Este artículo también está disponible en español.

In a put up on X printed yesterday, Jeff Park, Head of Alpha Methods at Bitwise, acknowledged that Bitcoin (BTC) at present presents a “generational alternative” amid intensifying international macroeconomic turmoil.

Park pointed to components reminiscent of US President Donald Trump’s proposed commerce tariffs, considerations over the US debt ceiling, and the rising sentiment of deglobalization as key contributors to the present financial uncertainty.

Bitcoin Reigns Supreme Amid World Political And Financial Turmoil

The 12 months 2025 has began on an unstable footing, marked by rising international financial and political instability attributable to commerce tariffs, US debt ceiling points, and the broader push towards deglobalization. These components may considerably influence monetary markets and geopolitical stability.

Associated Studying

Including to the uncertainty is the approaching expiration of the US Tax Cuts and Jobs Act (TCJA) later this 12 months, which may result in unprecedented tax coverage shifts and heightened financial unpredictability.

Park additionally underscored the “gold run tail threat,” referencing gold’s excessive worth volatility in periods of economic misery. On the time of writing, gold is buying and selling at $2,900 per ounce, up considerably from round $2,585 in December 2024.

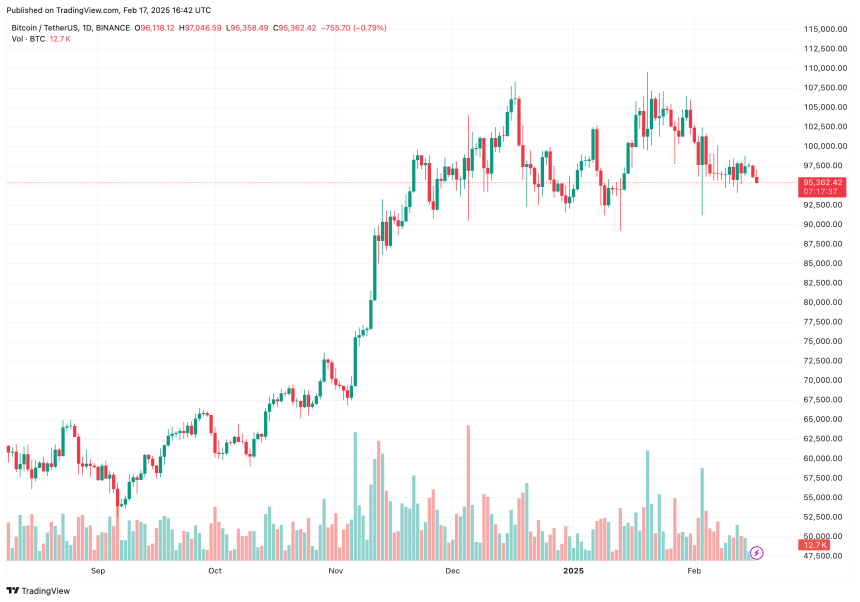

Regardless of these mounting dangers, Bitcoin has remained resilient, sustaining a worth vary between $90,000 and $100,000. Park highlighted BTC’s implied volatility (IV) percentile – a measure that displays how its present volatility compares to historic ranges.

He famous that BTC’s IV percentile is at its lowest degree of the 12 months, reinforcing his view that Bitcoin presents a “generational alternative.” Echoing this sentiment, Bitwise CEO Hunter Horsley remarked that many are underestimating “the huge leaps Bitcoin goes to take into the mainstream this 12 months.”

Certainly, Bitcoin continues to realize mainstream traction and exhibit resilience amid rising international financial uncertainty. For instance, BTC remained largely unaffected by the tech market sell-off triggered by the discharge of the Chinese language AI mannequin DeepSeek.

No Altseason Anytime Quickly?

As Bitcoin strengthens its dominance, the altcoin market has struggled, weighed down by skinny liquidity and waning retail curiosity. One key indicator supporting this development is Bitcoin dominance (BTC.D), which measures BTC’s market cap relative to the full cryptocurrency market.

Associated Studying

The weekly BTC.D chart exhibits a powerful rebound from round 54% in December 2024. On the time of writing, BTC.D stands at 60.65%, a degree not seen since March 2021.

That mentioned, some analysts stay optimistic a couple of potential Ethereum-led (ETH) altseason later in 2025. Current evaluation by Titan of Crypto means that Ethereum is poised for a serious upward transfer this 12 months.

The analyst additionally identified similarities between ETH’s present worth motion and BTC’s conduct throughout its third market cycle, implying that Ethereum might quickly enter what he calls its “most hated rally.” At press time, BTC trades at $95,362, down 0.4% prior to now 24 hours.

Featured picture from Unsplash, Charts from X.com and Tradingview.com