Be part of Our Telegram channel to remain updated on breaking information protection

Current developments within the regulatory panorama may form the way forward for digital belongings, with trade leaders weighing in on upcoming insurance policies. Lightspark CEO David Marcus just lately mentioned former President Donald Trump’s cryptocurrency technique, calling it a possible turning level for the trade.

In mild of this, buyers search promising initiatives with robust progress potential for portfolio addition. Because the market evolves, low-cost cryptocurrencies could profit from a extra favorable setting, making figuring out inexpensive tokens with robust fundamentals important. As such, Insidebitcoins compiles the finest low cost crypto to purchase now below 1 greenback.

5 Finest Low-cost Crypto to Purchase Now Underneath 1 Greenback

Arbitrum (ARB) has gained momentum by new integrations and technological developments. Its worth is $0.4626, marking a 4.94% rise over the previous week. In the meantime, Onyxcoin (XCN) is progressing with the launch of its Layer 3 blockchain, the XCN ledger. Algorand (ALGO) has demonstrated constant progress. It’s at present valued at $0.2867, reflecting a 3.09% enhance prior to now day. Cardano (ADA), then again, skilled a 0.62% decline in value, settling at $0.701, although its buying and selling quantity surged by 45.53% to $776.23 million within the final 24 hours.

Solaxy (SOLX) stays in its presale stage, priced at $0.00163, with expectations of a value adjustment within the upcoming spherical. In the meantime, XRP has declined whereas Bitcoin has proven upward motion, elevating questions concerning the broader affect of current market developments on cryptocurrency valuations.

1. Arbitrum (ARB)

Arbitrum (ARB) is gaining traction with new integrations and improvements. Its present value is $0.4626, reflecting a 4.94% enhance over the previous week. The market cap is $2 billion, whereas 24-hour buying and selling quantity has surged by 27.93% to $173.18 million. The quantity-to-market cap ratio is 0.1173, indicating robust liquidity.

Builders have launched a Common Intent Engine to reinforce cross-chain interoperability. This simplifies swaps and transfers, making Arbitrum extra accessible. Moreover, Arbitrum has built-in with BitcoinOS (BOS) to leverage Bitcoin’s safety. This integration permits Arbitrum One to operate as a hybrid rollup, increasing its use instances.

In gaming, Xai Play by Xai Video games hyperlinks Steam achievements to Arbitrum’s blockchain. Gamers can earn rewards primarily based on achievement rarity, driving engagement. In the meantime, the ETHDenver Model Hackathon shapes Ethereum’s branding, additional selling Arbitrum’s ecosystem.

Introducing Xai Play by @XAI_GAMES

With this, gamers’ gameplay is linked to Xai’s Arbitrum chain by their Steam achievements and may be rewarded primarily based on achievement rarity

Hyperlink, Earn, Play 🎮 https://t.co/Ec7v1ekwT8

— Arbitrum (@arbitrum) February 7, 2025

Market forecasts for February counsel a value enhance of 75.97%, with a mean value of $0.8132. The potential vary is between $0.4321 and $1.4659, providing a 217.19% ROI. Analysts predict a 267.71% value surge in March, with a mean of $1.6993. The anticipated vary is $1.3343 to $2.04, with a possible ROI of 341.05%.

Arbitrum’s rising adoption and powerful liquidity point out a bullish pattern. Its growing integration with Ethereum and Bitcoin strengthens its long-term potential. ARB may surpass $2 by March 2025 if market circumstances stay favorable.

2. Onyxcoin (XCN)

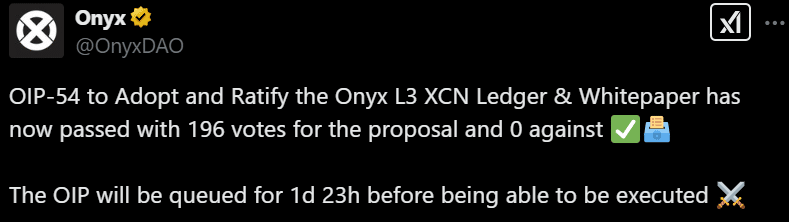

Onyxcoin (XCN) is making strides with its new Layer 3 blockchain, the XCN ledger. This blockchain is constructed on Arbitrum Orbit, providing near-instant confirmations and low charges. It leverages Base (Coinbase’s L2) as its financial layer, making certain cost-efficient and high-performance transactions.

