Decoding the 2025 Outlook

Goldman Sachs (GS) delivered a stellar 52% shareholder return in 2024, and with a dynamic 2025 on the horizon, the query on everybody’s thoughts is: can this momentum proceed? This deep dive explores GS’s potential, analyzing key highlights, catalysts, dangers, and finally, asking: is GS a bullish or bearish prospect? (Supply: Goldman Sachs This fall 2024 Earnings)

A Legacy of Management

Based in 1869, Goldman Sachs has cemented its place as a world monetary powerhouse. Navigating the turbulent waters of the 2008 monetary disaster, GS emerged stronger, solidifying its status for resilience and strategic prowess.

2024: A 12 months of Triumph

GS crushed expectations in 2024, boasting a 16% income surge and a 77% earnings explosion. This spectacular efficiency was fueled by report equities revenues, coupled with strong funding banking charges and FICC efficiency. Moreover, GS reigned supreme in worldwide Mergers & Acquisitions (M&A) completions and noticed a 12% enhance in property underneath supervision.

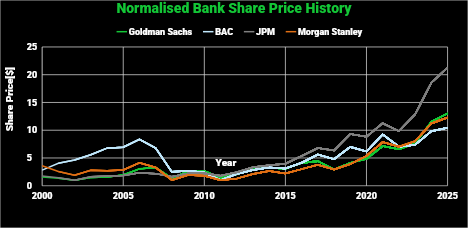

Above a visible show of the current robust inventory value development of GS versus the market.

2025: Catalysts for Progress

A number of elements level in direction of a promising 2025 for GS:

M&A Increase: Anticipation of eased rules and a extra aggressive monetary panorama, mixed with pent-up demand for portfolio transformation, suggests a major uptick in M&A exercise. GS’s personal consumer survey reveals that almost half of respondents see strategic development and new capabilities as main M&A drivers.

IPO Resurgence: The IPO market is displaying indicators of life, with a 50% year-over-year enhance in complete worth. This bodes properly for GS, a dominant participant in funding banking.

AI Revolution: Whereas 2024 noticed the popularity of AI’s potential, 2025 is poised for sensible utility. Firms are gearing up for substantial investments in AI and machine studying, creating new alternatives for GS.

Sector-Particular Dynamics: The retail banking sector, specifically, witnessed elevated M&A exercise in 2024, a pattern prone to proceed in 2025 with potential rate of interest reductions additional incentivizing inorganic development. The rise of “Group” constructions and cross-border offers might additionally unlock additional development avenues.

The Goldman Sachs Enterprise Mannequin: A 4-Pronged Method

GS operates throughout 4 core segments:

Funding Banking: Advisory, underwriting, and financing actions. The bedrock of GS’s status.

World Markets: FICC intermediation and financing, together with investing actions.

Asset Administration: Wealth preservation and development providers via numerous funding methods.

Shopper & Wealth Administration: Shopper platforms and transaction banking.

The Goldman Sachs Edge

GS’s dominance in funding banking is plain. Its status for high expertise, elite clientele, and political connections fuels its profitability and market affect. The agency’s distinctive strategy of mixing conventional funding banking providers with principal investments offers an extra income stream and strengthens its steadiness sheet.

Aggressive Panorama

GS faces stiff competitors from different monetary giants like Financial institution of America, JPMorgan Chase, Morgan Stanley, and Citigroup. Whereas market capitalization isn’t an ideal comparability metric, GS’s barely greater PE ratio suggests market optimism concerning future profitability. Excluding Citigroup, GS’s PB ratio signifies it could be buying and selling under its intrinsic worth.

Competitor evaluation

Inventory Value [$]

Mkt Cap [$Billion]

PE

PB

The Goldman Sachs Group Inc (GS)

655.90

205.89

16.2

3.71

Financial institution of America Company (BAC)

47.40

360.75

14.8

3.59

JPMorgan Chase & Co (JPM)

275.80

766.47

14.0

4.33

Morgan Stanley

139.98

224.95

17.6

4.13

Citigroup Inc

81.72

154.55

13.7

1.91

Common

15.3

3.53

GS’s inventory value development compares properly to that of the opposite foremost gamers within the trade.

Strategic Imaginative and prescient & Management

Underneath CEO David Solomon, GS is concentrated on enhancing its market place and driving sustainable development. Key strategic initiatives embody strengthening market presence, diversifying providers, and reaching bold monetary targets.

Monetary Well being

GS boasts wholesome earnings and returns, with expectations of continued success. Whereas a excessive debt-to-equity ratio presents challenges, the agency is actively pursuing methods to enhance margins and construct a sustainable future.

Valuation

The valuation fashions counsel important upside potential for GS inventory, significantly in a high-growth state of affairs.

Progress

LT-growth

WACC

Honest worth

Vs present

Excessive

17.5%

2.9%

10.9%

$ 809.32

24%

Medium

14.2%

2.9%

10.9%

$ 732.99

13%

Low

10.9%

2.9%

10.9%

$ 662.68

2%

Common

$ 734.99

13%

Guide worth

$ 336.77

93%

Present

$ 650.53

Dangers & Challenges

GS faces inherent dangers, together with regulatory scrutiny, market dependency, excessive operational prices, and the fixed stress to take care of excessive margins.

The Verdict: Bullish with Cautions

Goldman Sachs is well-positioned for continued development in 2025. The confluence of favorable market developments, strategic initiatives, and GS’s inherent strengths makes a compelling bullish case. Nonetheless, buyers must be conscious of the inherent dangers and potential volatility related to the monetary sector. GS is not only a market performer; it’s a market shaper. Its affect and flexibility make it a compelling funding alternative, however one which requires cautious consideration.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.