Centralized trade (CEX) listings have lengthy been seen as a milestone for crypto initiatives, promising elevated publicity, liquidity, and value surges. Nonetheless, the truth typically follows a predictable sample: a pointy preliminary pump, adopted by a extra dramatic dump. CryptoNinjas, in collaboration with Storible, analysed prime 6 main CEXs (Binance, Bybit, Upbit,..), to uncover the precise influence of CEX listings on token costs, revealing simply how fleeting the advantages could be.

Key Findings

98% of Binance listed tokens are dumped.

Binance itemizing has essentially the most constructive impacts on value, pumping tokens by 87%.

On common, CEX itemizing pumps tokens by 54%.

On common, 89% CEX listed tokens are dumped.

Methodology

We started by gathering all tokens listed in 2024 from six main CEXs: Binance, Bybit, OKX, Coinbase, Bithumb, and Upbit, totalling 389 tokens. We then collected the worth at itemizing, present value (at Feb 4th, 2025), and ATH value of collected tokens.

The information was gathered between Feb 2nd and Feb 4th, 2025.

The Preliminary Surge: CEX Listings Pump Tokens by 54%

Itemizing on a significant trade typically triggers a shopping for frenzy. On common, newly listed tokens expertise a 54% value surge upon itemizing. This phenomenon is essentially pushed by FOMO (worry of lacking out) and deep liquidity, as merchants rush to purchase the token earlier than it skyrockets additional.

The ATH Impact: 37% of Tokens Attain Peak Costs at Itemizing

A staggering 37% of newly listed tokens hit their all-time excessive (ATH) on the time of itemizing, by no means reaching such valuations once more. This highlights how CEX listings are sometimes the height of a token’s market efficiency, pushed by hypothesis relatively than long-term fundamentals.

The Harsh Actuality: Dumping Follows Shortly

Whereas the preliminary surge creates pleasure, the sell-off that follows is sort of inevitable. Our findings reveal that 89% of listed tokens expertise a major value drop post-listing, with a mean decline of 52% from their peak at CEX itemizing.

The Lifecycle of a CEX-Listed Token

Pump: Token value spikes 54% on common at itemizing.

ATH: 37% of tokens attain their peak value at itemizing.

Dump: 89% of tokens decline sharply post-listing.

Worth drop: Tokens lose a mean of 52% of their worth after the itemizing hype fades.

This sample means that many merchants view CEX listings as exit alternatives relatively than long-term investments.