XCN is priced at $0.02479, reflecting a 4.69% enhance over the previous week. Its market cap is $763.44 million, whereas 24-hour buying and selling quantity has surged by 27.45% to $113.43 million. The asset has excessive liquidity and is buying and selling 699.88% above its 200-day SMA ($0.003163).

XCN’s progress over the previous 12 months has been outstanding. It has elevated by 1,396% and outperformed 97% of the highest 100 cryptos. It has additionally outperformed Bitcoin and Ethereum whereas sustaining a powerful bullish sentiment. Nonetheless, the Concern & Greed Index stands at 43, indicating some market warning.

Analysts forecast a 106.81% enhance in February, with a mean value of $0.05246. The potential vary is $0.02775 to $0.09478, providing a 273.62% ROI. In March, predictions counsel a 333.30% value surge, with a mean of $0.1099. The anticipated vary is $0.0862 to $0.1319, with a possible ROI of 419.92%. XCN’s technical energy and integration with Arbitrum and Base point out long-term potential. If market circumstances stay favorable, XCN may see additional upside in 2025.

3. Algorand (ALGO)

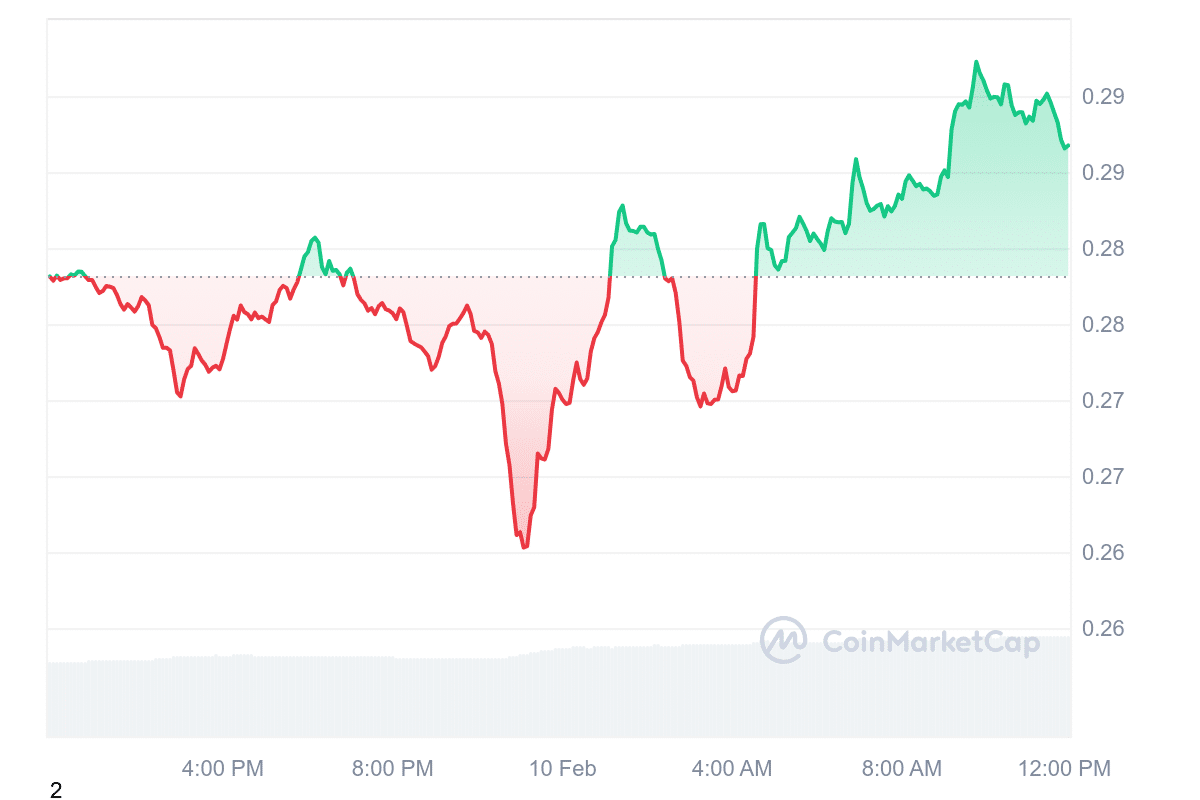

