Este artículo también está disponible en español.

Ethereum confronted a brutal capitulation occasion on Sunday, plummeting over 30% in lower than 24 hours as market-wide panic took maintain. The dramatic sell-off was fueled by rising fears of a U.S. commerce warfare, sending shockwaves throughout the crypto house and inflicting Bitcoin and main altcoins to drop considerably. ETH, which had been struggling to reclaim key ranges, noticed a pointy decline, shaking investor confidence and elevating considerations about its long-term pattern.

Associated Studying

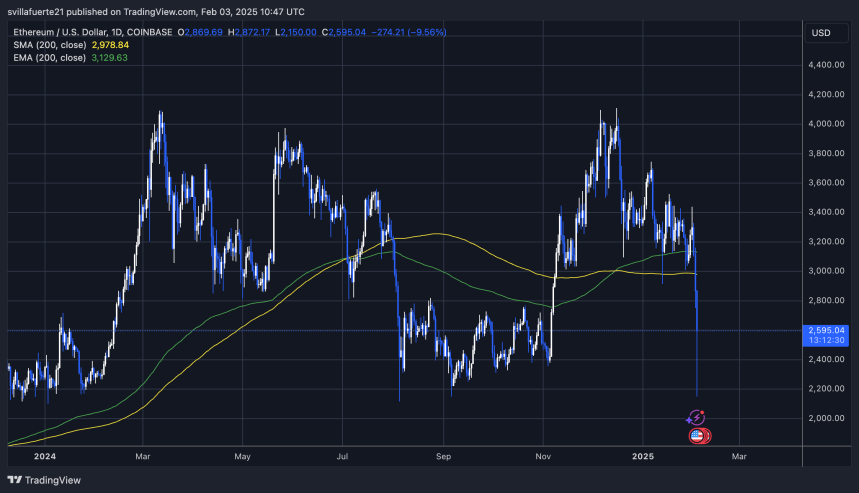

Prime analyst Ali Martinez shared a technical evaluation, revealing that Ethereum is forming a long-term head-and-shoulders sample. In line with Martinez, ETH should maintain above the essential $2,700 stage to keep up its bullish construction and forestall a deeper correction. A breakdown under this stage may set off an prolonged bearish section, additional delaying ETH’s potential rally towards new highs.

With volatility at excessive ranges and uncertainty dominating the market, Ethereum’s subsequent transfer can be vital. If bulls handle to defend key help, ETH may stage a robust restoration, however failure to carry may result in much more draw back. As buyers assess the injury from this weekend’s crash, all eyes stay on whether or not ETH can stabilize and reclaim momentum within the coming days.

Ethereum Faces A Key Problem

Yesterday, the crypto market witnessed the most important liquidation occasion in its historical past, with over $2 billion worn out in only a few hours. Worry has taken over, and buyers are bracing for excessive volatility this week because the U.S. market reacts to escalating commerce warfare tensions. With uncertainty dominating the panorama, Ethereum has been one of the impacted belongings, shedding a good portion of its worth as panic promoting intensified.

Ethereum’s worth plummeted over 37% since final Friday, marking one in every of its sharpest declines lately. The dramatic downturn has led analysts to query whether or not ETH can keep its long-term bullish construction or if a deeper correction is imminent.

Prime crypto knowledgeable Ali Martinez shared a technical evaluation on X, revealing that Ethereum seems to be forming a long-term head-and-shoulders sample. If this sample is confirmed, ETH should maintain above the vital $2,700 mark to maintain its bullish construction intact. Dropping this stage may set off a deeper selloff, doubtlessly pushing costs towards decrease demand zones earlier than any restoration takes place.

Nevertheless, if bulls efficiently defend this important help, Ethereum may nonetheless have a shot at reclaiming misplaced floor and concentrating on its long-term objective of $7,000. The approaching days can be pivotal in figuring out ETH’s trajectory as merchants assess whether or not this can be a short-term shakeout or the start of a chronic downtrend.

Associated Studying

As macroeconomic fears and commerce warfare tensions proceed to affect market circumstances, Ethereum’s worth motion can be a key indicator of broader investor sentiment. This week will probably set the tone for ETH’s motion within the coming months, making it a defining second for the second-largest cryptocurrency.

Worth Motion Particulars: Key Ranges To Watch

Ethereum (ETH) is at the moment buying and selling at $2,595 after a particularly risky Sunday that noticed its worth plummet to as little as $2,150. The drastic drop has left bulls in a precarious place, as ETH has misplaced all main help ranges and is now looking for demand to stabilize.

With the market shaken and fear-dominant sentiment, ETH should maintain above the $2,600 mark within the coming days to have an opportunity at restoration. Nevertheless, after such an enormous liquidation occasion, regaining bullish momentum might take time, and the probability of additional draw back stays excessive. Merchants and buyers are watching key ranges carefully as Ethereum struggles to seek out its footing.

Associated Studying

If ETH manages to reclaim the $2,800 stage and push above $3,000, confidence may return to the market, signaling the primary steps of a restoration. Till then, uncertainty stays the dominant drive, and the potential for an additional leg down can’t be dominated out. The subsequent few days can be essential in figuring out whether or not Ethereum can bounce again or if it should proceed its decline towards decrease help ranges.

Featured picture from Dall-E, chart from TradingView