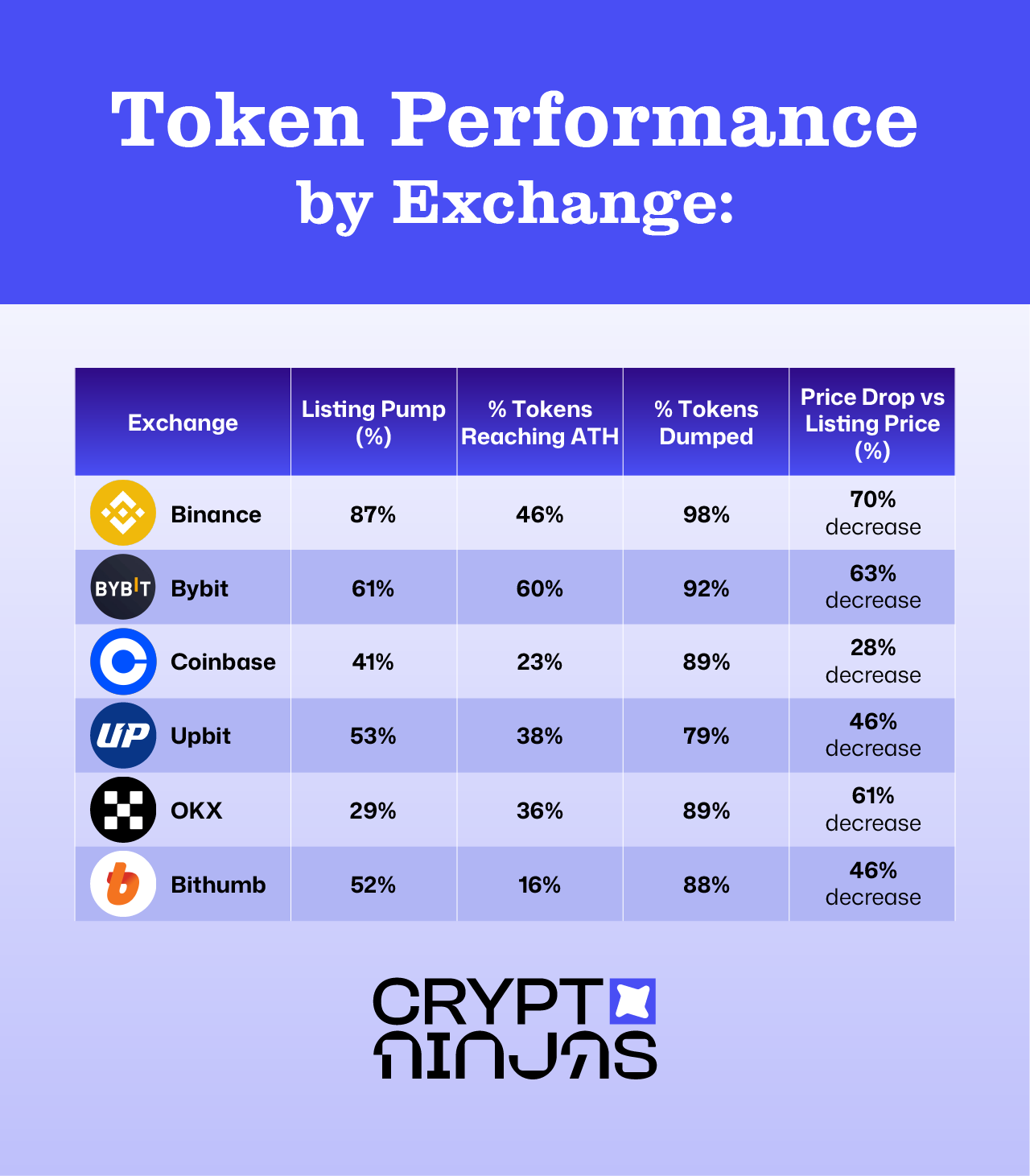

Alternate Comparisons: Which CEX Pumps and Dumps the Most?

Totally different exchanges have various impacts on token efficiency. Our analysis compares six main exchanges—Binance, Coinbase, Upbit, OKX, Bithumb, and Bybit—to evaluate their affect on token costs.

Binance Nonetheless Has the Strongest Impact—For Higher or Worse

Binance stays essentially the most influential CEX for token listings, delivering the strongest preliminary pump but additionally the most extreme dumps:

Tokens listed on Binance surge 87% on common at itemizing.

46% of those tokens attain their ATH at itemizing.

Nonetheless, 98% of Binance-listed tokens ultimately dump.

Costs drop by a mean of 70% from their itemizing value.

Whereas a Binance itemizing can generate large short-term features, the aftermath is usually brutal for late patrons.

Bybit: The Second Strongest Itemizing Impact

Bybit emerges because the second most impactful trade, with notable value actions:

Tokens listed on Bybit pump 61% on common.

Bybit boasts the best share of tokens reaching ATHs at itemizing (60%).

92% of those tokens expertise a post-listing dump.

Costs fall by 63% on common.

Bybit listings entice excessive hypothesis, however the sustainability of those value features stays questionable.

Coinbase: The Weakest Pump and the Least Extreme Dump

Not like Binance or Bybit, Coinbase listings have a weaker preliminary pump but additionally a much less drastic decline:

Tokens listed on Coinbase rise 41% on common at itemizing.

Solely 23% attain ATH at itemizing—the bottom amongst all exchanges.

89% of tokens nonetheless expertise a post-listing decline, however the drop is milder (28% lower).

Coinbase-listed tokens are inclined to have much less excessive value actions, presumably as a result of a extra conservative investor base.

Conclusion: CEX Listings Are a Double-Edged Sword

CEX listings stay a vital second for crypto initiatives, providing fast liquidity and publicity. Nonetheless, our knowledge proves that the worth motion follows a predictable pump-and-dump cycle, making it a dangerous wager for buyers.

For merchants, the lesson is obvious: CEX listings are sometimes the height of a token’s value efficiency, and shopping for into the hype can result in vital losses. Understanding the market dynamics behind these listings is essential to avoiding the pitfalls of speculative buying and selling.