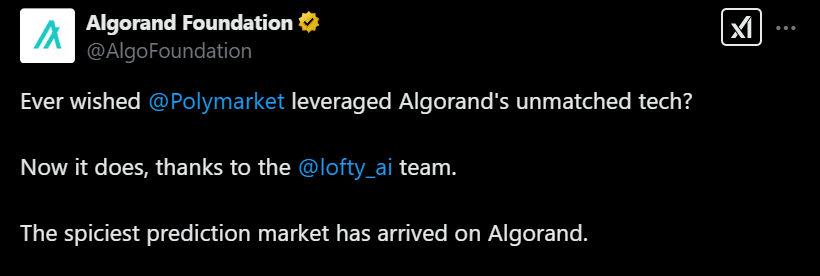

Algorand (ALGO) has proven regular progress out there, at present buying and selling at $0.2867 with a day by day enhance of three.09%. Its market cap is $2.41 billion, reflecting a 3.08% rise, whereas 24-hour buying and selling quantity has jumped 34.72% to $149.66 million. The Totally Diluted Valuation (FDV) is $2.86 billion, and liquidity stays excessive.

Over the previous 12 months, ALGO has gained 64%, outperforming 66% of the highest 100 crypto belongings. It’s buying and selling 10.02% above its 200-day SMA ($0.2631), suggesting robust market sentiment.

February forecasts counsel minimal progress of -0.64%, with a mean value of $0.28798. The anticipated vary is $0.26802 to $0.32045, providing a possible ROI of 10.56%. In March, analysts anticipate a 0.13% value enhance, with a mean value of $0.29023. The worth could fluctuate between $0.27655 and $0.30408, leading to a possible ROI of 4.91%.

Algorand’s constant efficiency and powerful liquidity make it an interesting asset for buyers. Its regular progress above the 200-day SMA and market resilience point out that ALGO may keep an upward trajectory.

