strategic Acquisitions: The acquisition of Adaptive Protect provides SaaS posture administration to CrowdStrike’s portfolio, additional strengthening its market place.

Lengthy-term Objectives: CrowdStrike stays dedicated to attaining $10 billion in ending ARR by the top of fiscal yr 2031 and its goal non-GAAP working mannequin by fiscal yr 2029.

supply: CrowdStrike firm presentation

Conclusion

CrowdStrike Holdings, Inc. stands out as a number one participant within the cybersecurity panorama, with its robust monetary efficiency, progressive options, and strategic development initiatives. Whereas the corporate’s premium valuation displays excessive investor expectations, its strong development trajectory and market management place it nicely for continued success within the evolving cybersecurity market.

The inventory is an inexpensive one to carry in a portfolio for traders excited about investing in development, innovation and expertise. With such a excessive ahead P/E you might nevertheless brace your self for potential excessive volatility and doable dips alongside the way in which.

Whether or not you determine to spend money on the inventory or not, cyber safety needs to be a high precedence for everybody. And us, customers, shall be the primary line of protection in opposition to attackers. So in case you learn this and consider your ‘qwerty’ or birthday date password, you might wish to change it now and add a two-factor authentication. 😉

Sources:

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.