4. Cardano (ADA)

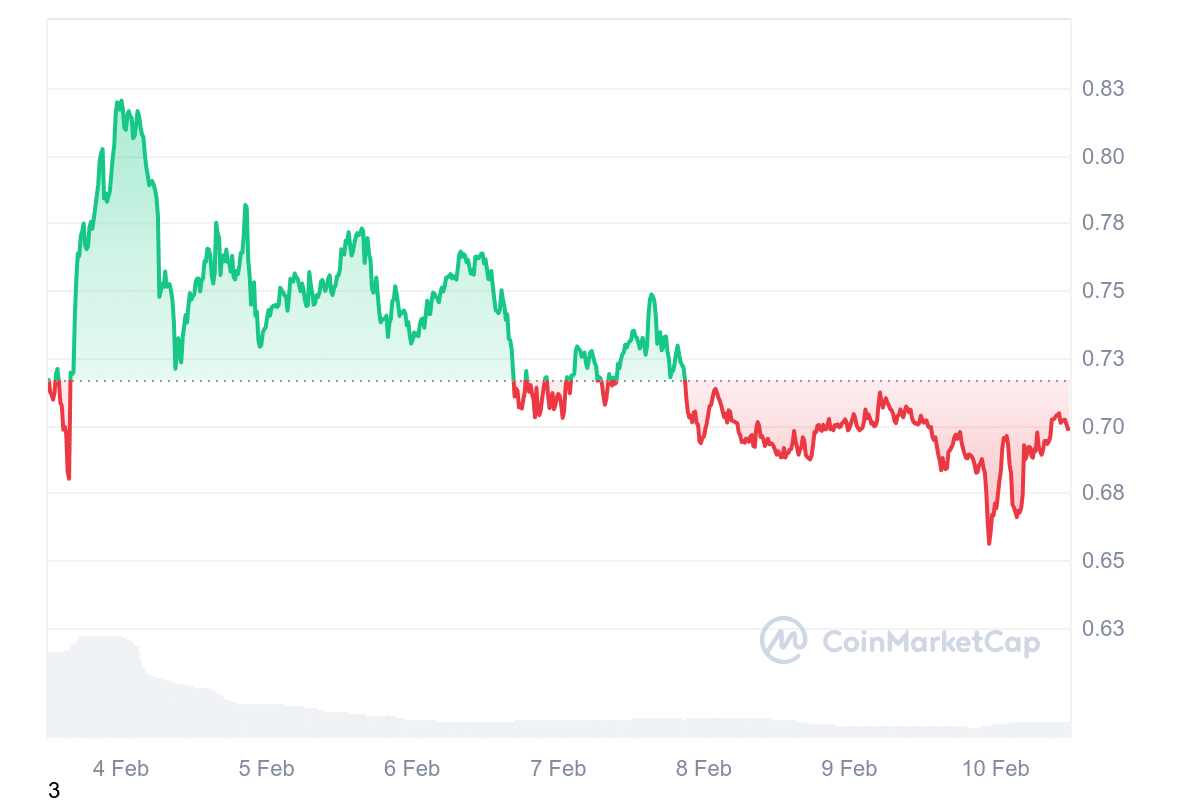

Cardano’s partnership with Walmart by the ADA cashback initiative through the Yoroi pockets is critical in growing cryptocurrency adoption in mainstream commerce. This collaboration highlights the rising acceptance of digital belongings in on a regular basis transactions.

Within the final 24 hours, Cardano’s value dropped 0.62% to $0.701, whereas its buying and selling quantity surged 45.53% to $776.23 million. ADA is priced at $0.6987, reflecting a 2.52% acquire over the previous week. Its market cap is $24.59 billion, marking a 0.44% enhance, and its 24-hour quantity has climbed 48.05% to $783.41 million. Over the previous 12 months, ADA’s value has risen by 27%, outperforming 58% of the highest 100 crypto belongings. It stays extremely liquid resulting from its giant market capitalization.

Analysts predict ADA may rise by 24.40% in February, reaching a mean value of $0.87298. The anticipated vary is between $0.6961 and $1.0497, providing a possible ROI of 49.58%.

By March, projections point out a 36.43% value enhance, with a mean value of $0.95735. The anticipated excessive is $1.05849, and the low is $0.88670, leading to a possible ROI of fifty.84%. Given its robust market presence and continued adoption, Cardano stays a promising funding for long-term holders.

5. Solaxy ($SOLX)

Solaxy ($SOLX) introduces a Layer-2 scaling answer to deal with Solana’s well-known points, akin to community congestion and failed transactions throughout peak demand. Processing transactions off-chain seeks to enhance effectivity whereas sustaining affordability on the main community.

Presently priced at $0.00163, SOLX is in its presale section, with an anticipated value enhance within the subsequent spherical. The challenge has raised over $19 million, which may speed up its plans for an change itemizing, tentatively set for Q2 or Q3 of 2025.

Solaxy additionally plans to bridge Solana with Ethereum, enhancing cross-chain compatibility. This characteristic could possibly be significantly helpful for decentralized purposes (dApps) requiring quick transactions. As Solana’s exercise grows—pushed by new tokens akin to $TRUMP and $MELANIA—scalability options like Solaxy could turn out to be more and more related. Moreover, the platform affords staking alternatives, with potential annual yields of as much as 212%. General, Solaxy is a doable answer to Solana’s community challenges.

Go to Solaxy Presale

Be taught Extra

Latest Meme Coin ICO – Wall Road Pepe

Audited By Coinsult

Early Entry Presale Spherical

Personal Buying and selling Alpha For $WEPE Military

Staking Pool – Excessive Dynamic APY

Be part of Our Telegram channel to remain updated on breaking information protection